SG_HSBC_CC_HSBC Revolution Credit Card SG_SCB_CC_Standard Chartered Journey Credit Card (Fee Waiver) SG_CIMB_CC_CIMB Visa Signature Card […]

This is a comparison of FTSE ALL-WORLD VS MSCI ACWI.

VWRL: FTSE All-World UCITS ETF

- VWRL & VWRD are the same ETF. VWRD is denominated in USD while VWRL is denominated in GBP.

- VWRA (dividends are accumulating). VWRD (dividends are distributed).

ACWI: iShares MSCI ACWI ETF

Both indexes include large and mid-sized companies in both developed and emerging markets.

If you seek a low-cost way to gain broad exposure to Global market, you may consider these index funds.

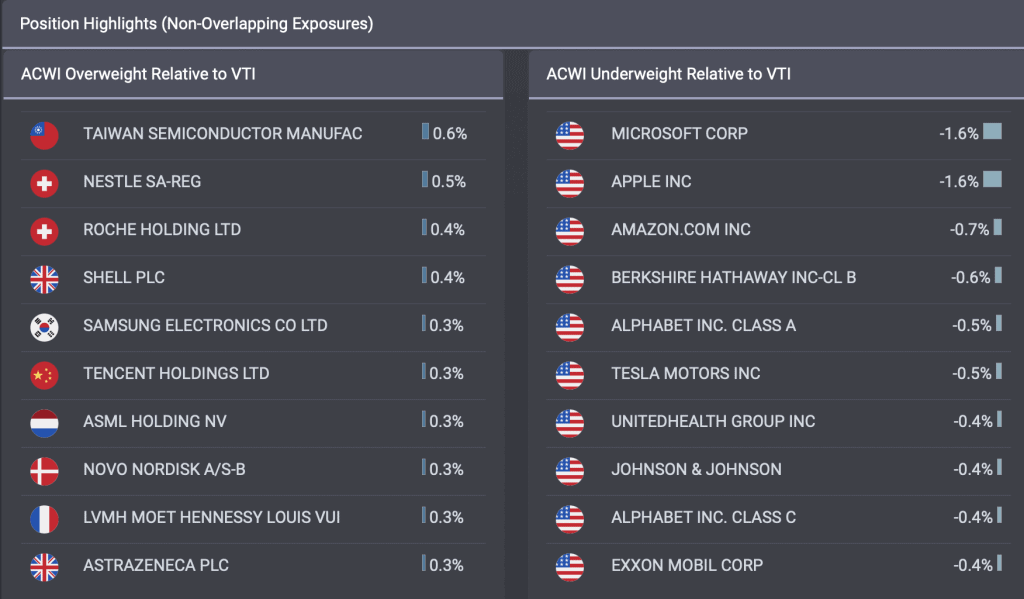

VTI vs ACWI

Comparing VTI with ACWI, 26.7% of ACWI's holdings is also in VTI.

FTSE All-World Index

- Measures the market performance of large- and mid-capitalisation stocks of companies located around the world.

- Includes approximately 3,900 holdings in nearly 50 countries, including both developed and emerging markets.

- Covers more than 95% of the global investable market capitalisation.

Vanguard FTSE ALL-WORLD

- Seeks to track the performance of the CRSP US Total Market Index.

- Large-, mid-, and small-cap equity diversified across growth and value styles.

- The fund remains fully invested.

- Employs a passively managed, index-sampling strategy.

- Low expenses minimize net tracking error.

MSCI ACWI

- The MSCI ACWI Index, MSCI’s flagship global equity index, is designed to represent performance of the full opportunity set of large- and mid-cap stocks across 23 developed and 24 emerging markets.

- Exposure to a broad range of international developed and emerging market companies

- Access to the global stock market in a single fund

Consolidated performance history

| MSCI ACWI | VWRL | EIMI (Acc) | IWDA (Acc) | |

| YTD return | -21.29 | -25.46 | -26.8 | -23.71 |

| 1 Year Return | -20.61 | -20.59 | -27.53 | -19.54 |

| 3 Year Return | 3.7 | 3.71 | -3.59 | 4.63 |

| 5 Year Return | 4.52 | 4.37 | -6.95 | 5.38 |

| 10 Year Return | 7.43 | 7.29 | - | 8.19 |

| Since Inception | 5.15 | 8.05 | 5.21 | 7.98 |

Key findings

| VWRL | MSCI ACWI | |

| Description | FTSE All-World UCITS ETF | iShares MSCI ACWI ETF |

| Asset Class | Equity | Equity |

| Net Assets | $7.5B | $15.1B |

| Inception Date | 5/22/2012 | 3/26/2008 |

| Expense Ratio | 0.22% (ongoing charge) | 0.32% |

| Minimum investment | N/A | N/A |

| Number of stocks | 3762 | 2334 |

| PE ratio | 14.2x | 15.3x |

| PB ratio | 2.3x | 2.46x |

| Distribution schedule | Quarterly | Semi-annual |

Both expense ratios are higher than VTI (0.03%) and SPY (0.09%). The sectors and top holdings breakdown for these two ETFs are relatively similar to VTI and SPY. Though emerging markets is an attractive market to enter in the future, the YTD performance is weak at the moment.

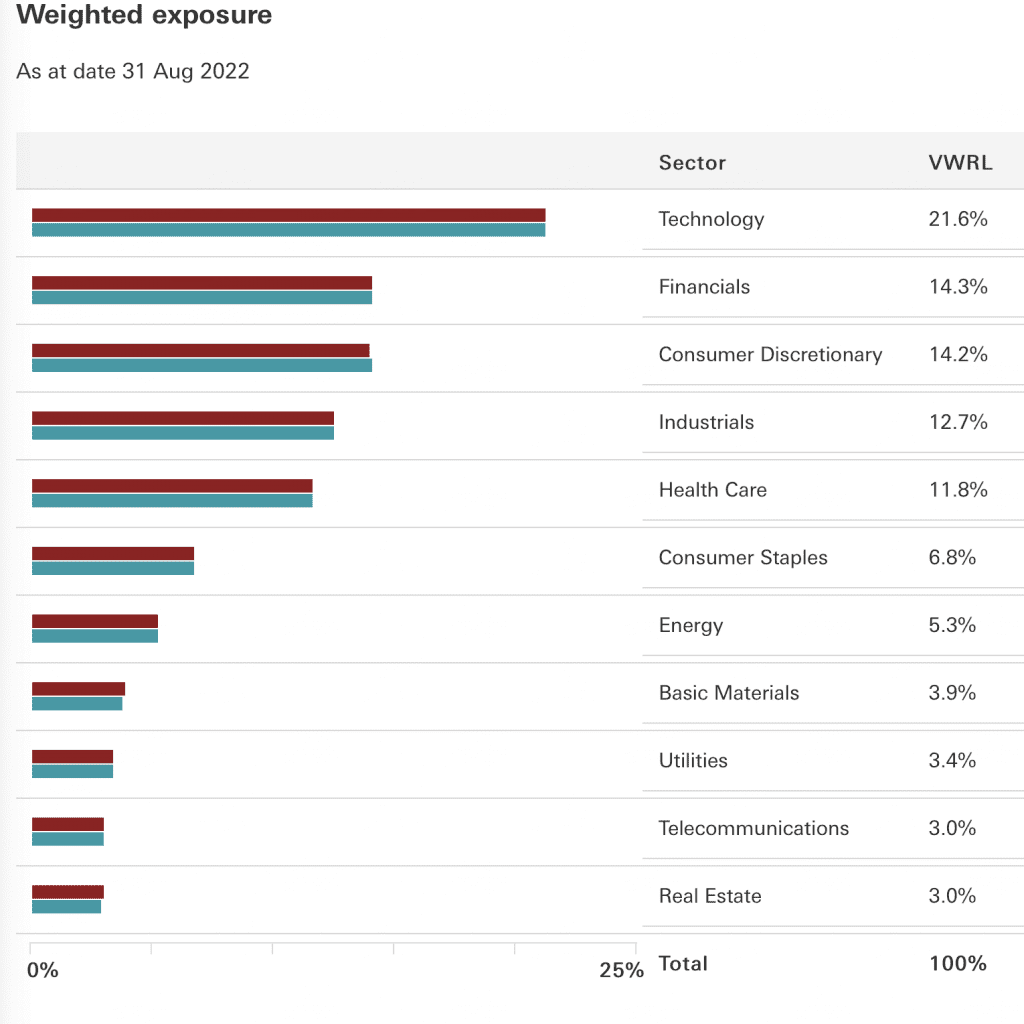

VWRL and MSCI have similar sectors breakdown

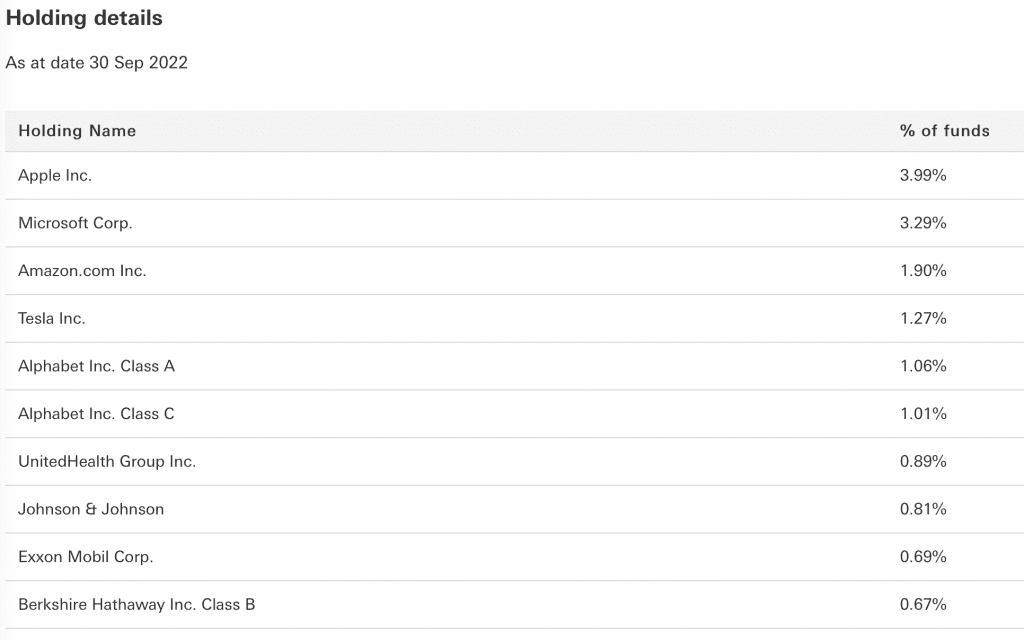

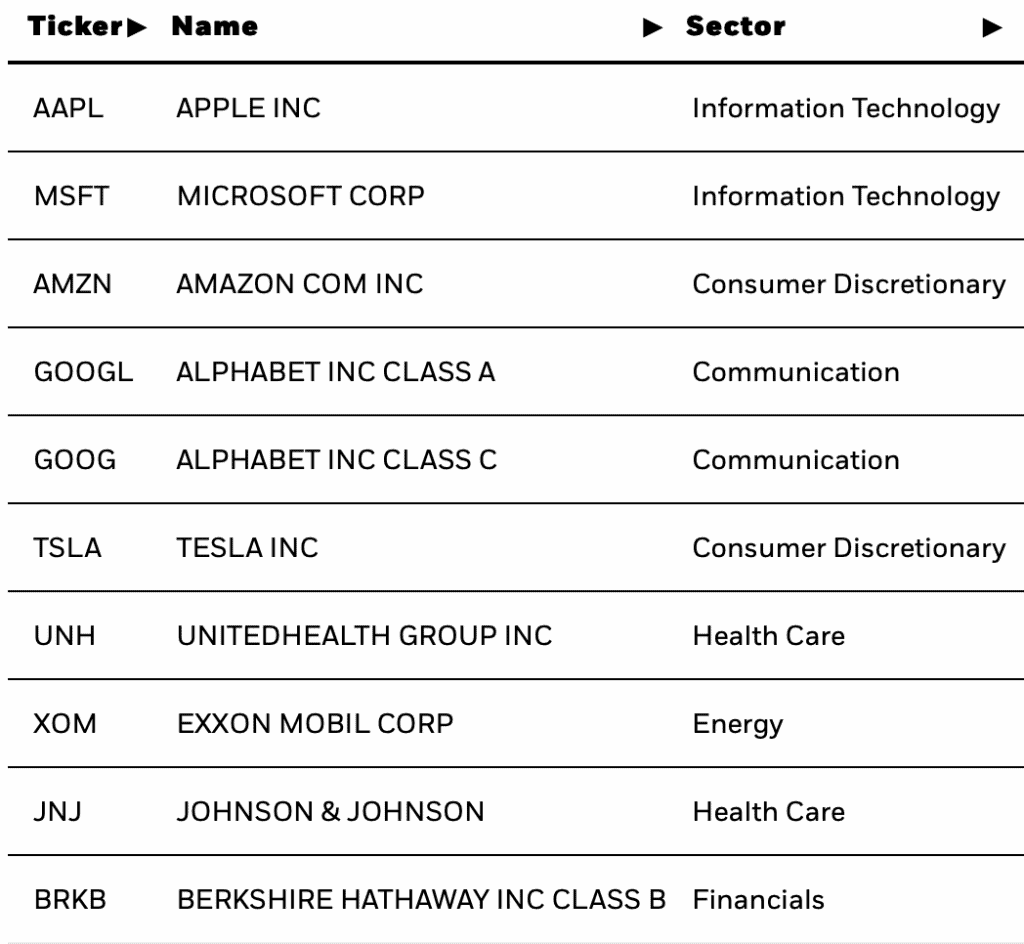

VWRL Fund top holdings

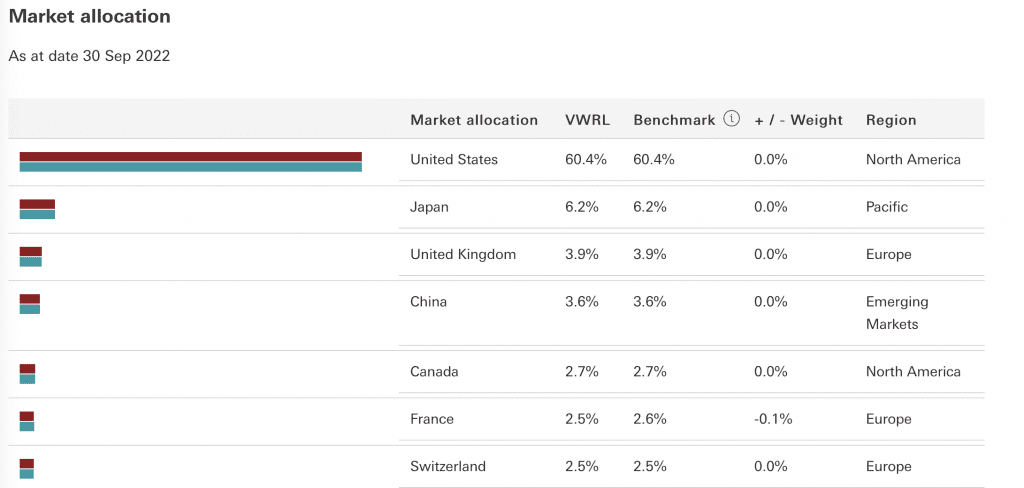

VWRL Market Allocation

MSCI ACWI Top 10 holdings

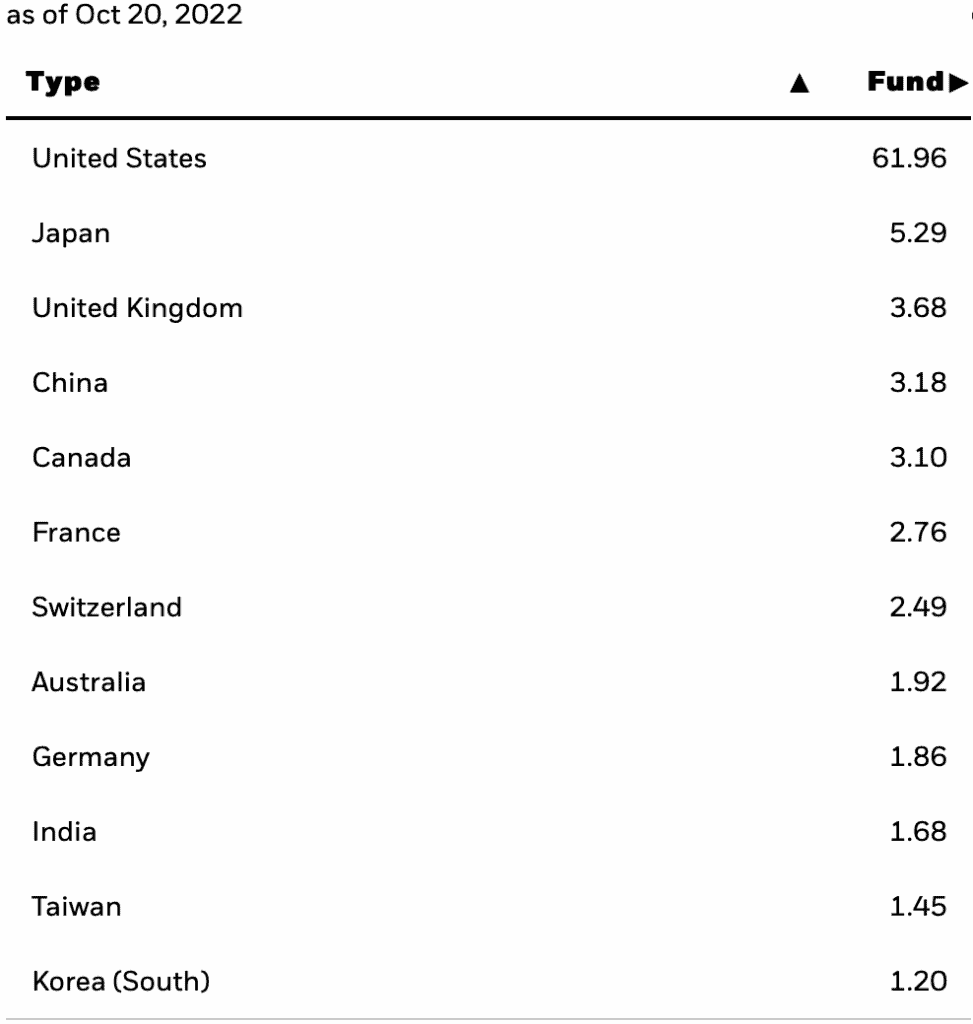

MSCI ACWI Geography

Caveat

The key risk for these funds is the volatility that comes with its full exposure to the stock market. Both carry the inherent risk of loss associated with owning assets that follow the stock market.

Differences between the 2 ETFs

Liquidity

Both can be bought or sold throughout the trading day.

They provide real-time pricing since they are an ETF, so you can see their prices change throughout the day during trading hours.

Unlike a mutual fund, it isn’t priced until the trading day is over. You will not know the price until you’ve placed your trade. As Vanguard explains on their investment page:

Regardless of what time of day you place your order, you’ll get the same price as everyone else who bought and sold that day. That price isn’t calculated until after the trading day is over.

Share Price

Both their share price changes according to the stock market's fluctuations.

Expense Ratio

It's essential that expense ratio is kept low as it can affect the performance of the index funds.

Minimum Fees

- For the price of 1 share

FTSE ALL-WORLD VS MSCI ACWI summary – which one is better?

The weightage of US firms of both ETFs are relatively similar at around 60% compared to before. It is attractive to hold an ETF that covers both developed and emerging markets. But it seems that emerging markets is not performing that well, so the YTD performance of an ETF covering developed countries and ETF with a global coverage is alike.

Related article

VTI vs VOO: which index fund is a better investment (updated 2020)

Thank you for reading! Please like my Facebook page to get the latest updates. Please click here for Referral deals.