Work shapes a third of our lives. If you’re unsure about how to genuinely feel […]

It took me a while to learn how to manage my stocks and to practice staying calm during the ups and downs of my portfolio. My plan isn’t perfect, and I can’t say it’s completely storm-proof, but given the effort I’ve put into managing it, I think it’s doing reasonably well.

Start With a Clear Investment Goal

Before touching a stock chart or clicking “buy,” decide what you’re investing for:

- Short-term growth (e.g., saving for a house in 3–5 years)

- Long-term wealth (e.g., retirement, passive income)

- Specific milestones (e.g., child’s education fund)

Your goals will influence your time horizon and risk tolerance. My time horizon is at least 20 years while my risk tolerance has decreased dramatically.

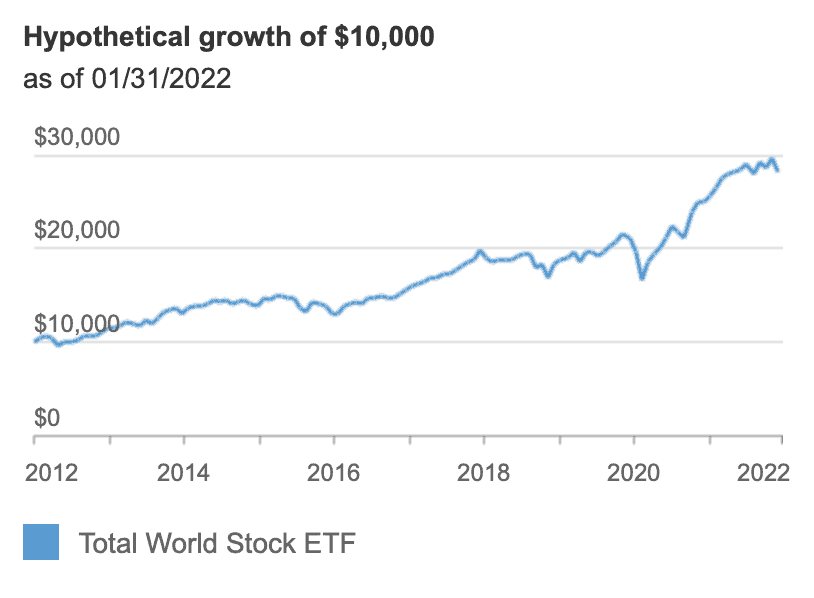

Pro Tip: The longer your time horizon, the more risk (volatility) you can typically afford to take.

Diversify, But Don’t Overcomplicate

Diversification spreads risk so you’re not relying on a single stock or sector. A well-diversified portfolio might include:

- Different sectors (technology, healthcare, consumer goods, energy)

- Different market caps (large-cap, mid-cap, small-cap)

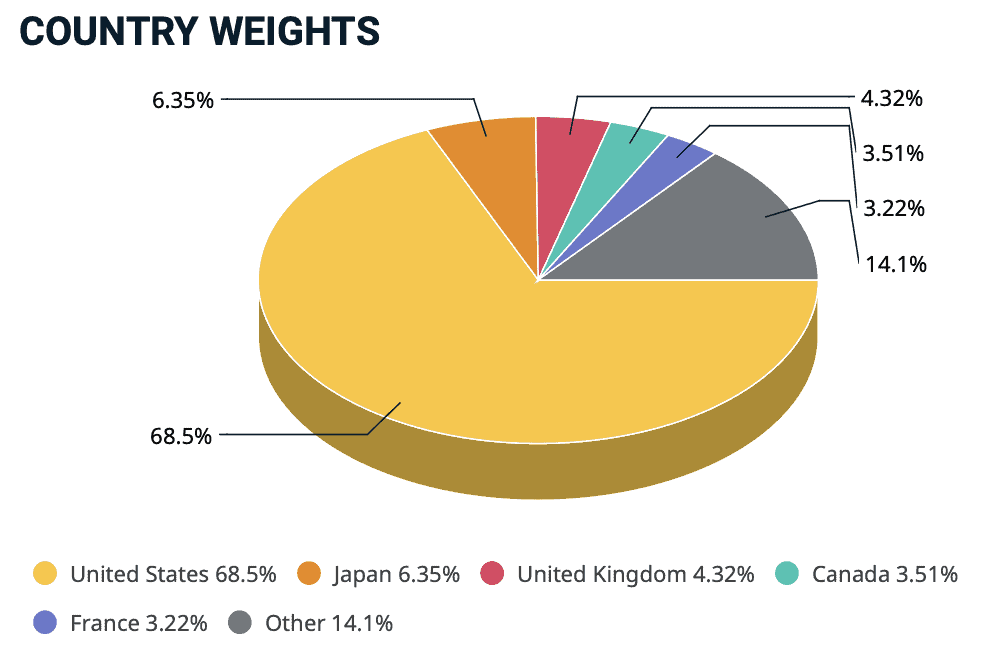

- Geographic spread (domestic and international stocks)

Aim for 10–20 quality companies or use ETFs for instant diversification.

Decide on an Asset Allocation

Stocks are just one part of your portfolio. You might balance them with:

- Bonds for stability

- Cash for flexibility and opportunities

- REITs or commodities for alternative exposure

Your asset allocation should match your risk profile. For example:

- Aggressive growth: 90% stocks, 10% bonds

- Balanced: 60% stocks, 30% bonds, 10% cash

- Conservative: 40% stocks, 50% bonds, 10% cash

Monitor, But Don’t Obsess

Checking your portfolio daily can lead to emotional decisions. Instead:

- Review quarterly to assess performance and sector balance

- Rebalance annually to maintain your target allocation

- Watch for red flags in company fundamentals (e.g., declining revenue, rising debt)

Remember: Market noise can trick you into selling too soon or buying too late.

Reinvest Dividends

If you’re in the growth phase, reinvesting dividends can turbocharge your returns through compounding.

Many brokerages offer Dividend Reinvestment Plans (DRIPs) that automatically buy more shares with your payouts.

Keep Costs Low

Fees and commissions eat into your returns.

- Use low-cost brokers

- Favor index funds or ETFs with low expense ratios

- Minimize excessive trading to avoid unnecessary transaction fees and taxes

Control Your Emotions

Markets will rise and fall

- Avoid panic selling during downturns

- Don’t chase hype or “hot tips”

- Stick to their plan, even when headlines scream otherwise

Think of your portfolio like a garden: you plant, nurture, and prune — but you don’t dig up the plants every time the weather changes.