SG_HSBC_CC_HSBC Revolution Credit Card SG_SCB_CC_Standard Chartered Journey Credit Card (Fee Waiver) SG_CIMB_CC_CIMB Visa Signature Card […]

2022 update: China Stocks Extend Post-Congress Rout Amid Lockdowns. Hang Seng China index falls 1.8% to lowest close since 2005

This is a comparison of 3067 vs 9078 Learn how to analyse which Hang Seng Tech ETF is a better investment.

As BlackRock offers two ETFs (3067 and 9067) on the HKEX, you may be wondering about their differences and how to choose between them.

How to choose between 3067 and 9067?

3067 and 9067 are exactly the same. However, 3067 is denominated in HKD while 9067 is denominated in USD. If you compare them in the same currency, the performance will be similar.

Similarities between 3067 and 9067

Both ETSs are designed for investors to buy into Hang Seng Tech Index constituents at one sitting. Both seek to closely correspond to the performance of Hang Seng TECH Index. If you want to focus your investments on the technology sector or tech-enabled businesses, 3067 and 9067 are popular low cost ETFs for consideration.

Their underlying index is Hang Seng TECH Index, provided by Hang Seng Indexes Company Limited

Both seek to track the investment results of an index composed of 30 Hong Kong listed companies, in the technology sector or with tech-enabled businesses.

Fund manager

Both 3067 and 9067 are managed by BlackRock. They were introduced in September 2020, with an all-inclusive and transparent annual management fee of 0.25%.

Hang Seng TECH Index

Both ETFs track the Hang Seng Tech Index.

The objective is to represent the 30 largest technology companies listed in Hong Kong which have high business exposure to the Technology Themes.

To be included in this index, companies have to:

- Have a high business exposure to technology themes

- Pass the index’s screening criteria

Meet at least one of the below criteria:

- Technology-enabled business (e.g. via internet / mobile platform)

- R&D Expense to Revenue Ratio ≥ 5%

- YoY Revenue Growth ≥ 10%

Rebalancing Frequency is on a quarterly basis.

A newly listed security will be added to index if its full market capitalisation ranks within the top 10 of the existing constituents on its first trading day. The ad hoc addition will normally be implemented after the close of the 10th trading day of the new issue

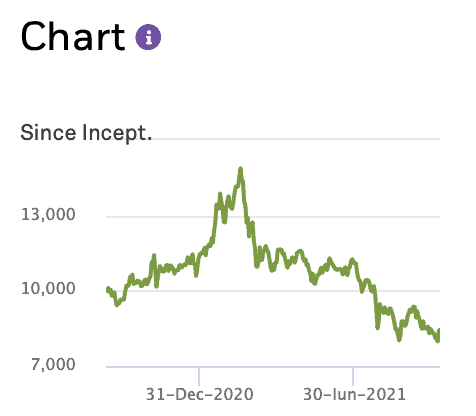

Historical Performance of 3067/ 9067

| 3067 | |

| 3 Month Return | -29.03% |

| YTD return | -38.91% |

| 1 Year return | -43.24% |

| Since inception | -52.89% |

Performance of 3067/ 9067

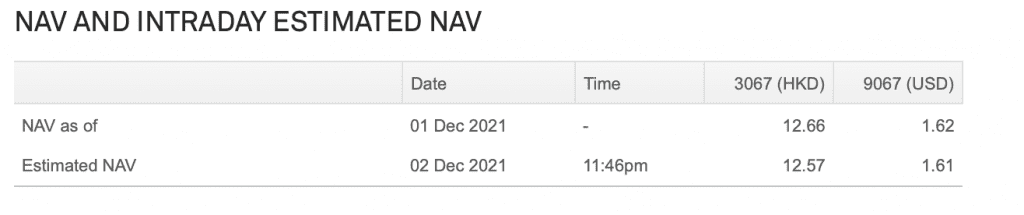

To make a fair comparison between 3067 and 9067 that are denominated in different currencies, you will need to compare the net asset value of both ETFs. They are pretty close in NAV.

Sector breakdown

| 3067 | |

| Consumer discretionary | 38.29% |

| Information technology | 32.95% |

| Communication services | 27.45% |

| Financials | 1.19% |

| Cash and/or derivatives | 0.13% |

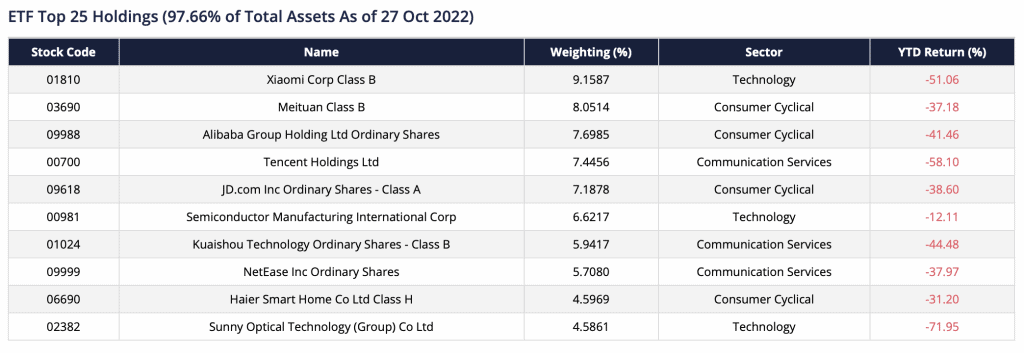

Fund top holdings

Before 2022

| 3067/ 9067 | |

| % of fund | |

| Meituan | 8.72% |

| Tencent Holdings Ltd | 8.50% |

| JD.com Inc | 8.20% |

| Alibaba Group Holdings Ltd | 7.97% |

| Kuaishou Technology | 7.75% |

| Xiaomi Corp | 7.18% |

| Sunny Optical Technology Group | 7.22% |

| Semiconductor Manufacturing In | 5.40% |

| JD Health International Inc | 4.52% |

| Haier Smart Home Co Ltd | 3.71% |

After 2022

Key findings

| 3067 | |

| Description | iShares Hang Seng TECH ETF |

| Total assets | 8,617,493,612 HKD |

| Outstanding units | 664,650,000 |

| Distribution frequency | Semi-annually |

| Current Management fee | 0.25% |

| Expense ratio | 0.25% |

| Inception date | 14th September 2020 |

| Volume | 9,935,513 |

As mentioned, 3067 is denominated in HKD while 9067 is denominated in USD. As 9067’s assets are denominated in HKD, the fund manager will still need to convert your USD to purchase the stocks in HKD.

Dividend distribution is the same

The distribution of dividends are carried out semi-annually. Do note that this is done at the fund manager’s discretion.

How to buy

You can consider using Tiger Brokers or moomoo to invest in the HKSE.

Read the guides here: moomoo, Tiger Brokers

Caveat

- The ETFs are subjected to general market risks and may fall in value.

- There is no guarantee of the repayment of principal.

- Subjected to tracking error risk, which is the risk that its performance may not track that of the underlying index exactly. The underlying Index is a new index and the ETF may be riskier than other exchange traded funds tracking more established indices with longer operating history.

- The ETF’s investments are concentrated in in companies with a technology theme from across the Greater China region listed in Hong Kong. The value of the ETF may be more volatile than that of a fund having a more diverse portfolio of investments or global / regional scope.

- Both ETFs are relatively new

How to choose between 3067 and 9067

If you live in Hong Kong, 3067 may be better as you can save on currency conversion fees and are not subjected to any currency fluctuations. If you live in US, 9067 would be more appropriate.

If you are a Singaporean investor, you may consider 3067 or HST ETF.

Related article

VTI vs VOO: which index fund is a better investment (updated 2020)

Thank you for reading! Please like my Facebook page to get the latest updates. Please click here for Referral deals.