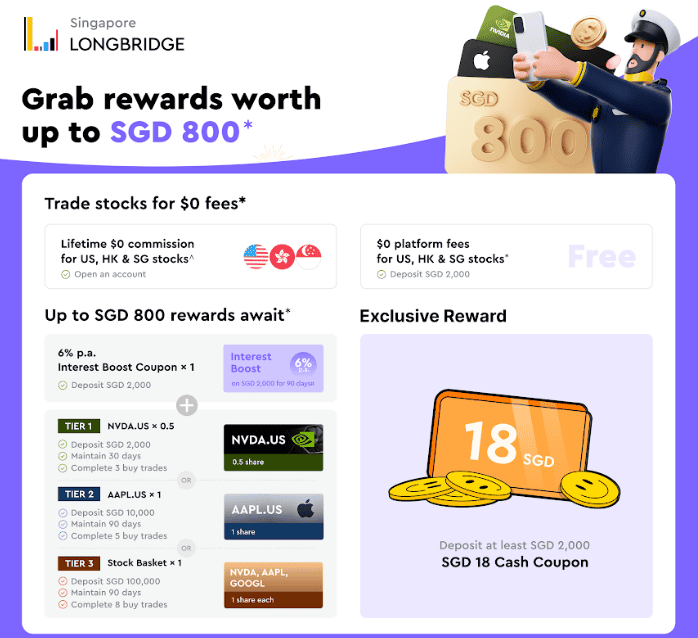

Longbridge positions itself as a "new-generation internet brokerage" which focuses on a mobile-first, zero-commission trading […]

I will be posting a short summary of Global Outlook to monitor the market movements. I hope this will help us make sound investment decisions, and filter out the noise in the market.

June

23rd: US markets were mixed overnight, with US equities struggling for direction before closing marginally higher (S&P: +0.37%; NASDAQ: +0.95%; Dow Jones: -0.01%). UST yields rose across the curve along with the DXY index. The drumbeat of global central bank hawkishness got louder yesterday. In the US, Fed Chair Powell repeated his message on the appropriateness of the Fed raising its policy rate again this year “and perhaps twice”.

April

3rd: Surprise OPEC+ cut of about 1.1 million barrels a day starting from May, with Saudi Arabia leading with 500,000 barrels cut per day, is likely to weigh on risk appetite. The S&P500 rallied 1.44% on the last trading day of March

4th: Global oil prices jumped higher on Monday following OPEC+ announcement of production cuts. Nevertheless, the weaker than expected US ISM manufacturing index outweighed the inflation concern from the higher oil prices pushing down the Fed rate hike expectation. US stocks extended its gain

March

9th: The job market remains resilient with 1.9 job openings per every unemployed person, down slightly from 2 in December.

10th: The US equity markets ended sharply lower again on Thursday despite the lack of catalyst ahead of today’s February non-farm payroll data. Market pared back its bet on Fed’s aggressive rate hike with the 2-year US Treasury yield fell by more than 20bps to about 4.82% as of this morning.

13th: in the US banking sector, startup-focused lender Silicon Valley Bank collapsed, after US regulators moved in to close it. According to the Federal Deposit Insurance Corporation (FDIC), 89% of the bank’s US$175bn deposits were uninsured as the end of 2022.

14th: Initial optimism fuelled by US authorities’ decisive action on SVB quickly fades and concerns morphed into fears for the health of the broader financial system. Global bank shares and short-dated U.S. treasury yields plunged on Monday. Market currently priced in 60% chance of 25bp hike in coming March FOMC meeting.

16th: Risk-off sentiment resumes as investors braced for more negative headlines in the banking sector, this time from outside the US with Credit Suisse (CS), as its top shareholder was reported to have ruled out the possibility of adding more takes.

17th: Fed business outlook for March remained weak in contractionary territory, suggesting a continued “tempered expectations” for growth in the region’s manufacturing activity over the next 6 months. With market news that a group of US banks agreed to place deposits at First Republic Bank, and Swiss National Bank offers a lifeline to Credit Suisse, this has somehow helped to ease the fears of a global banking crisis. The S&P500 was up 1.76% on Thursday

20th: The liquidity line provided by the Swiss central bank failed to save the troubled Credit Suisse. UBS agreed to take over Credit Suisse on Sunday. Credit Suisse shareholders will receive 1 UBS share for every 22.48 CS shares held, equivalent to 0.76 Swiss francs per share. This put CS price tag at 3 billion Swiss Franc, less than half of Friday’s closing market value. The US$17billion of a special class of CS bonds known as AT1s will be valued at zero. Under this case, it seems that equity holders are better protected than some bond holders.

The Swiss government said it would provide more than US$9 billion to deal with potential losses that UBS may incur in completion of takeover. In addition, the government will also provide more than US$100 billion liquidity to UBS to facilitate the deal.

21st: In the US, regional bank shares rallied on Monday led by the record surge of New York Community Bancorp after the lender agrees to take over Signature Bank’s deposits and some of its loans. However, First Republic share extended its loss after the rating downgrade. The Wall Street Journal reported that JP Morgan CEO is leading talks with other big banks on new efforts to stabilize the troubled bank. With worries around CS easing, attention is now turning to the US Fed who faces tough decision on rate increase.

22nd: US regional banks extended its gain on Tuesday as fears of banking crisis abated. The banks are reported to explore option to downsize via selling parts of its business, including part of its loan book to raise cash and cut costs.

23rd: The US Fed delivered a dovish 25bp interest rate hike, as most people expected, raising the fed fund rate to 4.75%-5%. The policy statement hinted that the tightening cycle is near the end. For 2024, the meeting participants now expect a much lower median rate at 4.25% by the end of 2024, even though inflation forecast is still modestly above 2% target.

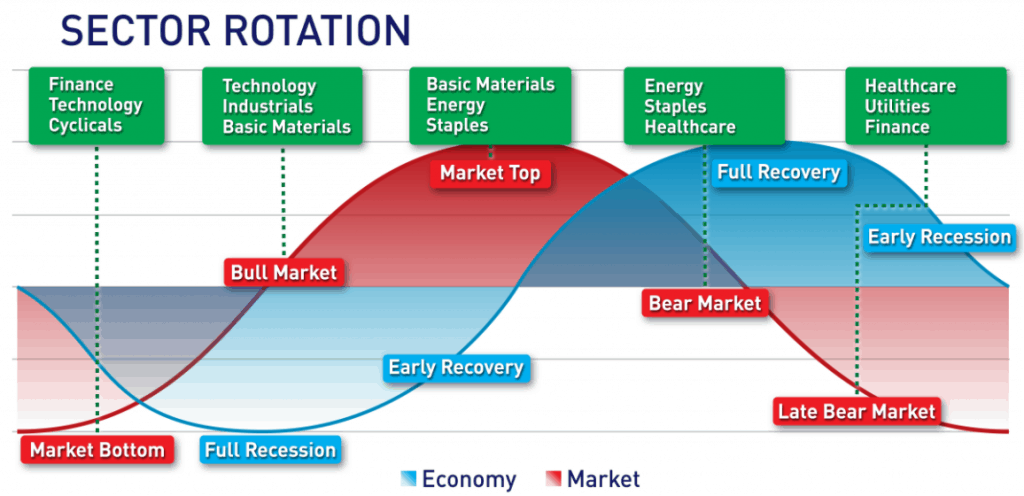

24th: The rotation from value to growth continued due to rising expectation of the end of tightening cycle. Singapore’s February headline inflation eased 6.3% YoY (0.6% MoM), while core inflation remained unchanged at 5.5% YoY (0% MoM), respectively. The slowdown in the latest headline inflation print was mainly driven by lower private transport inflation, due to a smaller increase in car prices and a decline in petrol prices.

27th: The concerns about the contagion effect from the banking crisis across the Atlantic worsened on Friday with the European bank shares tumbled again, led by a 12% drop in Deutsche Bank.

28th: Global risk appetite improved initially, with the S&P500 adding 0.16% overnight as news of First Citizens Bank’s purchase of SVB aided market sentiments for financials

29th: Risk off session with the S&P500 down 0.16% overnight as tech stocks faltered

30th: The S&P500 extended gains to climb 1.42%, led by tech shares which saw the Nasdaq closing at its highest since August and entering a bull market (20% from its December low).

March

1st: The S&P500 dipped 0.3% yesterday to cap a turbulent February in the red at -2.6% as US consumer confidence fell to a three-month low of 102.9 in February with the expectations gauge moderating from 76.0 to 69.7.

2nd: Optimism over China’s reopening story rose after the regional manufacturing PMIs generally saw improvements in February led by China

3rd: The S&P500 added 0.76%, with Dell Technologies posting better than expected results whilst Costco Wholesale’s earnings also beat forecast although sales fell short of expectations, and Macy’s and Best Buy tip sales to fall this year. The US Commerce Department has also added more Chinese companies to the Entity List, including Inspur Group and BGI Research.

5th: China set its 2023 growth target at a conservative 5% but increased its urban job creation target from 11m to 12m, the fiscal deficit target from 2.8% of GDP in 2022 to 3% for 2023 and also the central government debt ceiling, general and special local government debt ceilings, which suggested that growth remains a top priority this year

7th: even if there are some signs that price pressures are easing, the ECB is likely to increase its interest rate further in the coming months. "The current information on underlying inflation pressures suggests that it will be appropriate to raise rates further beyond our March meeting

Feb 2023

21st Feb: China left its 1- and 5-year Loan Prime Rates unchanged at 3.65% and 4.3% respectively as expected while Taiwan’s export orders shrank less than expected by 19.3% YoY BHP slashed dividends from 2022’s record US$1.50 per share to an interim dividend of US$0.90 per share amid rising costs and lower commodity prices partly attributable to the China slowdown.

20th Feb: Fed's Barkin said he favoured a 25bps rate hike in February to give flexibility whilst Bowman opined that inflation remains much too high. 6-month T-bill yield crossed 5% for the first time since 2007. Separately, China's Wang Yi urged the EU counterpart to bring bilateral exchanges back to pre-pandemic levels as soon as possible. Elsewhere, G7 nations and the EU are discussing how to trade and potentially restrict Russian diamonds. North Korea also fired more missiles after the US conducted joint military exercise with South Korea.

21st Feb: BHP slashed dividends from 2022’s record US$1.50 per share to an interim dividend of US$0.90 per share amid rising costs and lower commodity prices partly attributable to the China slowdown.

22nd Feb: The S&P500 slumped 2.0% overnight amid hawkish Fed concerns and as major retailers like Walmart gave cautious guidance due to macroeconomic uncertainty and Home Depot forecasting lower profit.

23rd Feb: Hawkish FOMC minutes sent the S&P500 down by 0.16%. The January FOMC minutes noted that “a few” favoured or could have supported a bigger 50bp rate hike and “a restrictive policy stance would need to be maintained until the incoming data provided confidence that inflation was on a sustained downward path to 2%, which was likely to take some time”.

24th: The S&P500 added 0.53% yesterday to halt a four-day losing streak, with tech stocks paving the way. US’ 4Q22 GDP growth was revised down from 2.9% to 2.7% annualised due to softer consumer spending, while initial jobless claims unexpectedly fell to a 3-week low

27th Feb: The Fed’s preferred inflation indicator - core PCE - unexpectedly accelerated to 4.7% YoY (PCE: 5.4% YoY) in January, keeping the heat on policy to keep hiking rates to combat inflation

28th Feb: US equity market gave up some earlier gains on Monday as the strong US economic overnight reinforced the narrative of Fed repricing. The decline of new orders for durable goods was weighed down by a 54.6% plunge in the nondefense aircraft category. However, durable goods excluding transportation rose by more than expected 0.7% MoM and core capital goods order, a closely watched proxy for business spending plans, rose 0.8% in January

17th Feb: Fed’s Mester opined that she saw a “compelling economic case for keeping the pace at 50” and tipped the Fed Funds rate to have to go above 5%, while Bullard also said he had advocated for a 50bps hike earlier this month and “we’ll probably have to continue to show inflation-fighting resolve as we go through 2023”

16th Feb: The US economic data again surprised the market on the upside. US retail sales jumped by more than expected to 3% MoM in January, the largest increase since March 2021 after two consecutive monthly sequential declines as demand for motor vehicles and other goods rebounded. Receipts at auto dealers accelerated by 5.9% MoM. Food and drinking sales, the only service category in the retail sales report jumped by 7.2%. Core retail sales excluding auto, gasoline, building material and food services also increased 1.7% MoM, largest gain in a year. In addition, the NAHB housing market index also increased by 7 to 42 in February, beating expectation of a smaller increase. The recent strong US data indicated two things to the market. First, it pushed back the US recession expectation. Second, it again increased rate hike expectation. US equities and dollar rallied together again as equity investors focused on the reduced probability of US recession while dollar rode on a higher rate expectation.

15th Feb: US’ headline and core inflation rose 0.5% and 0.4% MoM in January in line with market expectations, although the year-on year prints were higher than expected at 6.4% and 5.6% respectively, amid elevated housing costs

14th Feb: The S&P500 added 1.14%, led by a tech rally as a Fed York Fed consumer survey indicated that the 1-year inflation expectations were little changed in January. Crude oil prices also declined on news that the Biden administration will release more oil from its Strategic Petroleum Reserve. UST bonds also traded with a mixed tone ahead of the US inflation reading, with the 2-year yield up 4bps to a high of 4.56% before closing unchanged at 4.52% whereas the 10-year yield fell 3bps to 3.70%. Fed’s Bowman reiterated more tightening is necessary as “we are still far from achieving price stability”.

13th Feb: The S&P500 gained 0.2% on Friday, but still marked the worst week year-to-date amid heightened Fed rate hike fears, with futures market pricing having ratcheted up to near 5.2% in mid-2023 from under the 5% handle previously.

10th Feb: The S&P500 wiped out a rally of nearly 1% to close lower by 0.88%. Lyft Inc tumbled after earnings outlook missed analyst estimates whereas Tesla rallied further. UST bonds remained under pressure, with the 2–10 year yield curve widening to as much as 85bps (the steepest since the early 1980s) as the 10-year yield rose 6bps to 3.66%. Investors also piled into the US$75b 4-week bill auction at 4.52% amid the current uncertainties, while the 30-year bond auction flopped. US’ initial jobless claims rose for the first time in six weeks by 13k to 196k but remained historically low. The Fed will stress test US banks on a scenario of a severe global recession with higher unemployment rate and lower housing prices.

9th Feb: Markets stumble amid hawkish Fed rhetoric - following on the heels of Fed chair Powell, Williams opined of the need to keep a sufficiently restrictive policy stance for a few years while Waller echoed the need for keeping the rates higher for longer, and Cook noted "we're not done yet" with Kashkari also tipping the Fed funds rate to rise above 5% this year. The S&P500 fell 1.1%, dragged down by tech stocks including Alphabet Inc, while the 10-year UST bond auction was well received to push the yield down 6bps to 3.61%. Meanwhile, US president Biden denied that US-China relations had taken a big hit after the shooting down of the balloon.

7th Feb: Market risk sentiments continued to wane overnight amid hawkish central bank rhetoric. Fed's Bostic opined that the Fed may need to do a little more work to a higher peak than previously expected. BOE's Mann also advised to "stay the course" on rate hikes while Pill believes that Brexit has added to the supply side problems. The S&P500 slipped 0.6% while UST bonds also extended their sell off with the 2- and 10-year yields up 20bps and 13bps to 4.48% and 3.67% respectively. Meanwhile, US is planning a 200% tariff on Russian aluminium

6th Feb: The S&P500 fell 1.04% on Friday while UST bonds reversed course to see the 10-year yield back up 13bps to 3.53%. Fed's Daly said the December dot plot is still a good indicator of where policy is at least headed after Friday's “wow” number for nonfarm payrolls. Meanwhile, US-China tensions notched up after US Secretary of State Blinken cancelled his trip to Beijing over a supposed spy balloon that was subsequently destroyed.

3rd Feb: Risk sentiment continued to improve globally with the Nasdaq ended the day up by 3.25% on the back of ongoing monetary policy calibration which fuelled risk-on. However, major tech stocks gave up most of the gains after the closing bell due to weaker than expected earnings. Fed Chairman Powell’s comments this week that "the economy can return to 2% inflation without a really significant downturn or a really big increase in unemployment."

2nd Feb: Upbeat – risk appetite was stoked after the Fed delivered a smaller 25bps rate hike as expected even though Fed chair Powell continued to emphasize that “ongoing increases” will be appropriate to attain sufficiently restrictive stance to return inflation back to 2%. He also noted that “we will continue to make our decision meeting by meeting” and cautioned strongly against premature loosening policy as inflation has “eased somewhat but remains elevated”. He also warned that “no one should assume that the Fed can protect the economy from the consequences of failing to act in a timely manner” on the debt ceiling issue. The S&P500 rallied 1.05% while the 2- and 10-year UST bond yields both pushed 9bps lower to 4.11% and 3.42% respectively. On the data front, the US’ ADP employment added a smaller than forecast 106k in January from a revised 253k in December, while the manufacturing ISM softened further from 48.4 to 47.4, with the new orders gauge sinking further to 42.5 and the employment and prices paid gauges at 50.6 and 44.5. The Eurozone and Germany’s manufacturing PMIs came in at 48.8 and 47.3 respectively. The Asian manufacturing PMIs saw an improvement in January for Thailand (54.5), Philippines (53.5), Indonesia (51.3), China’s Caixin (49.2), South Korea (48.5) and Vietnam (47.4), possibly due to China’s reopening hopes, whereas Malaysia (46.5) and Taiwan (44.3) deteriorated further. Elsewhere, Adani Enterprises Ltd has pulled its stock offering.

1st Feb: Global risk sentiment rose into the month-end, with the S&P500 adding 1.46% overnight while Nasdaq notched up its best month since July as tech stocks rebounded. Month-end buying interest also pushed the 2- and 10-year UST bond yields down 3bps to 4.2% and 3.51% respectively. US’ Conference Board consumer confidence unexpectedly slipped from a revised 109.0 in December to 107.1 in January, as the expectations gauge declined from 83.4 to 77.8, albeit the present situation gauge was still healthy at 150.9 versus 147.4 previously. US’ FHFA house prices retreated a smaller than expected 0.1% MoM in November and the 4Q22 employment cost index cooled from 1.2% to 1.0%. On the corporate earnings front, McDonald’s Corp. and Caterpillar disappointed while GM and Exxon Mobil beat analyst estimates. Meanwhile, the Eurozone narrowly escaped a contraction in 4Q22 by eking out 0.1% QoQ (1.9% YoY sa) growth, compared to 0.3% QoQ (2.3% YoY sa) in 3Q22, as growth in France, Spain and Ireland offset the contraction in Germany and Italy. However, the outlook ahead remains weak amid elevated energy costs and rising interest rates with the ECB set to hike by 50bps tomorrow after hiking by a total of 250bps since July last year. The ECB’s quarterly Bank Lending Survey also revealed that banks have tightened credit standards by the most since the sovereign debt crisis more than a decade ago, especially for mortgages and other household loans in 4Q22, whilst loan demand from firms have also decreased.

Jan 2023

30th Jan: The S&P500 rose 0.25% on Friday, with Nasdaq notching up its best week since November amid gains in Tesla and Meta notwithstanding Intel’s bearish guidance.

27th Jan: The US economy moderated less than expected from 3.2% to 2.9% (market consensus forecast 2.6%) in 4Q22, initial jobless claims also unexpectedly fell from 192k to 186k, and durable goods orders rebounded more than expected from -1.7% to +5.6% in December. New home sales also accelerated 2.3% MoM to 616k in December. These data readings suggested that the US economy is in relatively good shape despite growing recession fears, albeit personal consumption did soften from 2.3% to 2.1% in 4Q22. The S&P added 1.10% overnight, aided by the tech stock rally, despite mixed corporate earnings news - Intel reported a 4Q loss and Visa and Mastercard saw card spending slow in 4Q22, whereas LVMH saw record profit amid resurgent luxury goods demand with China’s reopening.

26th Jan: Risk appetite appears to be holding up at this juncture amid the ongoing US earnings season. S&P500 shook off initial declines to close down just 0.02% overnight - Microsoft issued a sales warning whereas IBM was upbeat on sales but will cut 1.5% of its global workforce. Tesla which announced after hours saw profits beat estimates but plans to accelerate cost cuts.

20th Jan: Hawkish central bank rhetoric continued to weigh on market risk appetite. Fed’s Brainard opined that “we are determined to stay the course” and “move closer to a sufficiently restrictive level”, while ECB’s Lagarde echoed the need to “stay the course until such time we have moved into restrictive territory for long enough so that we can return inflation to 2% in a timely manner”. Knot also noted that “we will cover at a constant pace of multiple 50 basis-point hikes” and will not “stop after a single 50 basis-point hike – that’s for sure”. The S&P500 closed down again by 0.76% while the UST bond market also sold off, pushing the 2- and 10-year bond yields up 4bps and 2bps respectively to 4.13% and 3.39% respectively

19th Jan: The S&P500 plunged 1.56% as US retail sales fell more than expected by 1.1% MoM (the most in a year), with retail sales excluding auto and gas also down a sharper 0.7% MoM in December, which reinforced recession fears.

18th Jan: Caution ahead of BOJ policy decision. The S&P slipped 0.2% yesterday for the first time in five days, weighed down by financials including Goldman Sachs, as well as Travelers Cos and Pfizer. The Chinese economy moderated to 2.9% YoY in 4Q22 from 3.9% YoY in 3Q due to the disruptions from China’s abrupt zero-Covid pivot.

17th Jan: With US markets closed for holiday yesterday, all eyes were on Europe. The Euro Stoxx 50 closed up 0.15%, while the WEF annual meeting kicked off in Davos. Bitcoin rose above US$21,000 for the first time since November whilst commodities like oil, gold and iron ore slipped with the latter, responding to news that China’s NDRC will crackdown on illegal activities. Meanwhile, US Treasury Secretary Yellen will hold her first face-to- face meeting with Chinese Vice Premier Liu He on 18 January in Zurich to discuss economic issues. Elsewhere, BOE governor Bailey testified to parliament that the risk premium from the Truss budget is gone for now, but it will take some time to convince people that we’re back to normal. Separately, German Defence Minister Lambrecht has resigned, posing a setback to Chancellor Scholz’s government.

16th Jan: Market optimism that US inflation has peaked and the FOMC will further taper its rate hike pace to 25bps at the upcoming February meeting, continued to extend on Friday. The S&P500 rose 0.49% on Friday, as JPMorgan, Wells Fargo, Bank of America and Citi beat earnings expectations despite warning of recession headwinds. Meanwhile, the UST bond market saw the 10-year bond yield increasing 6bps to 3.50%, whilst the 2-year note yield bounced off a 3-month low to close. Separately, T-bill yields also rose across the board amid Treasury Secretary Yellen's warning of extraordinary measures to avoid breaching the US debt ceiling which may be reached as early as 19 January. Elsewhere, news that China's Covid related deaths nearly hit 60K in a month has fuelled calls for greater data transparency.

13th Jan: Easing US inflation prints gave risk sentiments a boost overnight. The December headline and core inflation rose 6.5% YoY (-0.1% MoM) and 5.7% YoY (0.3% MoM) in line with market expectations and down from the 7.1% YoY (0.1% MoM) and 6.0% YoY (0.2% MoM) respectively in November. Cheaper energy costs contributed to the first on-month CPI decline in 2.5 years. Meanwhile, real initial jobless claims also softened 1k to 205k, below market expectations for 215k, and real average hourly earnings fell 1.7% YoY. These were seen as sufficient justification for the Fed to taper to a smaller 25bps rate hike pace at the upcoming FOMC meeting on 2 February. Fed’s Harker opined that “hikes of 25bps will be appropriate going forward”, whereas Bullard favoured getting rates above 5% “as soon as possible”. The S&P500 rose 0.34% and UST bonds also rallied whilst the USD fell. The 2- and 10-year UST bond yields fell 7 and 10bps to 4.15% and 3.44% respectively, and the US$18b 03-year re-opening fetched 3.585% with a bid-cover ratio of 2.45x. Elsewhere,the10-yearJGByieldtestedtheBOJ’sYieldCurveControl limit by rising 3bps to 0.53% as market speculation of further policy tweaks build.

12th Jan: Market hopes of easing US inflation print later tonight runs high. The S&P500 rallied 1.28%, led by tech stocks, while UST bonds also gained overnight, with the 10-year yield down 8bps to 3.54%. The US$32b 10-year bond re-opening fetched 3.575% with a 2.53x bid-cover ratio. Fed’s Collins (non-voter) is also favouring a 25bps rate hike at the next FOMC meeting as “adjusting slowly gives more time to assess the incoming data before we make each decision, as we get close to where we’re going to hold” and “smaller changes give us more flexibility”. Meanwhile, BOJ officials are said to review the side effects of its ultra-loose policy according to Yomiuri Shimbun Japanese newspaper publisher. Elsewhere, some 10,000 UK civil servants plan to strike on 1 February over pay.

11th Jan: The S&P500 bounced around before closing up 0.7% while UST bonds traded weaker with the 2-year bond yield closing up 4bps at 4.25% while the 10-year yield was also up 8bps to 3.62% as debt ceiling concerns start to surface. The US government is about US$64b away from its US$31.4t statutory borrowing limit and extraordinary measures may be invoked soon. US president Biden has already asked Treasury Secretary Yellen to stay on. Meanwhile, Fed chair Powell was non- committal, citing that “restoring price stability when inflation is high can require measures that are not popular in the short term as we raise rates to slow the economy”, while Bowman also warned “we have a lot more work to do” and the sufficiently restrictive federal funds rate “will need to remain at that level for some time in order to restore price stability”. The US’ NFIB small business optimism slipped from 91.9 in November to 89.8 i n December, the second-lowest print since 2013, as firms anticipate sales and business conditions to deteriorate going ahead amid high inflation. Elsewhere, China’s aggregate financing fell from CNY1,987.4b to CNY1,310.0b in December amid likely Covid disruptions, while new Yuan loans rose from CNY1,213.6b to CNY1,400.0b.

10th Jan: Hawkish Fed rhetoric, albeit from two non-voters like Bostic and Daly, shook earlier market confidence that the US central bank was near a pivot point. Bostic opined that the Fed would hike to above 5% by early 2Q and hold for a long time, while Daly echoed that she expected rates to go somewhere over 5%. The S&P500 slipped 0.08% overnight while UST bonds continued to trade firm with the 2- and 10-year yields lower but off their intraday lows of 4.18% and 3.50% respectively. The Treasury sold US$57B of 3-month and US$48B of 6-month bills at 4.56% and 4.71% respectively, suggesting that investors were cautious about the potential debt ceiling issue for the latter amid the earlier difficulty in US House speaker’s vote. Meanwhile, China’s re-opening hopes continue to brighten amid increased travel ahead of the CNY festive season and plans to ramp up special local government bond issuance. Elsewhere, the Eurozone’s Sentix investor confidence index eased from -21.0 in December to -17.5 in January, suggesting improving confidence after it troughed in October 2022, whilst the unemployment rate was static at 6.5% in November.

9th Jan: services ISM contracted at 49.6 in December, marking a sharp correction from 51.5 in November as new orders plunged from 56.0 to 45.2, and indicating that the cumulative Fed rate hikes are starting to brake the US economy. In addition, November factory orders also fell more than expected by 1.8%. The S&P500 gained 2.28% on Friday, snapping a four-week losing streak amid market speculation that the Fed's aggressive rate hikes were starting to slow wage gains and the Fed may further taper the pace of rate hikes. Meanwhile, UST bonds rallied with the 2-year yield down 20bps to a low of 4.24% while the 10-year yield also lower by 15.5bps to 3.57%. Fed's Bostic opined that the central bank has more work to do, but he expected the Fed rate to be "not a lot above 5%", whereas Cook suggested "inflation remains far too high".

6th Jan: The latest US job market confirmed Fed officials’ observation of labour market remaining tight. The initial jobless claims dropped to 204K sa, better than consensus. In addition, the continuous claims also fell by 24K to 1.694 million, from an 11-month high of 1.718 million. The ADP national employment report showed that private payrolls increased by 235K, beating expectation of 150K, paving the way for potential positive surprise for the upcoming nonfarm payroll data today. A separate report from Challenger on job cuts also showed that US-based employers announced 43,651 job cuts in December. The bulk of the job cuts were in the technology sector. However, for the whole of 2022, the job cut was still the second-lowest recorded annual total since 1993. The outgoing Kansas Fed President Esther George reiterated higher for longer for the US rates. St. Louis Fed President James Bullard, who led the change for interest rate hike last year, said he is increasingly upbeat that the Fed can achieve its goal of lowering inflation without sending the economy into a recession. His optimistic came from the fact that the “labour market has not weakened in the way many had predicted” and he expects the labour market to remain resilient in 2023. On the Fed’s balance sheet, Bullard said he sees no reason to change the Fed’s balance sheet drawdown. Elsewhere, French central bank Governor said the ECB interest rates should reach a peak by this summer though he said it is still too early to set the level. But the ECB would then be prepared to remain the terminal rate as long necessary. The Bank of Japan was tipped to increase inflation forecast in January after the BOJ meeting on 18 Jan. However, the upward revision alone may not be enough to trigger any imminent change in its monetary policy as officials are still waiting for the annual spring wage negotiation.

5th Jan: Ignoring the hawkish messaging in the FOMC minutes, the S&P500 snapped two days of losses to rally 0.75% while the UST bond market also gained to push the 10-year yield down 5bps to 3.69%. The December FOMC minutes cautioned that “an unwarranted easing in financial conditions, especially if driven by a misperception by the public of the committee’s reaction function, would complicate the committee’s effort to restore price stability” and that a taper from 75bps to 50bps rate hike was “not an indication of any weakening of the committee’s resolve to achieve its price- stability goal or a judgment that inflation was already on a persistent downward path”. More importantly, none of the members expect a rate cut this year as there was agreement that inflation was “unacceptably high”. Fed’s Kashkari also opined that the Fed Funds Target rate may rise another100bps to 5.4% or “potentially much higher”. The futures market is pricing in a 25bp rate hike at the February FOMC meeting. Meanwhile, US’ manufacturing ISM retreated further from 49.0 to 48.4 with a moderation in new orders (45.2) and prices paid (39.4), albeit the employment gauge recovered from 48.4 to 51.4. US’ job openings also fell from 10.51m to 10.45m in November. Separately, the WSJ reported that Amazon.com is laying off more than 17,000 employees. Elsewhere, the Eurozone services and composite PMIs for December improved to 49.8 and 49.3 respectively4th Jan: Weak start to the first trading day of 2023 as S&P500 closed down 0.4%, dragged down by tech stocks including Tesla and Apple Inc on waning demand concerns, albeit the Stoxx Europe 600, FTSE 100 and HSI fared better yesterday. UST bonds rallied strongly with the 10-year bond yield lower by 13bps to 3.74%, notwithstanding a record annual loss of 12.5% in 2022 for theBloomberg US Treasury Index. The usage of the Fed’s overnight reverse repo facility also plunged by a record US$365b as year-end funding constraints eased. Meanwhile, the US Republican leader Kevin McCarthy failed to win a majority to be House Speaker after three voting rounds in the House of Representatives. Separately, former Fed chairman Greenspan opined that a US recession is the most likely outcome. As Covid cases mounted in China with the re-opening, EU is moving towards requiring pre-departure testing for flights from China even as China has said such measures targeting only China are unacceptable.

Nov 2022

1st: Global: Fourth straight 75bps hike expected from the FOMC • As of 31 October, markets have already fully priced in a 75bps hike in the upcoming meeting on 3 November as core inflation accelerated to 5.3% YoY in September, the fastest pace since November 2008. • Inflation continued to remain strong in September as US’ core PCE deflator rose 0.5% MoM (5.1% YoY) in September, while personal spending remained healthy at 0.6% (same as August) and outstripping personal income growth of 0.4%. • The elevated inflation print may suggest that it may be too soon to wish for a dovish pivot. However, a policy calibration should still not be ruled out should inflation momentum see clear signs of slowing in the coming months.

1st: Market sentiment consolidated ahead of the Fed meeting today and tomorrow. Equity investors are generally more positive about the Fed policy calibration than bond investors. Dow ended October up 14%, the strongest month since 1976 while the 2-year US Treasury yield returned to 4.5%.

2nd: the S&P 500 slipped 0.41% overnight as the US JOLTS job opening unexpectedly rebounded from 10.28mn to 10.72mn

3rd: The Fed unanimously hiked 75bps for the fourth time as expected but Fed chair Powell signalled that it was “very premature to be thinking about pausing” and that the terminal rate would be higher than initially expected even though it would be appropriate to slow the pace of rate hikes as early as the next meeting in December. He also warned that the probability for a soft landing has narrowed but is still possible. US markets whipsawed, with the S&P500 closing down 2.5%, dragged down by the tech shares in its worst rout post-FOMC since January 2021

7th: The S&P 500 broke a four-day losing streak to gain 1.36% on Friday. The USD was mostly softer while crude oil prices was lifted by market speculation that China could be relaxing its zero-Covid strategy earlier than expected. Meanwhile, the tech sector outlook remains challenging with Apple Inc warning that its newest premium iPhone shipments will be lower than expected due to Chinese lockdown impacts, and a news report that Meta Platforms Inc is planning to lay off thousands of workers from as early as this Wednesday

8th: With the US mid-term elections happening today, market sentiments remain fairly supportive since the S&P 500 rallied for a second session up 0.96% with broad-based gains. Meta Platforms rose on job cut plans whilst Tesla and Lyft fell. US-listed Chinese stocks also retreated after a four-day rally as China reiterated its zero-Covid strategy.

9th: While awaiting the US mid-term election outcome, where Republicans are tipped to take back at least the House if not also the Senate, did not deter the S&P500 from rallying for a third session by 0.56% with Nvidia among the gainers, whereas Disney, Tesla and cryptocurrency stocks fell. Market thinking is that policy gridlock could be positive for stocks.

10th: Cryptocurrency market indigestion overnight after Binance pulled the plug on its takeover offer for FTX.com. Bitcoin tumbled below US$16,000 (lowest since November 2020). The S&P 500 slumped 2.08% overnight while the UST bonds gained with the 10-year bond yield down 3bps to 4.09%. Oil prices also slipped as EIA reported US crude inventories rose 3.93mn barrels to the highest since July 2021 and on growing concerns about the Chinese economy. On the US mid-term elections, Republicans are headed to control the House but likely by a smaller than expected margin.

11th: Markets bounced back as US’ October CPI data surprised on the downside at 7.7% YoY (0.4% MoM) with the core CPI also more muted at 6.3% YoY (0.3% MoM). This was a deceleration from the September’s headline CPI and below consensus forecast. The S&P 500 surged 5.5% with Nasdaq up an even more impressive 7.4%, marking the best post-CPI day on record. The USD lost ground amid market speculation that the Fed could moderate its pace of rate hikes going forward, with the December futures market now fully on the side of a 50bps rate hike. Fed’s Logan believed “it may soon be appropriate to slow the pace of rate increases” but “should not be taken to represent easier policy” while Daly also opined that “pausing is not the discussion, the discussion is stepping down”. The dollar strength is primarily due to US economic fundamentals and different central bank tightening dynamics.

14th: China relaxes Covid-related restrictions and property measures ahead of Chinese President Xi's meeting with US President Biden at the upcoming G20 summit in Bali. The S&P 500 gained 0.92% on Friday. Democrats unexpectedly retained control of the US Senate after taking Nevada, thus setting the stage for policy gridlock. With FTX entering bankruptcy, the crypto market has lost about US$200bn in value in the past week. Improvements in two key macro risks – China’s Covid policy and property market. Latest 16 property measures indicated China’s pivot away from its restrictive housing policy to stimulus policy. It also signalled two important changes. First, China is moving from demand side stimulus to supply side stimulus. Second, China is moving from “saving projects” to “saving both projects and developers”.

15th: Biden and Xi talks in Bali signalled a willingness to improve ties, resume cooperation in areas like climate change and jointly criticized Russia. The S&P 500 fell 0.89% while UST bonds pared losses after Fed’s Brainard opined that a “more deliberate and a more data-dependent” pace of rate hikes may be appropriate soon given lags in the cumulative tightening even though “we have additional work to do”. Japan’s economy unexpectedly shrank 1.2% on an annualised basis in 3Q22 amid a Covid resurgence and a higher import bill due to JPY weakness.

16th: A softer than expected US producer price data print buoyed the S&P 500 to another 0.87% gain overnight while UST bonds also rallied with the 10- and 30-year yields to at least one-month lows at 3.77% (-8bps) and 3.96% (-8bps) respectively. The headline and core PPI came in at 0.2% MoM (8.0% YoY) and 0.0% MoM (6.7% YoY) respectively, down from 0.2% MoM (8.4% YoY) and 0.3% MoM (7.1% YoY) previously. Fed’s Bostic also opined that “there are glimmers of hope”, but “I will need to see indicators of broad- based easing of inflation”. Across in Germany, wholesale prices also fell 0.6% MoM (17.4% YoY) in October versus a 1.6% MoM (19.9% YoY) increase in September, which reinforced the market theme that inflation may have peaked. However, the geopolitical landscape remains challenging amid news that a Russian missile hit Poland (Nato member) with two casualties, pushing commodity prices higher on speculation of a potential response. Meanwhile, Apple is preparing to source chips from a plant in Arizona under construction and may expand chip supply from European plants too.

17th: Risk off after stronger than expected US retail sales and hawkish rhetoric renewed concerns about a hawkish FOMC. Resilience of the US consumer spending. October import prices also eased 0.2% MoM. On the corporate earnings front, Nvidia and Cisco also lifted market sentiments. Fed's Williams opined that "using monetary policy to mitigate financial stability vulnerabilities can lead to unfavourable outcomes for the economy" while Daly stressed that a pause is "off the table" and Waller signalled his comfort for a step down to a 50bps hike in December. The S&P 500 fell 0.83% while the UST 2-10 year bond yield curve inverted further to 67bps as the 10-year yield fell to as low as 3.683% which is the low end of the Fed's target Fed Funds range amid strong demand for the 20-year auction. Meanwhile, China's holdings of UST bonds fell by US$38.2bn to US$933.6bn in September, the lowest since June 2010. Asian markets are likely to take a breather today while waiting for BI and BSP policy decision where a 50bps and 75bps rate hike are already anticipated respectively.

18th: US equity market ended slightly lower on Thursday as hawkish comments from Fed official James Bullard and resilient US job market data pushed back the pivot narrative. In his speech yesterday, St. Louis Fed President Bullard showed that using even "dovish" assumptions, a basic monetary policy rule would require the Fed's policy rate to rise to around 5%, while stricter assumptions would recommend it climb above 7%.

21st: Hung parliament in Malaysia with PH ahead with 82 seats, PN with 73 seats, BN with 30 seats, but none with a simple majority puts the onus on a coalition alliance ahead of today’s 2pm deadline set by the King. Meanwhile, the S&P 500 rose 0.48% on Friday while the 10-year UST bond yield rose 6bps to 3.83% amid hawkish Fed comments, namely by Bullard that interest rates need to rise to at least 5-5.25% to curb inflation and Kashkari also opined that it was an “open question” how high rates need to go, albeit this was tempered by Bostic who said he prefers to slow the pace of rate hikes with only another 75-100bps of additional tightening to go

22nd: Oil market fluctuated before closing largely unchanged after Saudi Arabia denied a WSJ report that OPEC+ will consider a 500k barrel per day increase at the meeting next month to factor in the EU’s Russian oil embargo and the G7’s Russian oil price cap proposal. The S&P 500 retreated 0.39% overnight, dragged down by tech stocks, while shorter-dated UST bond yields rose 1-2bps on hawkish Fed rhetoric and a soft 5-year note auction with the 10-year UST bond yield little changed at 3.83%. Fed’s Mester opined that “we can slow down from the 75bps at the next meeting” but “I don’t think we’re anywhere near to stopping” whilst Daly said “we will need to be mindful” as we work to “bring policy to a sufficiently restrictive stance” and “5% to me is a good starting point”. : Asian markets may be off to a mixed start as investors digest the Fed rhetoric, oil market gyrations and renewed China’s Covid concerns.

23rd: The S&P 500 rose 1.36% higher amid upbeat earnings from Abercrombie & Fitch and despite hawkish Fedspeak. UST bonds also rallied with the 10-year yield down 7bps to 3.76% despite a weak US$35bn 7-year note sale at 3.89%. Fed’s George suggested that higher US savings may mean higher interest rates are needed to cool spending. However, the US Richmond survey suggested further manufacturing weakness. Meanwhile, China is grappling with a possible lockdown risk after Beijing mandated tests within 48 hours to access public venues amid a “severe and complex” uptick in Covid cases.

24th: FOMC minutes signalled that it would “soon be appropriate” to reduce the tightening pace, with various officials also tipping the terminal rate to be “somewhat higher” than previously expected and a slower tightening pace could allow for evaluating progress. Meanwhile, the Fed staff economists also warned that the chances of a US recession in 2023 had risen to nearly 50%. Still, the S&P 500 rose 0.59% ahead of Thanksgiving while VIX fell to its lowest in more than three months.

25th: The dollar index is heading towards the weakest month in 12 years, down about 5% month to date. Policy calibration hope continued to weigh down the dollar while lifting the equity sentiment in the absence of the US market due to thanksgiving holiday. The former Bank of Japan (BoJ) board member said a slower pace of Fed tightening would ease pressure on the BoJ to ramp up bond buying to defend the 0.25% cap for the 10-year government bond. The Bank of England deputy governor said he backed more interest rate hikes yesterday. However, he also said he would consider cutting rates if the economy and inflation stop being a concern. The meeting minutes from the Oct ECB meeting showed that policymakers feared that inflation may be getting entrenched. Some policymakers even expressed the view that monetary tightening would probably need to continue after the monetary policy stance has been normalized and moves into broadly neutral territory. While the meeting minutes showed ECB’s commitment to fight inflation, markets now expect a 50bps rate hike in December meeting

Oct 2022

3rd: The S&P 500 closed down 1.51% on Friday to near-2 year lows. Fed Vice Chair Brainard opined that interest rates will need to stay higher for some time and that the Fed is committed to avoid pulling back prematurely.

4th: The S&P 500 staged a 2.59% comeback in the first trading day of October, aided by tech stocks and marking its best day since July after suffering its worst September performance in two decades. The Biden administration plans to announce fresh restrictions on chip technology exports to China later this week. Over in Europe, bond markets also gained, led by the UK gilts after the Truss government reversed on top income tax cuts. Separately, North Korea fired a midrange ballistic missile.

5th: The S&P 500 posted another 3.06% rally, clocking up its best 2-day gains since April 2020, despite some worries that this would turn out to be a technical bounce due to a short squeeze

6th: US stocks ended the strong two-day rally on Wednesday as stronger than expected US data reduced hopes of a Fed pivot.

7th: Global risk appetite remained soft in the wake of the OPEC+ decision to cut its output quota by 2 million barrels per day. The S&P 500 slipped 1.02%

10th: The S&P 500 fell 2.8% on Friday while the 10- year UST bond yield also rose 6bps to 3.88% amid heightened Fed rate hike anxieties. Meanwhile, the UK Parliament returns from recess, with the BoE's Financial Policy Committee meeting on Wednesday, and could brew further opposition for the Truss administration.

11th: The S&P 500 slipped 0.75% overnight with chipmakers and US-listed Chinese companies bearing the brunt of the sell-off amid moves by the Biden administration to restrict chip exports to China

12th: End of the week is the deadline set by the BoE for funds to wind up positions and "get this done" before the central bank ends market support. Coupled with the ongoing sell-off in chipmakers and the IMF downgrade of global growth forecast from 2.9% to 2.7% this year, risk appetite is unsurprisingly taking a beating. The S&P 500 fell 0.65%, dragged down by tech shares while UST bonds fell with the UK gilt turmoil, pushing the 10-year bond yield up to 3.95%. The US$57bn of 3-month bills sold at 3.51% while the US$54bn of 6-month bills fetched 4.03%. The IMF had warned of a 25% probability that growth will sink to below 2% this year and while growth is tipped at 2% next year, about one-third of economies could contract next year and inflation will only gradually ease from 8.8% in 2022 to 6.5% in 2023 and 4.1% in 2024.

13th:FOMC minutes signalled the Fed’s commitment to hike rates to a restrictive level and hold them there to bring inflation back to target, but “several” members also said it would be important to “calibrate” rate hikes to mitigate risks, albeit “the cost of taking too little action to bring down inflation likely outweighed the cost of taking too much action”. US producer prices also rose more than expected by 8.5% YoY (0.4% MoM), but the core PPI eased slightly to 7.2% YoY (0.3% MoM) in September, suggesting that factory-gate price pressures may continue to pass through to consumer prices for a broad range of goods. Fed’s Kashkari also opined that the bar for a dovish pivot is “very high”. The S&P 500 fell again by 0.33% to near 2-year lows and the UST bond market gained, with the 10- year yield down 5bps to 3.90% while the USD was little changed. Meanwhile, the Biden administration is thinking about adding aluminium to the list of economic sanctions against Russia, which prompted metal producers to soar. Elsewhere, the JPY hit a fresh 20-year low against the USD after BoJ governor Kuroda reiterated his dovish commitment to get inflation up to 2% in a “sustainable and stable manner”. OPEC+ also cut its global oil demand forecast by 900,000 barrels per day (bpd) for this quarter, and by 460,000 bpd and 360,000 bpd to 2.64m bpd and 2.34m bpd for 2022 and 2023 respectively. Separately, BoK had hiked 50bps to 3.00% as widely expected, but with 2 dissenters even though “the board sees rate hikes as warranted, as inflation is expected to remain high” and growth is tipped to be slower than its August forecast of 2.1% amid very high uncertainty.

14th: The S&P 500 index swung 5.4% during intraday trading to close 2.6% higher. The huge swing was due to the unwinding of derivative protection. The Singapore economy grew stronger than expected by 4.4% YoY (1.5% QoQ sa) in 3Q, averting a technical recession. The MAS tightened its monetary policy for the fourth time this year via recentring its policy band to the prevailing level. MAS noted that core CPI is tilted to the upside of around 5% for the rest of 2022 and into early 2023, suggesting that the doors remain open to further tightening.

17th: Global risk appetite continued to soften as the BoE ended its emergency bond purchase program on Friday. Although the UK PM Truss had replaced Chancellor Kwarteng with Jeremy Hunt and U-turned on its controversial tax cut plans, market sentiments remain very fragile ahead of the medium-term fiscal plan announcement on 31 October. The S&P 500 also fell 2.37% on Friday with Nasdaq 100 slumping more than 3%

18th: Overnight bounce in US equity markets on the back of strong corporate earnings such as Bank of America. The S&P 500 gained 2.65% to close above a key technical level19th: Risk sentiments were bolstered by upbeat US corporate earnings from the likes of Netflix (which reported an increase in subscribers), Goldman Sachs, Johnson & Johnson, and a better-than-expected September industrial production. Fed’s Kashkari opined that “if we don’t see progress in the underlying inflation, or core inflation, I don’t see why I would advocate stopping at 4.5, or 4.75, or something like that’.

19th: Risk sentiments were bolstered by upbeat US corporate earnings from the likes of Netflix (which reported an increase in subscribers), Goldman Sachs, Johnson & Johnson, and a better-than-expected September industrial production which came in at 0.4% MoM (previously -0.1%). The S&P 500 gained another 1.14%. The Biden administration is expected to announce plans to release 15 million barrels of oil from the emergency reserves to ease high gasoline prices

20th: Recession worries return as the Fed’s Beige Book warned of “growing concerns about weakening demand”. While Fed’s Bullard and Kashkari remained hawkish, basically telegraphing the need for “follow through” as inflation may not have peaked yet, the S&P 500 reversed a 2-day rally to slip 0.67% and Tesla’s earnings also disappointed.

21st: US administration is considering expanding the export ban for China from semiconductors to quantum computing and AI software. The S&P 500 fell 0.80%. Fed’s Harker also warned that the central bank may hike to “well above 4% by the end of the year” as “inflation is known to shoot up like a rocket and then come down like a feather” while Cook also repeated the mantra for “ongoing rate hikes and then keeping policy restrictive for some time”. Asian markets are likely to trade with a cautious tone given the accelerating speed of policy changes and heightened geopolitical uncertainties.

25th: The Chinese economic growth accelerated to 3.9% YoY in 3Q from 0.4% YoY in 2Q beating market expectation. On a sequential basis, the economy also grew 3.9% QoQ sa. The stronger than expected growth was mainly supported by strong external demand, resilient industry activities and infrastructure investment as well as diminishing impact of Covid-19 restrictions. Nevertheless, the household sector remained weak.

26th: The S&P 500 gained another 1.63% overnight with Nasdaq registering its highest level in a month but post-market trading saw tech earnings disappointment from Alphabet, Microsoft and Texas Instruments. Visa reported that consumer spending growth grew less than expected by 10.5% amid inflationary pressures, which is slower than the 12% growth seen in the previous three months. The weak property market remained as the key challenge to China’s fiscal revenue.

27th: The S&P 500 snapped a 3-day rally to slip 0.74%, weighed down by tech shares which is facing the twin challenges of softening demand and USD strength.

28th: The S&P 500 slipped 0.61% overnight in choppy trading, and Amazon and Apple’s earnings disappointed.

Sep 2022

1st Sep: Markets remain nervous ahead of tomorrow’s US nonfarm payrolls report. The S&P500 slipped by 0.78% to bring the index to its worst month since June as Fed’s Mester reiterated that “even if the economy were to go into a recession we have to get inflation down” and supports lifting the policy rate to above 4% with no anticipated rate cuts in 2023. Oil also posted its third monthly decline due to ongoing growth slowdown concerns and despite Russia halting the Nord Stream gas pipeline to Europe. Meanwhile California has declared a state-wide grid emergency amid surging demand due to a heatwave. Elsewhere, a fresh record inflation print of 9.1% YoY (previously 8.9%) in the Eurozone saw ECB’s Nagel urging a “strong” reaction which added to market speculation of a jumbo 75bps hike next week and likely followed by another 50bps at the subsequent meeting. This contrasted with China whose official manufacturing PMI rose from 49 to 49.4 in July, but still stayed in contraction territory, whilst the nonmanufacturing PMI also slipped from 53.8 to 52.6 amid ongoing Covid outbreaks and lockdowns, property market turmoil and droughts.

2nd Sep: : Stabilization ahead of tonight’s key US labour market report. The S&P 500 edged up 0.30% on a late session reversal while UST bonds slumped and sent the 2-year Treasury bond yield to another 15-year high at 3.50% and the 10-year yield up 6bps to 3.25%. The 4- and 8-week T-bills fetched yields of 2.47% and 2.73% respectively. The USD also rallied on expectations that the Fed may continue to hike 75bps at the 22 September FOMC and USDJPY went past the 140 handle. Fed’s Bostic (non-voter) opined that “we have to figure out how fast we are going to move our policy to try and arrest that inflation and to wrestle it back down to 2%”. Meanwhile, US’ initial jobless claimed fell to a 9-week low of 232k, while the manufacturing ISM was unchanged at 52.8 in August. Elsewhere, Russia is considering purchasing up to US$70bn in yuan and other “friendly” currencies to slow the ruble’s surge. Separately, China’s Chengdu is under lockdown due to COVID while Hong Kong is targeting to end hotel quarantine in November.

5th Sep: Stronger US nonfarm payrolls data (315k versus market expectations for 300k) failed to support risk appetite as the unemployment rate unexpectedly jumped from 3.5% to 3.7% (with the labor force participation rate rising from 62.1% to 62.4% as more workers returned to the workforce) and the average hourly earnings eased to 5.2% YoY. The S&P 500 lost 1.07% to register its third weekly loss (longest since mid-June) while UST bonds rallied on Friday, led by the shorter tenors with the 2- and 10-year bond yields down 11bps and 6bps to 3.39% and 3.19% respectively. Weighing on market sentiments was also the worsening energy crisis for Europe amid news that Gazprom had halted gas supplies via the Nord Stream pipeline (which was supposed to reopen on Saturday after a 3-day maintenance period), likely in reaction to the G7 news of an agreement to implement a price cap on Russian oil. This prompted Germany to unveil a EUR65bn package to help consumers, with Chancellor Scholz saying that tapping the windfall profits of energy companies will yield “many, many billions” of euros and remains confident that there will not be blackouts during winter despite energy rationing. Meanwhile, China extended its lockdown in some districts in Chengdu, whilst the Biden administration is said to be considering measures to restrict US investment in Chinese tech companies

6th Sep: With the US markets out for Labor Day holiday yesterday, market attention continued to focus on the energy woes plaguing Europe amid the indefinite shutdown of the Nord Stream pipeline

7th Sep: The unexpectedly strong US services ISM data, which improved from 56.7 in July to 56.9 in August, bolstered market expectations for a more hawkish Fed rate hike at the upcoming September FOMC. Both the business activity and new orders gauges rose to year-to-date highs, reinforcing the resilience of the US economy. The S&P 500 fell 0.41% while VIX rose to 26.91. The UST bond market tumbled overnight, with the 30- year yield exceeding its June 2022 high to rise 15bps to 3.49%

8th Sep: Some respite as the S&P 500 rebounded 1.83% overnight, marking the biggest jump in a month, aided by the drop in oil prices which may cool inflation as WTI fell to US$81.84 per barrel on growing recession fears. UST bonds also rallied, pushing the 10-year yield down 9bps to 3.26%. The Fed’s Beige Book also noted that economic activity was unchanged on balance since early July, with most districts reporting steady consumer spending, solid leisure travel activity, but also falling home sales and production generally constrained by supply chain bottlenecks for critical components, albeit the future growth outlook remained generally weak with expectations for further softening of demand over the next 6-12 months. Fed’s Brainard reiterated “monetary policy will need to be restrictive for some time to provide confidence that inflation is moving down to target” and Mester also opined that “in formulating my monetary policy views, I will be guarding against declaring victory over the inflation beast too soon”.

9th Sep: Hawkishness is in as major central banks embellish their inflation fighting credentials! The ECB unanimously hiked 75bps while temporarily removing a 0% cap for renumerating government deposits which would reduce the incentive to shift cash into short-term debt until 30 April 2023. ECB also cut its 2023 growth forecast from 2.1% to 0.9% (implying no recession, but just stagnant growth) but raised its inflation forecast to 2.3% in 2024.

12th Sep: Hawkish rhetoric continues to haunt financial markets, but this did not douse market enthusiasm which led to the S&P 500 gaining 1.53% on Friday while the 10-year UST bond yield was little changed at 3.31%. Fed's Waller said he supports "another significant increase" until he sees a meaningful and persistent moderation in the rise of core prices, while Bullard also said he is leaning "more strongly towards" a jumbo 75bps rate hike for the 20-21 September FOMC meeting. A San Francisco Fed study also suggested that inflation will only return to its 2% target at the beginning of 2025

13th Sep: The US equity rally extended overnight, with the S&P 500 clocking up another 1.06% gain to complete its best four-day surge since June, led by Apple on strong demand for iPhone 14 Pro Max, as well as hopes that US inflation is cooling. Oil prices rose while USD was lower against most G10 currencies. A US railroad worker strike by the end of this week, while Goldman Sachs is reportedly cutting hundreds of jobs. Elsewhere, the EU is seeking to curb power consumption, provide liquidity to energy markets, as well as cap excessive revenues of energy companies.

14th Sep: Fragile market sentiments cracked in the face of a nasty inflation print which disappointed market hopes for easing prices. The US headline CPI slowed from 8.5% to 8.3% YoY (0.1% MoM) but missed consensus forecast of 8.1%, while the core CPI accelerated more than expected from 5.9% to 6.3% YoY (0.6% MoM), driven by rental inflation that saw its biggest monthly surge as well as food, transportation, medical care and recreation services. This data print fuelled market speculation that the Fed would hike at least 75bps for the third straight meeting at the 22 September FOMC meeting, with some even anticipating a possible 100bps. The S&P 500 slumped 4.32% overnight in its worst session since 11 June 2020 and erasing nearly all the gains in the last fourday rally due to the drag by tech stocks

15th Sep: the S&P 500 recovered 0.34%. Elsewhere, ECB’s Holzmann warned that inflation is “likely to accelerate even more” and “we’ll continue to react in future” while France will cap electricity and gas price hikes at 15% for households and small companies next year.

16th Sep: the S&P 500 declined 1.13% overnight to its lowest level since July, with tech stocks leading the decline, as market players weighed the prospects of another 75bps at next week’s FOMC meeting. The World Bank warned that global growth is slowing sharply but global core inflation rate could stay ~5% in 2023 and global monetary policy tightening could give rise to significant financial stress and trigger a global recession next year.

19th Sep: FOMC anxiety abound ahead of the anticipated 75bps hike, with a tail risk of even a 100bps hike. The S&P500 fell 0.72% on Friday, marking its worst week since its June lows after FedEx withdrew its earnings guidance on weakness in Asia and Europe.

20th: Rebound in US equity markets saw the S&P 500 up 0.69% overnight despite a choppy session, with Apple and Tesla leading market gains after the worst weekly rout since mid-June. World Bank president Malpass said that China is “less eager to really stimulate this time” compared to previous global down cycles which in turn puts more burden on the US, and tips 2023 growth to slow to 0.5% and contract 0.4% in per capita terms which would meet the technical definition of a recession.

21st: The S&P 500 slipped 1.13% overnight while VIX rose to 27.16. UST bonds slide with the 2- and 10-year yields up to 3.97% (+3bps and nearing the 4% handle) and 3.56% (+7bps) respectively, while the USD gained against most of its G10 counterparts. Meanwhile, Economist Nouriel Roubini tips a further 40% drop in stocks with a long and ugly US recession. Elsewhere, BOC deputy governor Beaudry opined that inflation is “headed in the right direction” but is “still too high”.

22nd: The Fed has signalled a total of 125bps by end of the year to around 4.4% and to reach 4.6% in 2023 before moderating to 3.9% in 2024. Global risk appetite did not react well to the Fed’s third 75bps rate hike to 3.25% with an even more hawkish bias, with the S&P 500 falling 1.71% to bring its plunge from the January to exceed 20%.

23rd: The S&P 500 tumbled to June lows with the main drag from tech stocks while the dollar mostly advanced. The hawkish message was reinforced by the BOE's second 50bps hike with three gunning for a larger hike. BI also surprised markets to opt for a 50bps hike (most aggressive move since mid-2018) to frontloading in anticipation of inflation peaking above 6% by end-2022 while core inflation will also hit 4.6%

24th: UK Chancellor Kwarteng scrapped the top 45% income tax bracket and cut the basic rate by 1ppt to 19% and pledged more to come, spooking markets about how they would pay for the largest tax cuts since 1972 which would cost GBP161bn over the next five years. The S&P 500 slumped 1.72% paled in comparison with the 2-year gilt which jumped as much as 57bps.

27th: The BOE said it will make a “full assessment at its next scheduled meeting” on the impact of the government’s fiscal plan and the GBP drop with the pledge that it will not “hesitate to change interest rates by as much as needed to return inflation to the 2% target sustainably in the medium term”, but financial markets were not impressed with the absence of immediate action. S&P 500 also fell 1.03% overnight. Central bank rhetoric remained hawkish with Fed’s Collins advocating “further tightening of monetary policy”, Mester calling for “further increases in our policy rate…to be in a restrictive stance… and remaining there for some time”. ECB’s Lagarde indicated that rate hikes is the most appropriate for fighting inflation and will only consider QT after completing interest rate normalization, whilst Nagel opined that “further decisive action is required to bring the inflation rate down to 2% in the medium term” and de Cos echoed the need to be “extremely vigilant” on inflation expectations.

28th: US markets remain unsettled overnight with the S&P 500 extending losses for the sixth day by 0.2% in its longest losing streak since February 2020. Fed's Kashkari warned that "there's a lot of tightening in the pipeline" while Bullard and Evans suggested that the US economy would escape a recession despite much higher rates.

29th: The S&P 500 snapped a 6-day losing streak to rally 1.97%. Central bank rhetoric elsewhere remained generally hawkish as ECB’s Lagarde opined that the central bank will “continue hiking interest rates in the next several meetings”, but “our primary goal is not to create a recession”, while Kazaks said the next hike must be big with smaller steps to follow and Rehn also said neutral may be reached by Christmas which reinforced the market speculation of a 75bps rate hike at the October meeting.

30th: The S&P 500 fell 2.11% while the 10-year UST bond yield rose 5bps to 3.79% and the average 30-year mortgage rate jumped to 6.7% (highest since 2007). Germany is also planning to borrow up to EUR200bn to offset the energy price hike through its Economic Stabilisation Fund. Separately, Russia will proceed to annex controlled parts of Ukraine today. China will cut mortgage rates for home purchases for eligible cities.

Aug 2022

1st: Strong market headwinds loom ahead for the week as China’s official manufacturing PMI unexpectedly contracted to 49 in July from 50.2 in June, while the non-manufacturing PMI also eased from 54.7 to 53.8. The S&P 500 rallied 1.42% on Friday to cap the best month since 2020 as market players hope the Fed will slow rate hikes after the US economy entered a technical recession in 1H22.

2nd: The S&P 500 snapped a three-day rally to fall 0.28% overnight after the US’ manufacturing ISM retreated from 53.0 in June to 52.8 in July

3rd: the S&P 500 fell 0.67% while UST bonds also traded in a choppy fashion with the 10-year bond yield jumping 18bps higher to 2.75% amid the tug of war between US-China tensions and Fed’s still hawkish rhetoric

4th: Risk appetite rebounded overnight with the S&P 500 snapping a two-day loss to close up 1.56% amid healthy US corporate earnings from PayPal and Moderna as well as robust economic data and as market jitters over US-China tensions (due to Taiwan) subsided slightly.

5th: BoE hikes for the sixth consecutive time by 50bps to 1.75% in its largest move in 27 years with governor Bailey flagging that inflation may peak at 13.3% in October and that “all options are on the table for our September meeting and beyond that”, but warned that a recession will start in 4Q22 and last through 2023. Meanwhile, the S&P 500 edged down 0.08% overnight while UST bonds range traded yesterday with the 10-year yield hovering around 2.69% even as monkeypox is declared a public health emergency in the US. Fed’s Mester reiterated that the central bank is “committed to getting inflation” down to its 2% target

8th: the S&P 500 declined 0.2% on Friday while UST bond yields surged, led by the shorter tenors as market players repriced the Fed rate hike expectations.

10th: Crude oil prices saw choppy trade on news that Russian oil had stopped flowing to central European countries of Hungary, Slovakia and the Czech Republic last week according to Russian pipeline operator Transneft PJSC. The S&P 500 declined 0.42% overnight, dragged down by semiconductor companies after Micron cut its 4Q forecast.

11th: Cooling US inflation gave risk appetite a boost overnight, sending the S&P 500 up 2.13% to a 3-month high and VIX down below the 20 handle for the first time since 4 April. Nasdaq also surged more than 20% from its June trough. Asian markets may be lifted today on hopes that the FOMC would reconsider another 75bps rate hike at the September FOMC meeting as US inflation is now cooling.

12th: Post-CPI euphoria has evaporated, leaving the S&P 500 lower by 0.07% overnight while UST bonds also softened, with the 10-year yield up 11bps to 2.89%. China’s automotive sector continued to recover in July with sales rising by 29.7% YoY, according to the data from the China Association of Automobile Manufacturers. In addition, automotive production also rose by 31.5% YoY. The Association expects the automotive sales growth to remain steady in the next two months due to supportive policies and seasonal demand.

15th: News that a US congressional delegation led by Senator Ed Markey has landed in Taiwan for a 2-day visit with plans to meet Taiwanese President Tsai Ing-wen this morning mean US-China tensions may come to the fore again. The S&P 500 had rallied 1.73% on Friday to cap a fourth straight week of gains (the longest run since November)

16th: Despite the weak Empire State manufacturing index (-31.3 versus +11.1 previously amid sharp declines in orders and shipments) and soft NAHB housing market index (49 versus 55) data, the S&P 500 still added 0.4% overnight while VIX stayed below the 20 handle for the second session. Nasdaq also bounced, led by Tesla and Apple Inc as market toned down their expectations of aggressive Fed rate hikes.

17th: The S&P 500 added 0.19% overnight, aided by Walmart Inc and Home Depot despite weakness in tech stocks. Oil also held near a six-month low amid concerns of slowing demand outlook and the potential return of Iranian supply. Meanwhile, Chinese Premier Li Keqiang urged six key provinces to boost growth measures and vowed to “reasonably” step up policy support. Separately, Germany may only have natural gas reserves for about 2.5 months if Russia cuts off supply completely

18th: The focus of the market overnight was the release of the minutes from the late July FOMC meeting. Officials expressed the need to slow the pace of rate hikes "at some point", noting the risk of over-tightening being "unacceptably high", despite price pressures. Still, the officials remained cautious of the significant risk of entrenched inflation, pointing out the risk that they "could tighten the stance of policy by more than necessary to restore price stability."

19th: Fed officials pushed back against investor expectations that the Fed would start to cut rates next year. Overall, the broadly still-hawkish Fed stance came at a time when the US labour market appeared to remain strong, with the initial jobless claims data declining on the week. The comments also came ahead of the Jackson Hole Fed symposium next week, whereby market watchers will be looking out for clues regarding the Fed interest rate path not just for the September meeting, but going into 2023, even as there may not be much new information in the end.

22nd: The S&P 500 fell 1.29% on Friday amid renewed Fed rate hike concerns.

23rd: Pre-Jackson Hole jitters – S&P 500 sank 2.14% overnight, weighed down by consumer discretionary stocks

24th: Risk sentiment consolidated lower slightly ahead of the Jackson Hole meeting this Friday as weaker than expected US new home sales fuelled the concerns of an economic slowdown. US new home sales tumbled more than expected by 12.6% MoM to a seasonally adjusted annual rate of 511K units, lowest since January 2016. June sales was also revised down by 5k units to 585k units. Minneapolis Fed President Kashkari said on Tuesday that it is very clear the Fed has to tighten monetary policy, stating that “When inflation is 8% or 9%, we run the risk of unanchoring inflation expectations and leading to very bad outcomes.” His biggest fear is that if the Fed is wrong that this inflation is embedded at a much higher level, then the Fed will have to be more aggressive than he anticipates.

24th: Risk sentiment consolidated lower slightly ahead of the Jackson Hole meeting this Friday as weaker than expected US new home sales fuelled the concerns of an economic slowdown. US new home sales tumbled more than expected by 12.6% MoM to a seasonally adjusted annual rate of 511K units, lowest since January 2016. June sales was also revised down by 5k units to 585k units. Minneapolis Fed President Kashkari said on Tuesday that it is very clear the Fed has to tighten monetary policy, stating that “When inflation is 8% or 9%, we run the risk of unanchoring inflation expectations and leading to very bad outcomes.” His biggest fear is that if the Fed is wrong that this inflation is embedded at a much higher level, then the Fed will have to be more aggressive than he anticipates.

25th: hawkish Fed rhetoric failed to dampen market sentiments overnight with the S&P 500 up 1.41% (on the back of Apple and Amazon.com) a

26th: the S&P 500 added 0.29% overnight after a three-day slump while UST bonds remained on the backfoot ahead of Fed Chair Powell’s speech and as US new durable goods orders rose more than expected by 2.2% in June. The 2- and 10-year yields jumped 9 and 6bps to 3.39% and 3.10%, while the US$45bn 5-year auction tailed at 3.23%. Meanwhile, China announced plans for a 19-point package to keep growth at a reasonable range, that includes a quota of more than CNY300bn for financial tools. Elsewhere,Thailand’s Constitutional Court has suspended PM Prayuth pending a court decision on a petition filed by opposition parties, with DPM Prawit as the new caretaker leader during this period. Separately, crude oil prices rose as US commercial crude oil stocks fell more than expected by 3.3 million barrels

Jul 2022

1st: Worst half-year close since 1970 for the S&P 500 amid persistent inflation and emerging recession fears. The S&P 500 fell 0.88% overnight whereas Chinese shares extended gains after China’s official manufacturing

and services PMIs expanded in June to 50.2 and 54.7 respectively

4th: Heightened US recession concerns. The S&P 500 gained 1.06% on Friday after a worst first half performance since 1970. Eurozone's inflation exceeded market expectations and hit another record high of 8.6% in June, up from 8.1%, whilst the unemployment rate fell to a record low of 6.6% too, which reinforced the case for ECB rate hikes starting this month when they meet on the 20th.

5th: President Biden may be announcing a rollback of some US tariffs on consumer goods imports from China this week, in a bid to contain domestic inflation surge. To placate those who are against the tariff pullback, in part because of the view that the US would lose a key negotiating leverage, he is likely to announce a new probe into industrial subsidies that may well lead to more tariffs in certain areas such as technology

6th: The US equity markets did manage to stage an intraday rebound, with the S&P 500 closing 0.16% higher while the Nasdaq was up by over 1.7%. The US dollar posted gains, trading at 1.027 against the Euro, with market chatters about reaching parity potentially.

7th: Minutes from the June FOMC meeting signaled that Fed officials saw the need to hike by either 50 or 75bps in the next meeting in July, viewing that it was crucial to maintain the central bank's credibility in fighting against inflation. Moreover, it noted that "an even more restrictive stance could be appropriate if elevated inflation pressures were to persist." The market sentiment took the FOMC minutes in its strides

8th: Pushback against recent recession concerns saw Fed governors Waller and Bullard reiterating the need for another 75bps rate hike at the upcoming FOMC meeting on 26-27 July. Waller opined that he definitely supports a 75bps rate hike in July, but probably 50bps in September and then after a debate whether to go back down to 25bps, while Bullard said the US economy has a good chance of a soft landing.

12th: Stronger than expected US nonfarm payrolls which printed at 372k in June versus the market expectation for only 265k in May strengthen theFed's resolve to proceed with another 75bps rate hike at the upcoming

FOMC meeting later this month. Fed's Bostic voiced support for a 75bps rate hike amid the strong US economy and Williams opined that growth may slow to below 1% before rebounding to around 1.5% next year, whereas George (the dissenter favouring a 50bps rate hike in June) warned that “moving interest rates too fast raises the prospect of oversteering”. The S&P 500 fell 1.15% yesterday while the flight to quality lifted the USD (above 108 for the first time in two decades)

13th: Recession fears came to the fore again. The IMF has cut its US growth forecast to 2.3% this year and 1.0% next year, warning that the unemployment rate will increase from the current 3.7% this year to 4.6% next year and exceed 5% from 2024-2025 as the “policy priority must be to expeditiously slow price growth without precipitating a recession”

14th: US CPI rose 9.1% YoY in June, beating expectations. The market is now pricing in the possibility of almost a 100bps rate hike in next week's FOMC meeting. Inflationary pressures continue to swirl and show no signs

of abating despite the Fed's recent rate hikes, and the central bank may be coming under increasing pressure to step up its rate hike cycle.

15th: Market chatter continues to revolve over whether a 100bps rate hike is forthcoming from the Fed next week. Fed officials Bullard and Waller publicly continued to back a 75bps rate hike yesterday. US banks

earnings missed in some results released yesterday, casting a gloomy start to the earnings season.

18th: US equity market rebounded on Friday as June retail sales rose more than expected by 1.0% MoM and the University of Michigan sentiment index also surprised on the upside at 51.1 in July, with the 1- and

5-10 year inflation expectations gauges easing slightly to 5.2% and 2.8% (previously 5.3% and 3.1%). The S&P 500 gained 1.92%, snapping a 5- session losing streak as financial stocks rose, while VIX dipped to 24.23 on

Friday. Separately, the IMF is signalling it will cut its global growth forecast substantially from the current 3.6% in the upcoming review.

19th: News of Apple’s plans to pare back hiring in 2023 contributed to the softening of market confidence. The S&P 500 slipped 0.84% while UST bonds retreated

20th July: The S&P 500 rebounded 2.76% overnight, led by tech stocks. Netflix rose in extended trading after losing fewer customers (970k) than expected in 2Q, but is tipping flat margins due to a slowdown in revenue growth, whilst Johnson & Johnson cut its sales and profit guidance amid a stronger USD and rising costs. The US Treasury bond market sold off with the 10-year bond yield up 4bps at 3.02% while the USD also slipped.

21st S&P 500 added 0.59% in a choppy session overnight, although tech stocks pared gains after Google said it would briefly stop hiring. Tesla and Alcoa were among the gainers.