Work shapes a third of our lives. If you’re unsure about how to genuinely feel […]

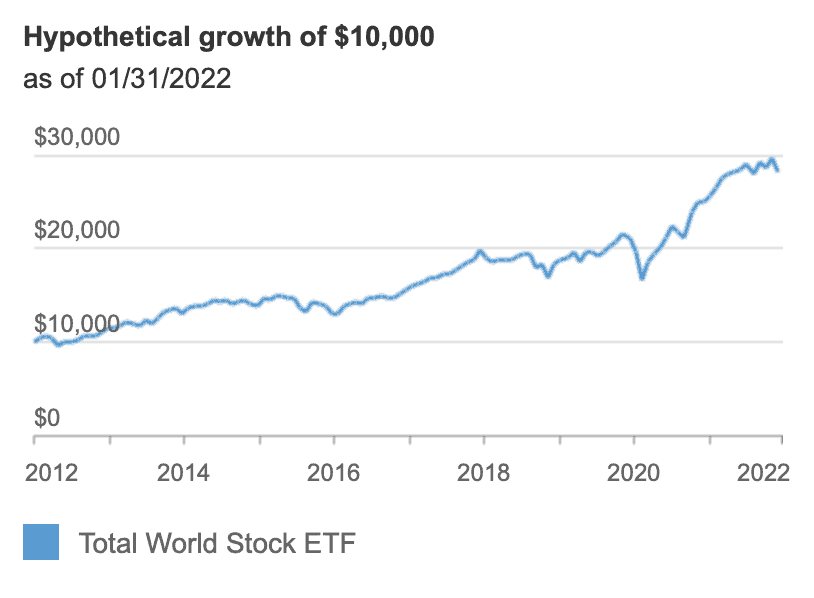

After a year of working, I made my first investment of $10K into VTI. My portfolio has now grown over the past six years. Below, I share my current progress and future goals for 2 portfolios.

US market ($246K>$500K)

Since graduating, I’ve primarily focused on investing in the U.S. stock market, aiming for capital appreciation due to the 30% dividend withholding tax. Over time, I’ve gradually shifted towards the Singapore stock market, focusing on dividends, broader market investments, and specific sectors.

I haven’t been actively managing this portfolio as much as I’ve been on the fence about how to proceed since stock picking already takes up a significant portion of my overall portfolio.

Meanwhile, I’m working on growing other areas of my investments.

Portfolio goal distribution

- IBKR: $500K

- Syfe: $50K (fixed)

- Singapore: $250K

- Endowus: $250K

My goal is to grow my IBKR portfolio to $500K, and I’m considering the best way to achieve that. Right now, U.S. stocks have been rising, with a $43K increase in my portfolio since the election results.

I need to figure out the specific stocks I want to buy and the price to enter.

Investment Priorities:

- Avoid a gambling mindset.

- Stay invested while maintaining diversification.

- Continue to save and invest consistently.

- Buying at the dips.

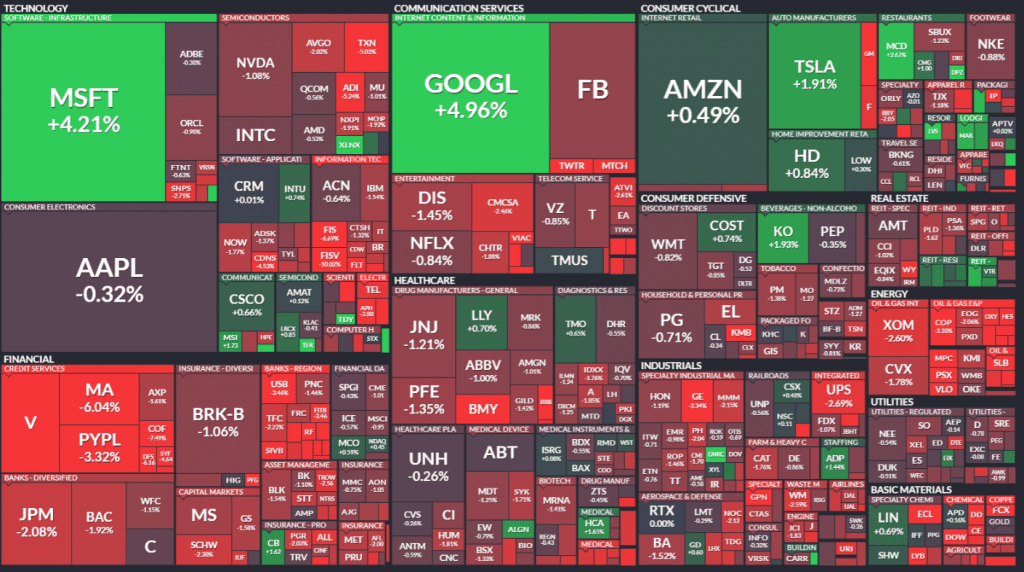

Keepers

- VTI

- IWDA

- MSFT

- GOOGL

- META

- CRM

- TSLA

- ASHR

- JPM

- AMZN

- AAPL

- IBKR

To be considered

- EL

- BAC

- CROX

- HUYA

- GXC

- YUMC

- CQQQ

- CHIQ

SG market ($86K>$250K)

As I am too heavily invested in the US market, I decided to allocate some funds into Singapore market. What’s on my mind: how much to allocate to capital gains (US market) vs dividend stocks (SG market).

Arbitrary allocation is the goal of 75% growth stocks and 25% dividend stocks.

The amount I put in for the Singapore market has dropped drastically as I had reallocate all the funds away from REITs.

Current allocation for Singapore market

- Banks 76%

- Reits 24%

Stocks allocation goal

- YZJ

- ST engineering

- HK land

- SGX

- REITs

- OCBC

- DBS

- UOB