Work shapes a third of our lives. If you’re unsure about how to genuinely feel […]

If you are into purchasing ETFs for your portfolios, you may have wondered about the differences between S&P 500 and MSCI World Index. Buying into ETFs such as MCSI World Index or SPY is the simplest way to build wealth overtime.

The MSCI World Index captures large and mid cap representation across 23 Developed Markets (DM) countries. With 1,539 constituents, the index covers approximately 85% of the free float-adjusted market capitalization in each country. While SPY (SPDR S&P 500 ETF Trust) contains the top 500 large cap companies from the USA.

As such, the MSCI World Index provides a greater diversification.

This is a comparison of MCSI World Index or SPY.

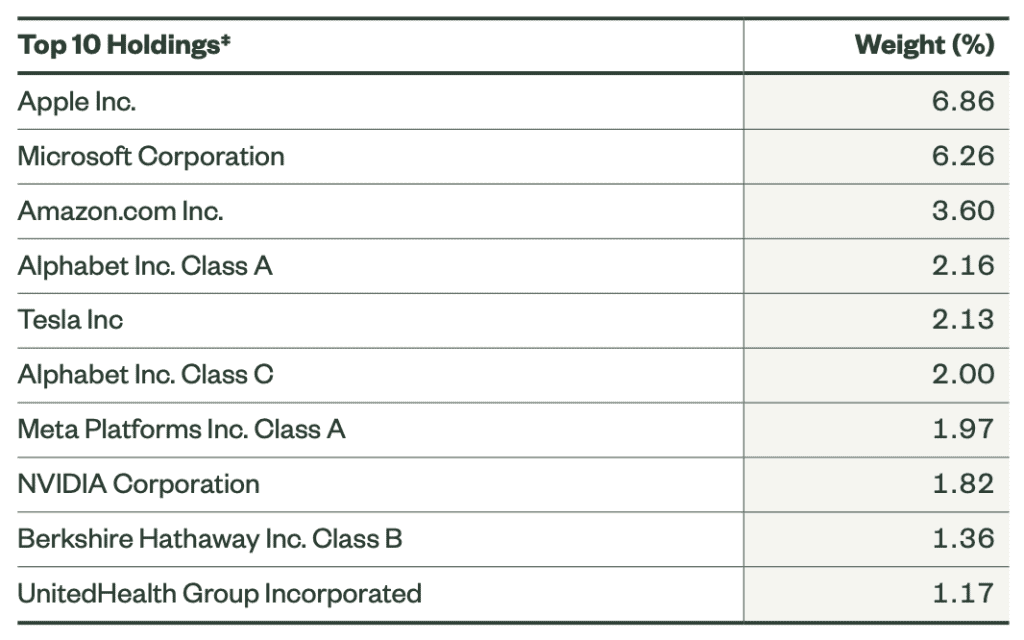

SPY Top 10 holdings

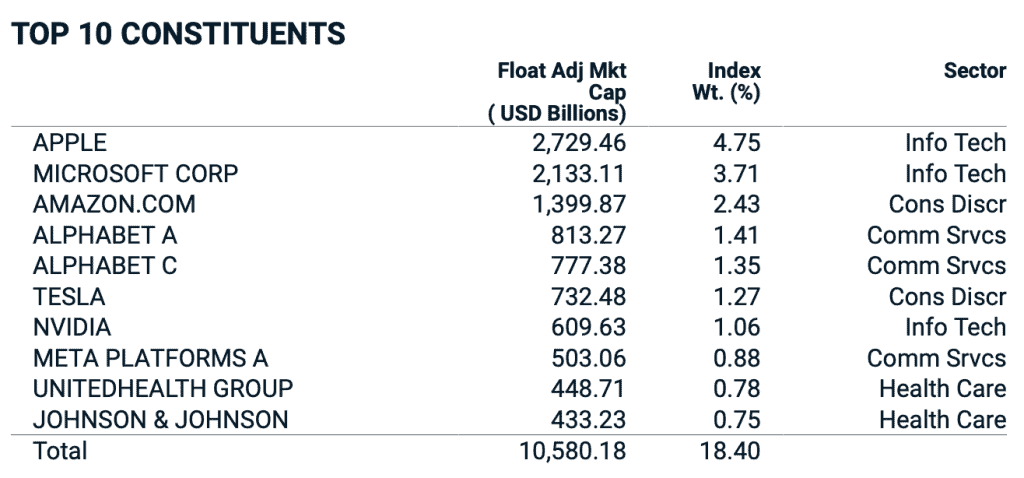

MSCI Top 10 holdings

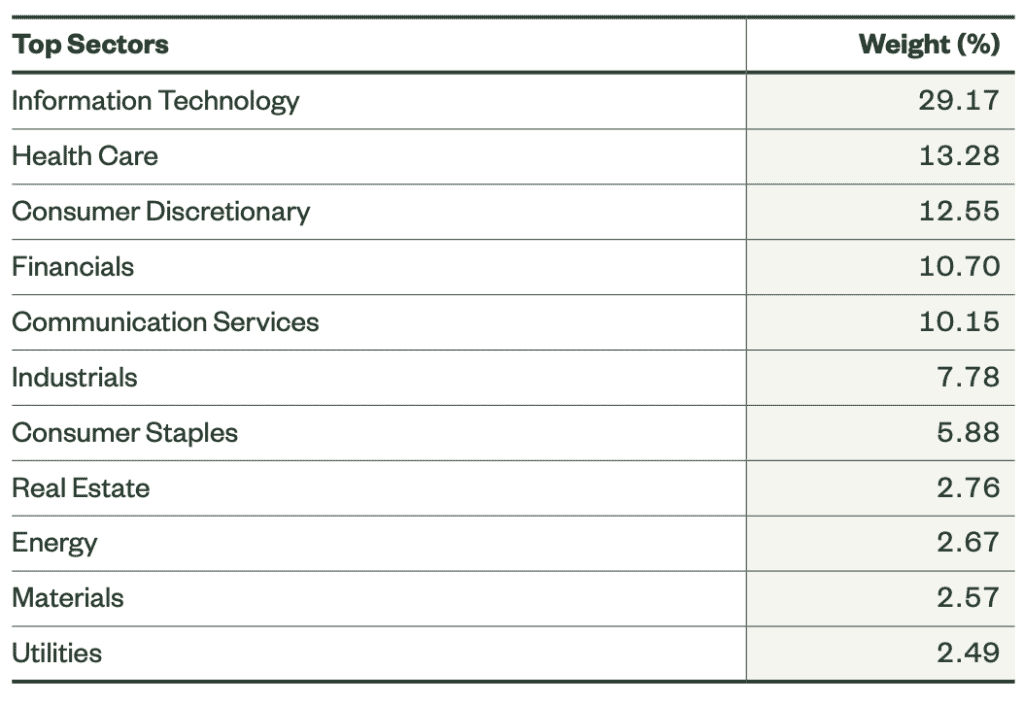

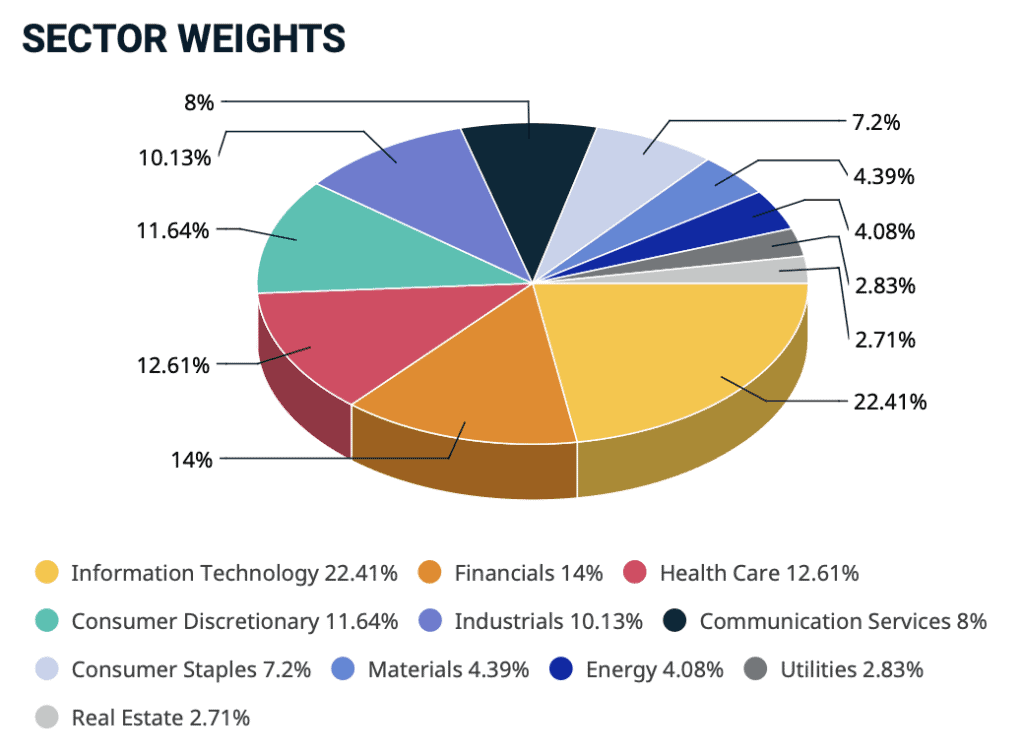

SPY Top Sectors

MSCI Top Sectors

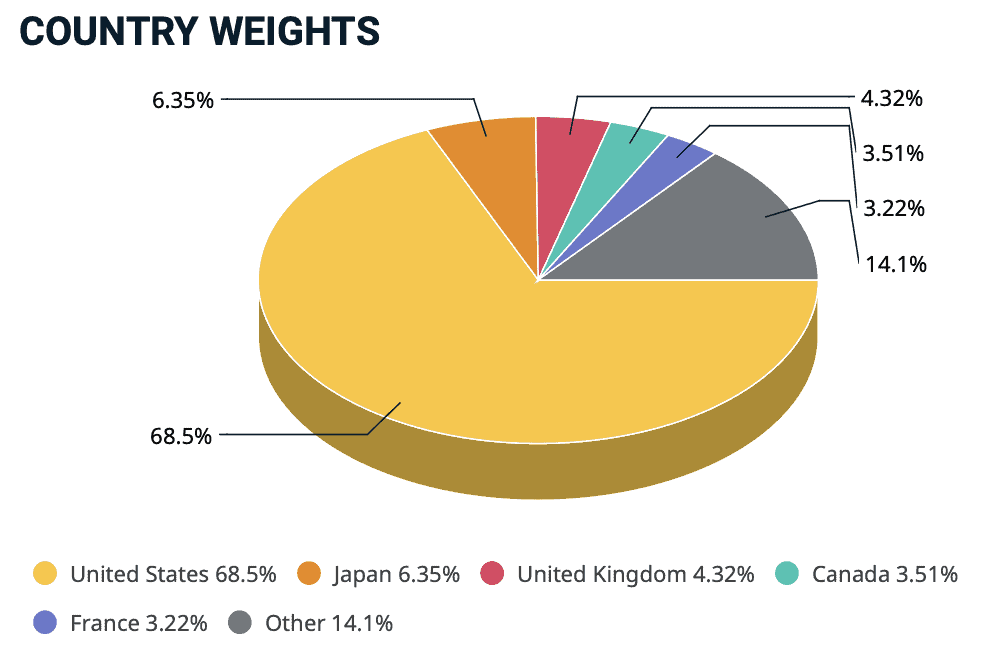

Country diversification

As mentioned earlier, MSCI World Index has a more diversified portfolio compared to S&P500

The MSCI World Index includes both large and mid cap stocks from 23 developed countries.

- A large cap company is one that has a market capitalisation of more than $10 billion.

- A mid cap company has a market capitalisation between $2 to $10 billion.

This is significantly different from S&P 500 as the index only tracks large cap US equities which are listed on the US exchanges. The S&P 500® Index is composed of selected stocks from five hundred (500) issuers, all of which are listed on national stock exchanges and spans over approximately 24 separate industry groups.

Small-cap companies are not included in the fund.

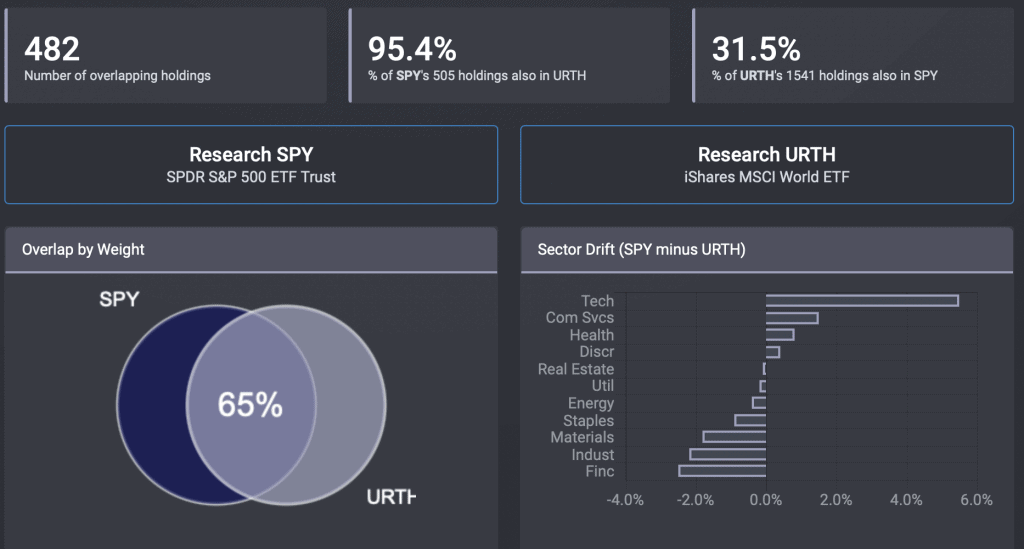

Comparison of holdings

The MSCI World Index has 1,562 different constituents, while the S&P 500 only has 505 holdings!

In case you're wondering why the S&P 500 has 505 stocks when there are 500 companies, this is because 5 companies have multiple share classes.

The MSCI World Index has stocks from various countries and are listed on different exchanges:

Overlap: S&P 500 only includes stocks from the USA, and some of these stocks are included in the MSCI World Index

From ETF Research Center’s Fund Overlap tool, there are 482 stocks (65%) that are on both SPY and MSCI.

MSCI World Index will have a lower weightage of US stocks as compared to the S&P 500.

Comparison of sectors

Both ETFs have a high weightage in information technology. For SPY, its weightage is 29.17% while MSCI has a weightage of 22.41%. One noticeable difference is that MSCI World Index is more weighted towards stocks in the industrials and financial sectors.

Top holdings

9 out of 10 of the top holdings for both ETFs are the same as most of the top companies in the world come from the US. One noticeable difference is a slight difference in weightage for each stock.

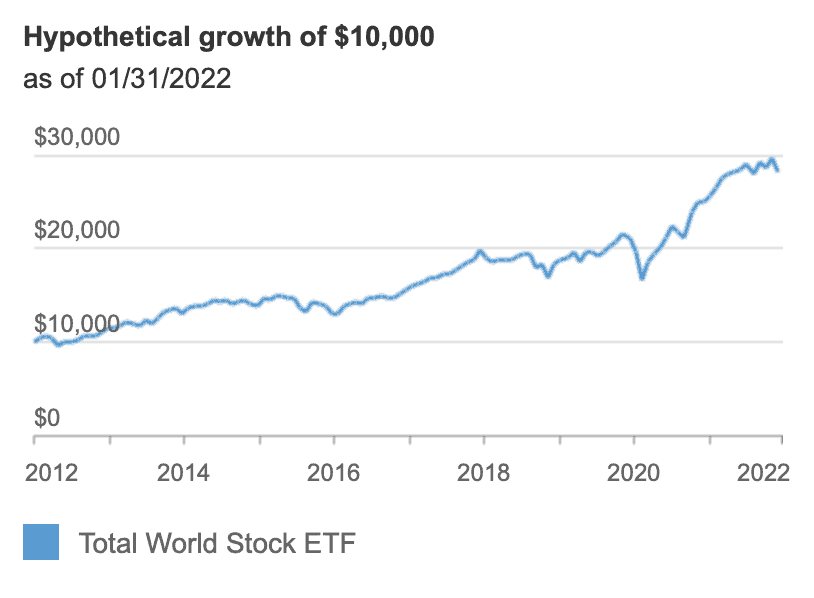

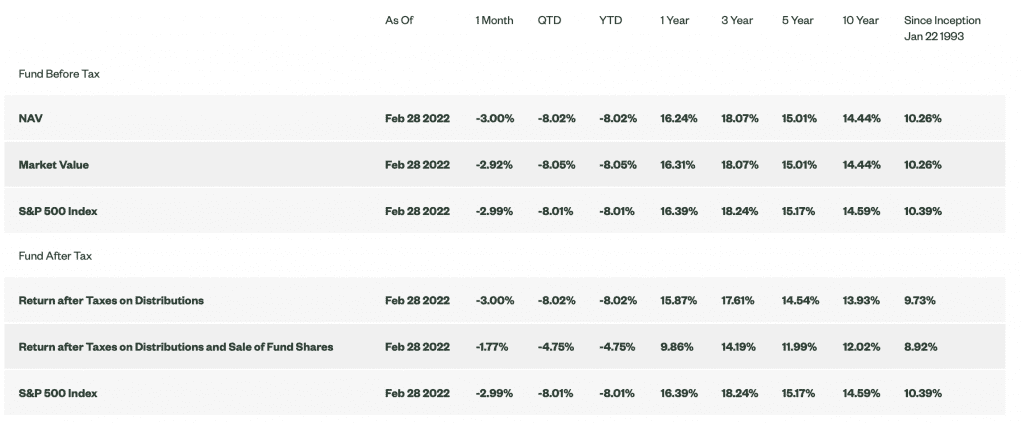

Performance of MSCI World Index

Performance of SPY

SPY has a more attractive return than MSCI Since the US economy has been performing better than other economies, S&P 500 shows a better performance.

Caveat

The key risk for these funds is the volatility that comes with its full exposure to the stock market. Both carry the inherent risk of loss associated with owning assets that follow the stock market.

Differences between VTI vs SPY

Liquidity

Both can be bought or sold throughout the trading day.

They provide real-time pricing since they are an ETF, so you can see their prices change throughout the day during trading hours.

Unlike a mutual fund, it isn’t priced until the trading day is over. You will not know the price until you’ve placed your trade. As Vanguard explains on their investment page:

Regardless of what time of day you place your order, you’ll get the same price as everyone else who bought and sold that day. That price isn’t calculated until after the trading day is over.

Share Price

Both their share price changes according to the stock market's fluctuations.

Minimum Fees

How to buy

You can consider using moomoo/ TD Ameritrade/Tiger Brokers invest in NYSE.

Read the guides here: moomoo, Tiger Brokers

MSCI vs SPY summary – which one is better?

If you are prioritising diversification, MSCI World Index would be more suitable as it contains stocks from various countries. If you prefer to invest in the growth of the US economy, SPY is the appropriate ETF to invest in. If your investment decision is based on a long-term growth approach, either funds will be a good addition to your portfolio. I personally prefer SPY for its concentration in the US economy.

Related article

VTI vs VOO: which index fund is a better investment (updated 2020)

Thank you for reading! Please like my Facebook page to get the latest updates.