Longbridge positions itself as a "new-generation internet brokerage" which focuses on a mobile-first, zero-commission trading […]

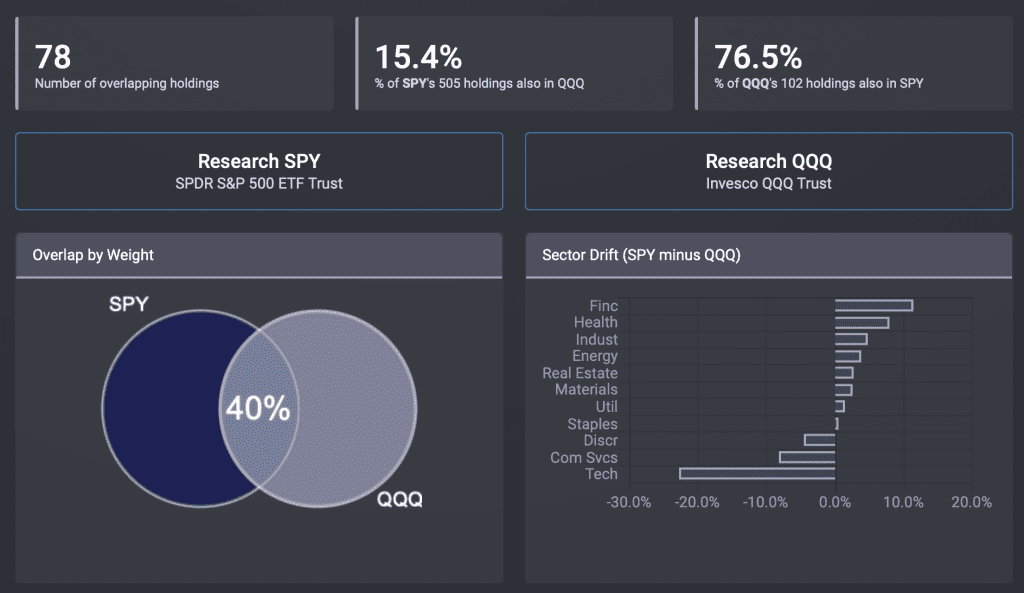

This is a comparison of QQQ vs SPY. Buying into ETFs such as QQQ or SPY via Dollar Cost Average is an advised approach if you are not into stock picking. Invesco QQQ is an exchange-traded fund based on the Nasdaq-100 Index®, while SPY refers to SPDR S&P 500 ETF Trust.

The advantage of an index fund/ETF over an actively managed fund, is its ability to outperform individual stocks over time. According to Vanguard, in a study of index funds vs active funds, 87% of Vanguard mutual funds and ETFs performed better than their peer-group averages over the past 10 years (For the period ended December 31, 2019)

Invesco QQQ is an exchange-traded fund based on the Nasdaq-100 Index® The S&P 500 Index is a diversified large cap U.S. index that holds companies across all eleven GICS sectors.

SPY

- Tracks the S&P 500 index which includes the 500 largest cap companies in the United States

- The S&P 500® Index is composed of selected stocks from five hundred (500) issuers, all of which are listed on national stock exchanges and spans over approximately 24 separate industry groups.

- Small-cap companies are not included in the fund

QQQ

- Invesco QQQ gives you access to Nasdaq’s 100 largest non-financial companies in a single investment.

- The Index includes 100 of the largest domestic and international non-financial companies listed on the Nasdaq Stock Market based on market capitalization

- The Fund and the Index are rebalanced quarterly and reconstituted annually.

- The Fund will, under most circumstances, consist of all of stocks in the Index

Why should you consider an ETF

If you seek a low-cost way to gain broad exposure to the U.S. stock market/ Global market, you may consider these index funds. Because QQQ and SPY (and similar investments) come with built-in diversification, they involve less risk than individual stocks and bonds.

From ETF Research Center’s Fund Overlap tool, there are 78 stocks (40%) that are on both SPY and MSCI.

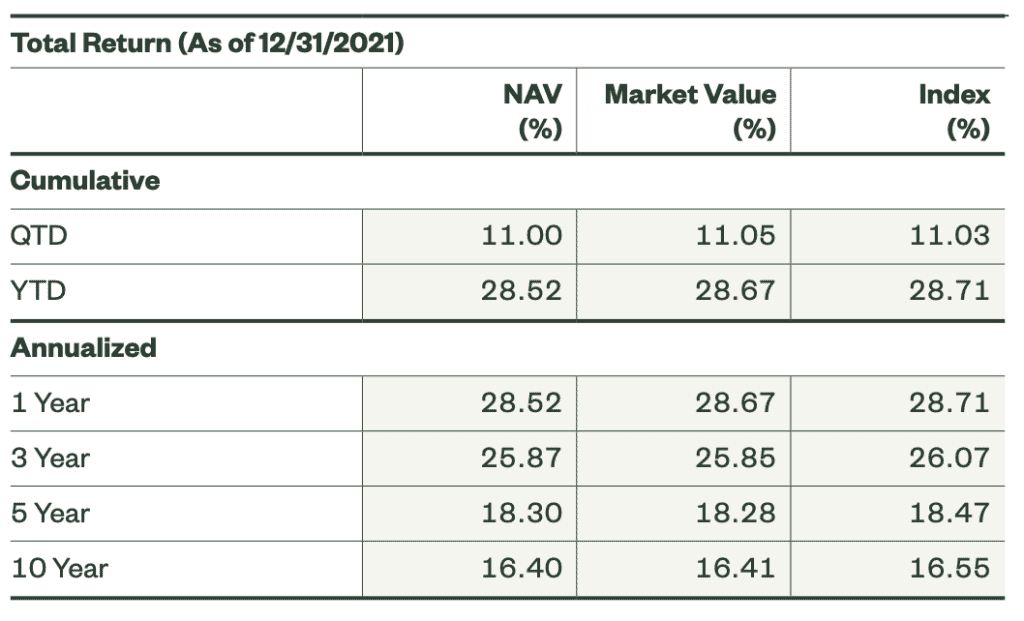

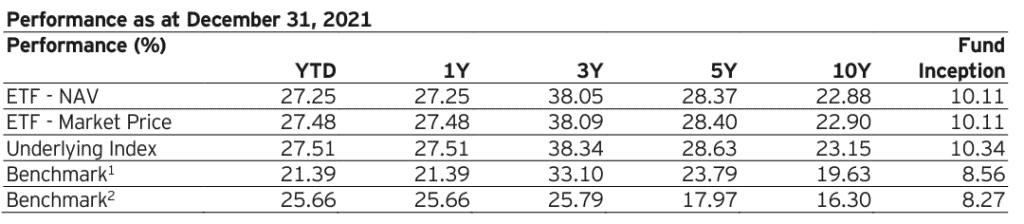

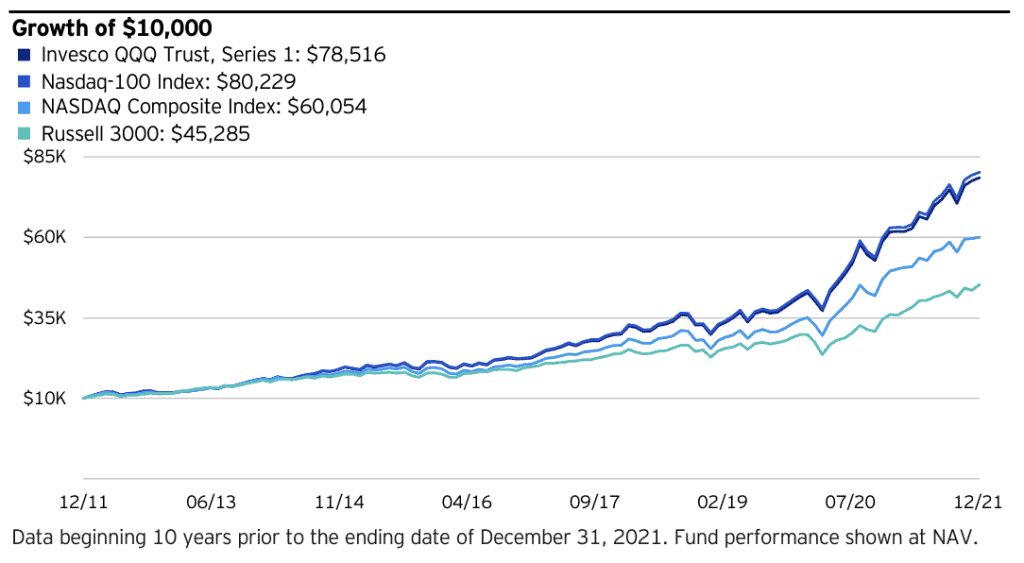

QQQ and SPY: Historical Performance

| QQQ | SPY | |

| 1 Year Return | 27.48% | 9.86% |

| 3 Year Return | 38.09% | 14.19% |

| 5 Year Return | 28.40% | 11.99% |

| 10 Year Return | 22.90% | 12.02% |

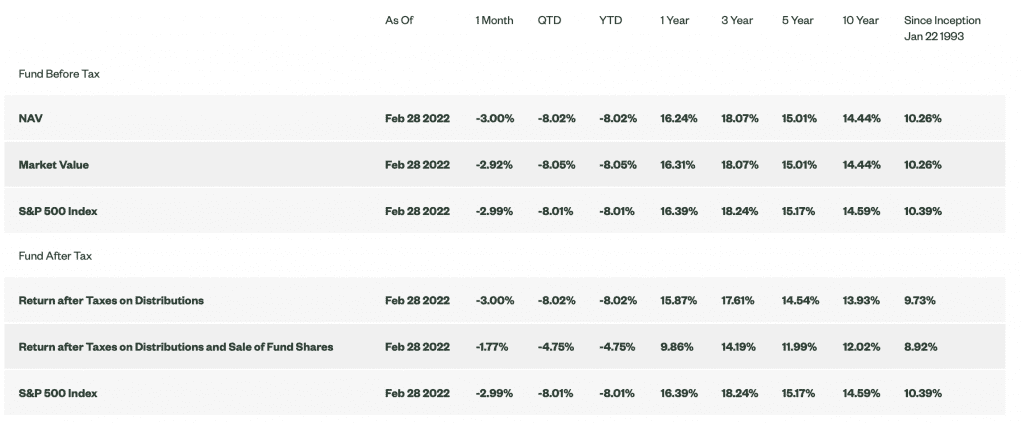

SPY fund before and after tax

SPY NAV

QQQ after tax return

QQQ hypothetical growth

QQQ vs SPY: key findings and overlap

| QQQ | SPY | |

| Description | Invesco QQQ Trust, Series 1 | SPDR S&P 500 ETF Trust |

| Asset Class | Non-financial companies | Equity: U.S. - Large Cap |

| Net Assets | $1,037.6M | $398.6M |

| YTD Daily Total Return | 27.48% | 28.71% |

| Inception Date | 10/3/1999 | 1/22/1993 |

| Expense Ratio | 0.2% | 0.0945% |

| Minimum investment | N/A | N/A |

| Number of stocks | 101 | 505 |

| PE ratio | 45.47x | 22.5x |

| PB ratio | 19.32x | 4.71x |

Expense ratio: SPY has a significantly lower expense ratio of 0.09% compared to QQQ (0.2%), the difference in fees will add up over time. This means that you would pay $20 in fees for a $10,000 investment in QQQ and $9 in fees for a $10,000 investment in its SPY.

Since net assets of both index funds exceed 100 billion dollars, both ETFs are tradable.

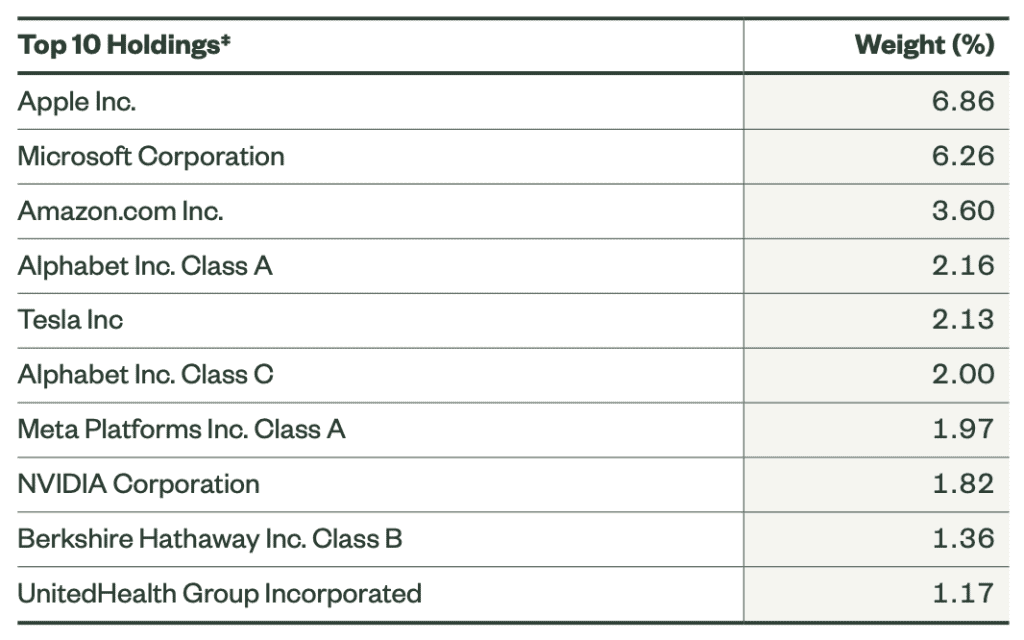

QQQ: Fund top holdings

| Allocation | |

| Apple Inc | 11.65% |

| Microsoft Corp. | 10.09% |

| Amazon | 6.76% |

| Meta (A) | 4.76% |

| Tesla | 4.24% |

| Meta | 4.14% |

| NVIDIA | 3.68% |

| Alphabet Inc. (C) | 3.48% |

| Alphabet Inc. (A) | 1.82% |

| Broadcom | 1.79% |

SPY Top 10 holdings

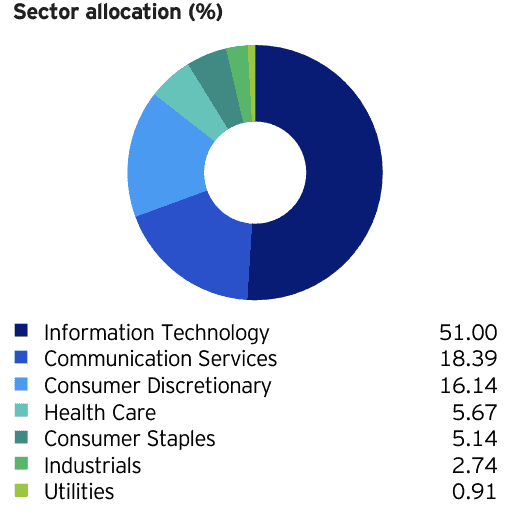

QQQ Top sectors

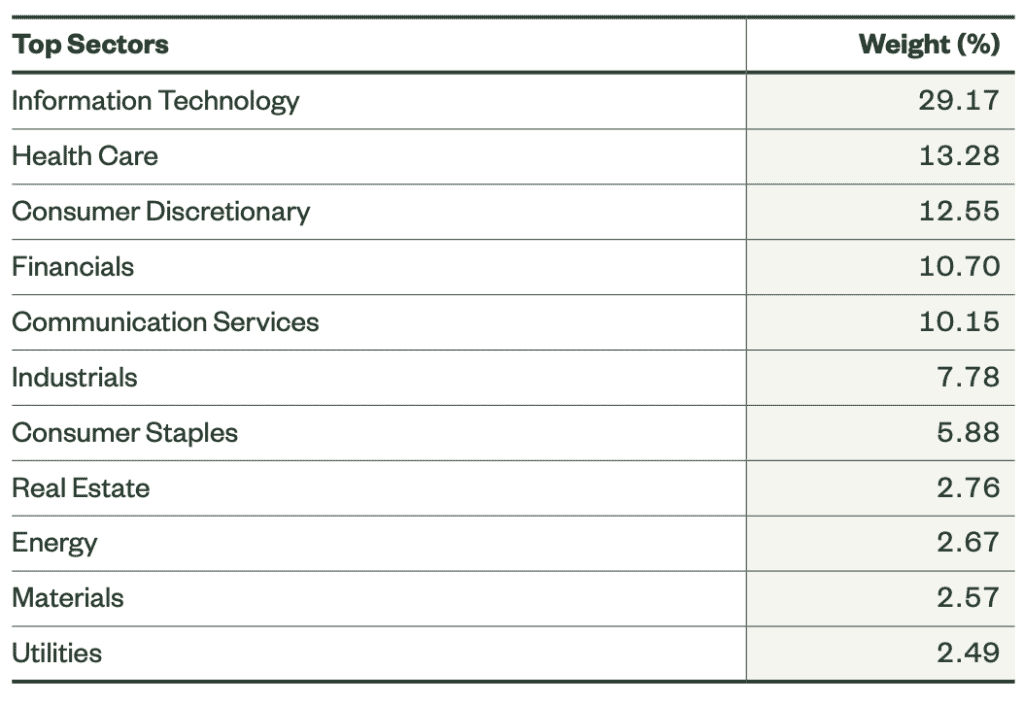

SPY Top sectors

Caveat

The key risk for these funds is the volatility that comes with its full exposure to the stock market. Both carry the inherent risk of loss associated with owning assets that follow the stock market.

- Shares are not actively managed and are subject to risks similar to those of stocks, including those regarding short selling and margin maintenance requirements.

- Ordinary brokerage commissions apply.

- The Fund’s return may not match the return of the Underlying Index.

- The Fund is subject to certain other risks.

- Investments focused in a particular sector, such as technology, are subject to greater risk, and are more greatly impacted by market volatility, than more diversified investments.

Differences between QQQ vs SPY

Liquidity

Both can be bought or sold throughout the trading day.

They provide real-time pricing since they are an ETF, so you can see their prices change throughout the day during trading hours.

Unlike a mutual fund, it isn’t priced until the trading day is over. You will not know the price until you’ve placed your trade. As Vanguard explains on their investment page:

Regardless of what time of day you place your order, you’ll get the same price as everyone else who bought and sold that day. That price isn’t calculated until after the trading day is over.

Share Price

Both their share price changes according to the stock market's fluctuations.

Expense Ratio

It's essential that expense ratio is kept low as it can affect the performance of the index funds. SPY is more affordable than QQQ.

Minimum Fees

- For the price of 1 share

How to buy

You can consider using moomoo/ TD Ameritrade/Tiger Brokers invest in NYSE.

Read the guides here: moomoo, Tiger Brokers

QQQ vs SPY summary – which one is better?

Both ETFs focus on different sectors of the market. QQQ focuses on large non-financial firms, while SPY looks at large cap firms. If your investment decision is based on a long-term growth approach, either funds will be a good addition to your portfolio.

Related article

VTI vs VOO: which index fund is a better investment (updated 2020)

Thank you for reading! Please like my Facebook page to get the latest updates.