Work shapes a third of our lives. If you’re unsure about how to genuinely feel […]

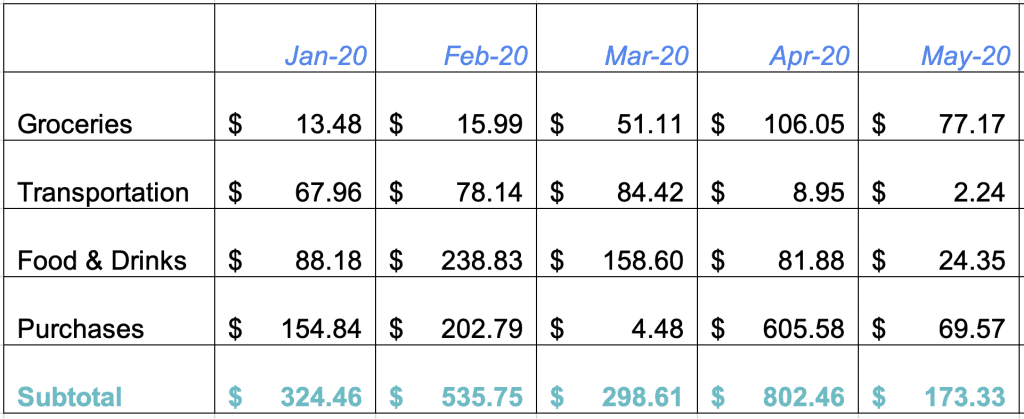

I tabulated my expenses from Jan-May 2020 in this post as I was curious how my expenses had changed because of Covid-19. There were 2 habits which I would like to follow through, even after the end of circuit breaker.

First, reduce the number of times that I dine out. I picked up a new habit to catch up over a call or texts. If I head out for a meal, I reduce my spending via the tips below!

Second, having zero or reduced paid fitness activities. I used to have multiple fitness packages until I discovered the effectiveness of home workouts via Youtube. Using Youtube for my workouts will help me to save >$1k annually. Admittedly, some activities which I did (Muay Thai, Yoga and Spinning) are hard to replicate at home.

Another reason why I am not buying a package was to reduce the time spent on travelling. A two way trip takes up more than an hour, which could have been put to better use.

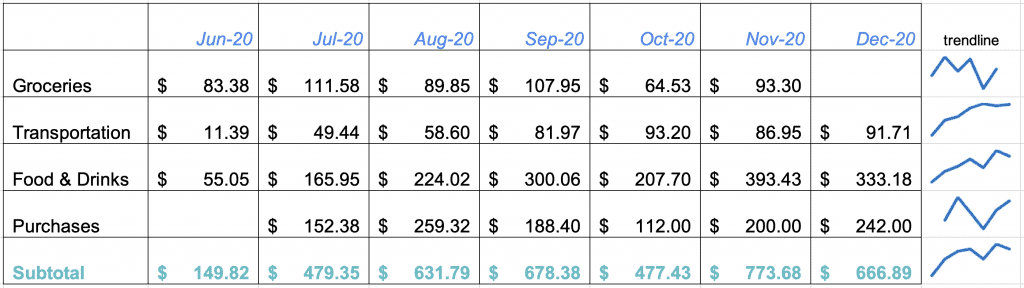

Here's my variable expenses from Jun-Dec 20. I had excluded fixed expenses such as insurance (~$500), telco bill ($25) and household contribution ($400).

- Groceries: Surprisingly, the purchases are still quite high. It has become a habit to shop at supermarkets.

- Transportation: Since I have to make my way to the office on alternate weeks, my expenses have increased from <$10 to ~$100

- Food & Drinks: This is the category which takes up the majority of my spending

- Purchases: Minimal purchases made in late 2020 as I got my iMac, Ipad and Apple Pencil beforehand. It took some self-restraint to not get the latest phone.

Here's my variable expenses from Jan-May 20.

How to save money on food

I try to minimise my expenses in F&B category, as I spent a significant portion of my income on it.

I use these apps to reduce my dining-out expenses: Burpple Beyond, Entertainer, Chope, Quandoo, Eatigo, Shopback, Klook and Fave.

Burpple

My biggest savings come from using Burpple Beyond. After using 1 for 1 from the app, a meal cost around $15-20 per pax ( vs >$30 per pax without the app). Feel free to use my link to get 30% of the purchase price.

Chope

Chope is a platform that rewards you with Chope Dollars for every reservation made. Both Chope and Quandoo have the similar perks and functions. I like Chope for its convenience as many restaurants are on the platform.

Feel free to use my link to create a Chope account to earn 300 Chope-Dollars after fulfilling your first booking. The Chope Dollars can be used to offset the cost of vouchers.

2 ways to reduce your expenses on Chope: buying their vouchers and via redemptions from their loyalty programme, ChopePerks

Quandoo

Similar to Chope, Quandoo is a platform to make reservations. You will gain loyalty points when you make a reservation, provide reviews and refer a friend. Every 1,000 points you earn is worth $15 cashback (they will transfer it to your bank account).

Here's the promo code QUANDOO2116ZQL if anyone is interested!

A way to reduce your expenses on Quandoo: cashback redemption from their loyalty programme

Eatigo

I have not used Eatigo for some time as they offer lesser discounts. If you dine at off-peak timings, this free app would be suitable. Here's the link to sign up. We will get $10 as a reward.

2 ways to reduce your expenses on Eatigo: buying their deals and enjoying a discount when dining at selected timings

Shopback

Shopback offers flash sales, upsized cashback and in-store promotions for F&B. I use Shopback when I make my online purchases, and redeem the cash back.

Here is the link to sign up. There will be a $5 discount for both of us ($20 spend needed)

2 ways to reduce your expenses on Shopback: buying their deals and getting cashback when shopping with their partners

Klook

Although Klook is more known for their travel discounts, there are plenty of F&B deals on their website. Some popular ones are Ya Kun, Ng Ah Sio Bak Kut Teh, Jumbo and Tung Lok. Feel free to use my link to sign up. We can get $5 off after your purchase.

2 ways to reduce your expenses on Klook: their stated discount and redemption of points after you complete and/or provide a review of your purchase.

Fave

At times, there are fantastic promotions run by various restaurants. Nowadays, I use this app to make payment.

How to save money on purchases

Here's what I have been doing to make sound purchases.

- Don't give in to instant gratification. Set aside a window of time before you make any purchases

- Head to Carousell to check the offerings before buying anything at retail price

- Shop online, with no pressure from the retail assistants

- Planning for purchases in advance

Summary

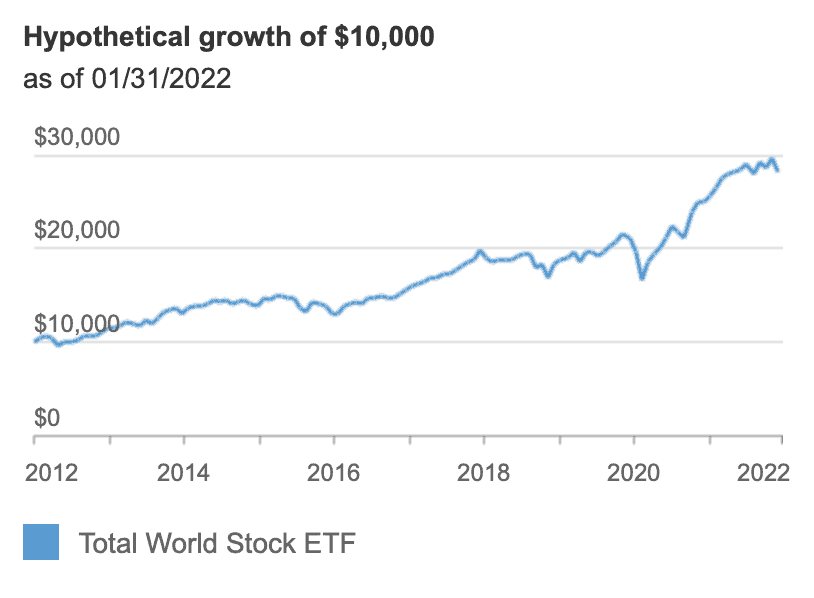

I try to maintain the balance in spending on things that I value and maximising my savings rate. By not spending carelessly, I can set aside a healthy surplus for investment.

Admittedly, it can be hard to deny immediate self-gratification in favour of a long term reward. But knowing what I do today will affect my future is the push for me to reduce unnecessary spending.

Hope these tips help!

I will share more updates on my Facebook page. Really appreciate if you could drop a like and connect.

Happy to share that Scrappy Finance is one of the Top Personal Finance blogs