Work shapes a third of our lives. If you’re unsure about how to genuinely feel […]

2022 update: China Stocks Extend Post-Congress Rout Amid Lockdowns. Hang Seng China index falls 1.8% to lowest close since 2005

This is a comparison of SGX-listed ETF (HST) vs HKEX (3067). Learn how to analyse which Hang Seng Tech ETF is a better investment.

Both ETFs are relatively new. Their underlying index is Hang Seng TECH Index, provided by Hang Seng Indexes Company Limited.

3067 was started in September 2020 while HST was started in December 2020. Since they hold the same stocks in the same proportion, their performance are quite similar. If you are keen on the technology sector, HST and 3067 are popular low cost ETFs for consideration.

Hang Seng TECH Index

Both ETFs track the Hang Seng Tech Index.

The objective is to represent the 30 largest technology companies listed in Hong Kong which have high business exposure to the Technology Themes.

To be included in this index, companies have to:

- Have a high business exposure to technology themes

- Pass the index’s screening criteria

Meet at least one of the below criteria:

- Technology-enabled business (e.g. via internet / mobile platform)

- R&D Expense to Revenue Ratio ≥ 5%

- YoY Revenue Growth ≥ 10%

Rebalancing Frequency is on a quarterly basis.

A newly listed security will be added to index if its full market capitalisation ranks within the top 10 of the existing constituents on its first trading day. The ad hoc addition will normally be implemented after the close of the 10th trading day of the new issue

Differences between 3067 and HST?

- Exchange they are listed on

- Minimum units to purchase. HST requires a minimum purchase of 10 units on SGX vs 100 units of 3067 on HKEX.

- Currency denomination: HST is denominated in SGD while 3067 is denominated in HKD.

For Singapore-based investor who invests in HST, you can avoid the currency conversion fees charged by the brokers and the fluctuating exchange rates.

If you invest in 3067, the fund manager has to do to purchase the stocks in HKD.

- Fund Manager: HST is managed by Lion Global Investors, while 3067 is managed by BlackRock under the iShares family of ETFs.

- Expense ratio: 3067 has the lowest TER (0.25%) among all the Hang Seng Tech Index ETFs listed in HKEX and SGX. Management fee of 3067 is 0.25%.

Things to note: 3067 has a higher tracking error because they have announced no new investments in sanctioned Chinese companies from Feb 2021 onwards.

Why you should consider Hang Seng Tech ETF

- Compare to individual stocks, an ETF offers good diversification and lower volatility

- There is a lower investment threshold than investing in all Hang Seng Tech Index constituents at one sitting

- Physical access to the 30 largest stocks (in the technology sector or with tech-enabled businesses), listed on the Hong Kong Stock Exchange

- Direct exposure to companies across key sectors including information technology, consumer discretionary, and communication services

- To capture Greater China Technology sector

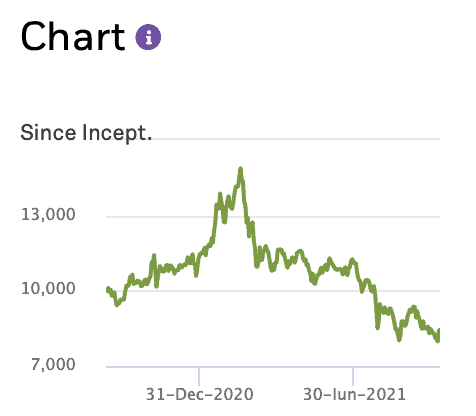

3067: Historical Performance

| 3067 | |

| 3 Month Return | -29.03% |

| YTD return | -38.91% |

| 1 Year return | -43.24% |

| Since inception | -52.89% |

3067

3067 is managed by BlackRock.

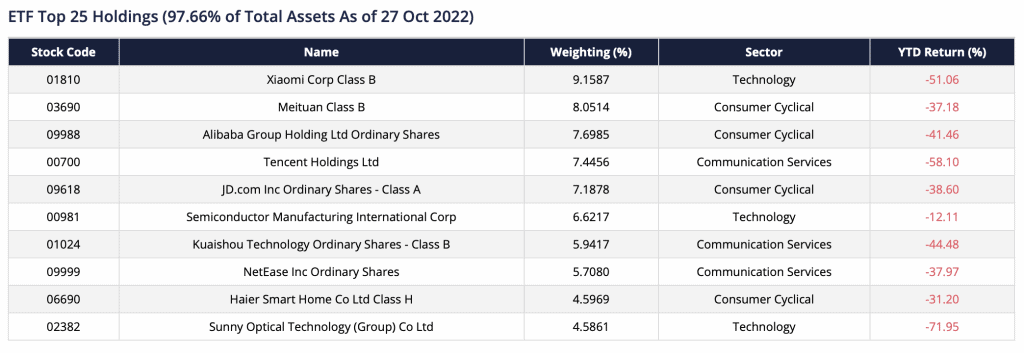

Sector breakdown

| 3067 | |

| Consumer discretionary | 38.29% |

| Information technology | 32.95% |

| Communication services | 27.45% |

| Financials | 1.19% |

| Cash and/or derivatives | 0.13% |

3067: Fund top holdings

Caveat

- The ETFs are subjected to general market risks and may fall in value.

- There is no guarantee of the repayment of principal.

- Subjected to tracking error risk, which is the risk that its performance may not track that of the underlying index exactly. The underlying Index is a new index and the ETF may be riskier than other exchange traded funds tracking more established indices with longer operating history.

- The ETF’s investments are concentrated in in companies with a technology theme from across the Greater China region listed in Hong Kong. The value of the ETF may be more volatile than that of a fund having a more diverse portfolio of investments or global / regional scope.

- Both ETFs are relatively new

Key findings

Their main difference lies in the expense ratio which you’ll incur. However, their expense ratios are higher than most S&P 500 ETFs which usually cost less than 0.1%.

The expense ratio for HST is capped at 0.68% p.a. for 2 years from the inception of the fund. HST has the second lowest TER (0.45%) among all the Hang Seng Tech Index ETFs listed in HKEX and SGX.

On trading volume: 3067 has a higher larger trading volume compared to HST as it is the more well-established fund

| 3067:HK | |

| Description | iShares Hang Seng TECH ETF |

| Total assets | 8,617,493,612 HKD |

| Outstanding units | 664,650,000 |

| Distribution frequency | Semi-annually |

| Current Management fee | 0.25% |

| Expense ratio | 0.25% |

| Inception date | 14th September 2020 |

| Volume | 9,935,513 |

How to buy

You can consider using Tiger Brokers or moomoo to invest in the HKSE.

Read the guides here: moomoo, Tiger Brokers

Conclusion

When you are investing in 2 ETFs that track the same index, the performances will be very similar. As such, you should look into their fund manager, expense ratio, currency denomination etc.

Overall, the 2 ETFs' performance may only differ slightly due to the tracking error of the fund.

3067 has a much lower expense ratio, which makes it more attractive. The huge difference in expense ratio will affect your net returns.

Related article

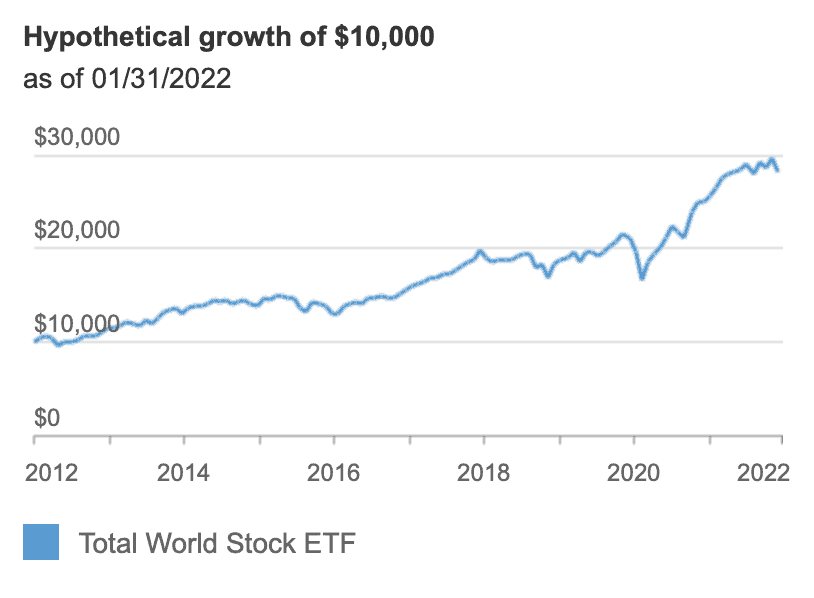

VTI vs VOO: which index fund is a better investment (updated 2020)

Thank you for reading! Please like my Facebook page to get the latest updates. Please click here for Referral deals.