Work shapes a third of our lives. If you’re unsure about how to genuinely feel […]

There are different types of FIRE movement in the Finance Community. The concept has become more mainstream over the years, and several variations have appeared since then.

The journey towards achieving FIRE can be satisfying, exhilarating and challenging. Being able to have the funds to channel into investments means being frugal by focusing on your needs more than wants. It also means working longer hours if applicable.

While striving to achieving this milestone, know how to manage the balance of being able to enjoy life yet still having enough for the future. Knowing how to save (by reducing expenses) and increasing your income are the keys to achieving FIRE.

Increasing your savings

Reducing your expenses means being more purposeful with your finances. So you don't indulge in Consumerism like buying multiple outfits, luxurious meals and newest gadgets etc. Saving money by not spending on your desired wants may seem like self-deprivation. But the money that you save will buy your freedom.

I try to swop the expensive activities like spinning classes for leisure cycling and home workouts. On my food expenditure, I eat at home on weekdays as much as possible. These steps allows me to cut back on unnecessary purchases and direct my funds into something that I value personally.

Increase Your Income

When you have decreased the maximum amount of your expenses, you need to set your sights on increasing your income. That way, you can have more funds for investments.

- Look for a higher paying role in another company

- Apply for a promotion and get a raise at your current company

- Start a side hustle/ build a scalable business

- Sell your items

Even if you have "retired" after achieving FIRE, you can choose to work part-time if it interests you.

Origins of FIRE movement

The main ideas behind the FIRE movement come from

- 1992 best-selling book Your Money or Your Life by Vicki Robin and Joe Dominguez

- 2010 book Early Retirement Extreme by Jacob Lund Fisker.

Your Money or Your Life by Vicki Robin and Joe Dominguez encourages people to enjoy their life more fully by taking part in their hobbies, spending time with family, and doing the things they enjoy rather than working their life away.

FIRE (Traditional)

It took decades for FIRE (Financial Independence, Retire Early) Movement to spread. It started with saving a lot of money as quickly as possible to achieve FI. Regular fire means your investments can cover your expenses associated with your current lifestyle. So, you would be able to enjoy the same level of spending with or without a job.

Achieving FIRE is when you have achieved FI or when you have got enough passive income to cover your living expenses. Then, you can retire early.

Accumulating income and assets that reach a level such that it can cover your current living expenses takes a lot of discipline. Typically, you need to be aggressive in reducing your expenses and increasing your income, saving and investments. Some recommend following the 4% rule and setting a goal of at least 25 times your estimated annual living expenses.

If this regular FIRE don't suit you, there's Lean FIRE, Fat FIRE, Coast FIRE, and Barista FIRE.

Lean FIRE

Lean FIRE is about cutting costs and minimizing living expenses. You will be living on something lesser than the average person does. It also means that your investments can only cover your essential expenses such as housing, food, and utilities. It's the opposite of Fat FIRE.

Individuals who pursue Lean FI are usually frugal and adopt a minimalist lifestyle. According to Reddit community for LeanFire, you’ll be aiming to retire and live under $40,000 per year. Thus, you will require a smaller investment portfolio but may have to supplement your retirement with extra active income sources.

Fat FIRE

Fat FI is having enough investments that can cover expenses associated with a higher standard of living than your current lifestyle. This is suitable for those who wants to have more funds to enjoy life after retirement and mitigate any financial risks. If you think that this category fits you, you can learn more from FatFIRE Reddit thread .

Barista FIRE

Barista FIRE refers to a lifestyle where you’ve hit a version of your FIRE number, but you continue to work part-time. You have enough investments that can cover a portion of your current expenses and have supplementary income with a lower stress, part time job. You can enjoy more of your life today and reduce the time taken to build a massive portfolio.

While traditional FIRE might require a portfolio of $1 million or more to retire, Barista FIRE could allow for financial independence with a smaller portfolio alongside a small income.

Working part-time could also help cover health insurance, which is a major expense.

Companies like Starbucks offer healthcare benefits to their part-time employees. That tremendous benefit can save people hundreds of dollars per month. Paying out of pocket for private insurance is expensive.

Coast FIRE

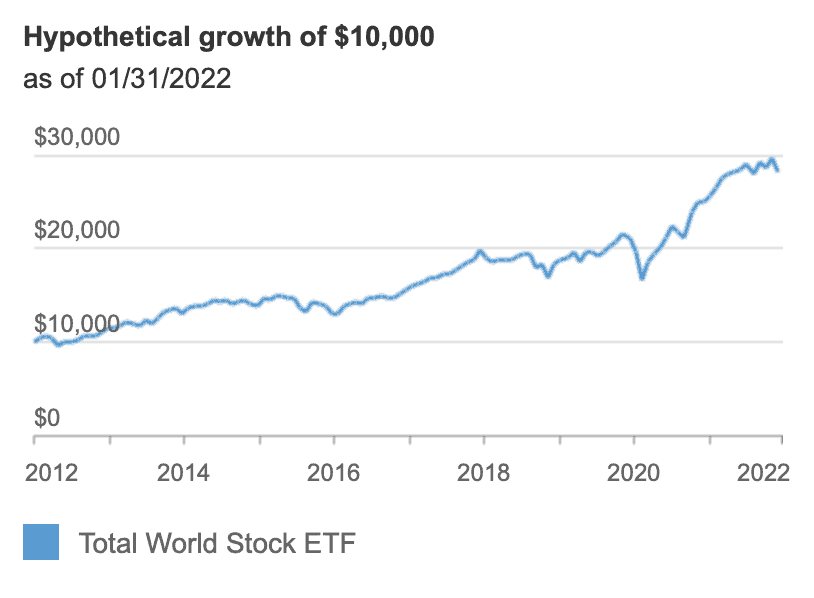

Coast FI is investing up to specific amount and then rely on compound interest to reach your FI number. You let compound interest work its magic without the need to invest anymore. The idea is that by investing early and regularly, you will hit a point where you no longer need to pump in the funds. As such, you are ‘coasting’ to retirement.

FIRE in Singapore

Although one can rent a flat in Singapore, majority would prefer to own a house as an asset. This means you probably need a regular and stable pay cheque to pay off the loan. Our unique circumstances will make pursuing FIRE take a different stance from people living in Western countries.

My FIRE Strategy

I am pursuing Regular FIRE currently as it is fitting to my lifestyle and stage of life. Financial independence is just a milestone on paper for me. I derive a huge level of satisfaction from work. Thus, I will continue to diversify my income streams to build the life that fits me well.

Since I have no regular commitments, I have the capacity to hustle as much as possible. This also allows me to save as much as possible.

On another note, I still quite like what the corporate world can offer. Having an office job also gives me a peace of mind and safety net, allowing me to explore other options during my down time.

My priority is building up my investment funds as much as possible, while maintaining a decent standard of living. At the same time, I am also looking at the future opportunities that are more aligned to my passions and interests.

Conclusion

After you have understood the difference between the forms of FIRE, you can create a customized approach that is uniquely suited for you. Everyone will take a different path depending on how they value work, life, and money. It’s important to explore all the options and know that we have a different destination.

Think critically and thoughtfully on how you can optimize your financial path.

Thank you for reading! I will share more updates on my Facebook page. Really appreciate if you could drop a like and connect.