Work shapes a third of our lives. If you’re unsure about how to genuinely feel […]

2024 update: VTI is at/ near all-time high. I am still holding on to it.

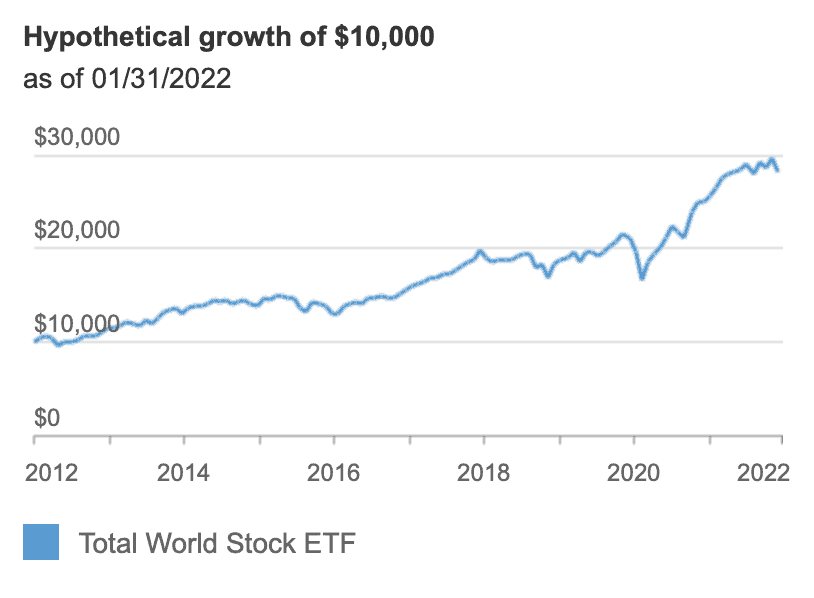

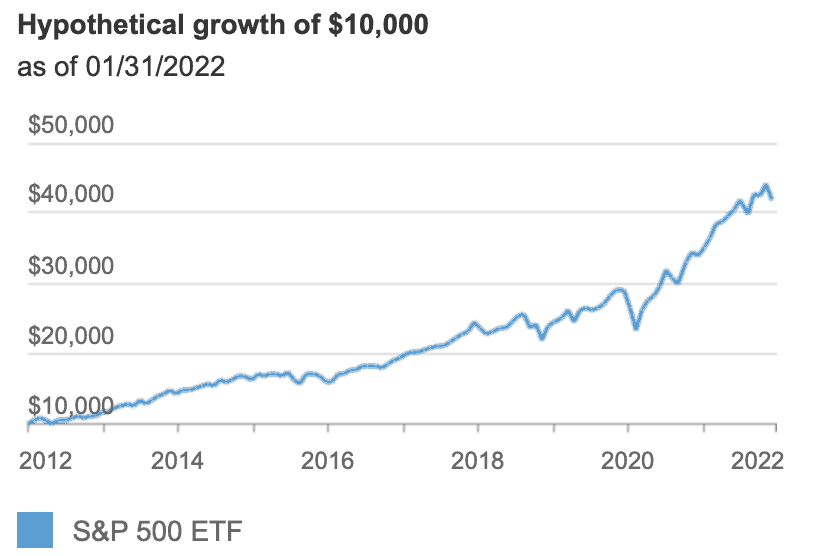

This is a comparison of VTI vs VOO. Both are different ETFs from Vanguard. Buying into VOO or VTI is the simplest way to build wealth overtime. The overlap between the 2 funds can be found here.

The advantage of an index fund/ETF over an actively managed fund, is its ability to outperform individual stocks over time. According to Vanguard, in a study of index funds vs active funds, 87% of Vanguard mutual funds and ETFs performed better than their peer-group averages over the past 10 years (For the period ended December 31, 2019)

VOO: Vanguard S&P 500 ETF (S&P 500 Index)

VTI: Vanguard Total Stock Market Index Fund ETF ( Total U.S. stock market)

VOO is the Vanguard equivalent of S&P 500. VTI is just the U.S. stock market.

VTI is designed to provide investors with exposure to the entire U.S. equity market, including small-, mid-, and large-cap growth and value stocks. The fund’s key attributes are its low costs, broad diversification, and the potential for tax efficiency.

VOO is also available as an Admiral™ Shares mutual fund. To understand the difference between ETF and mutual funds, please read my article here.

VOO

- Invests in stocks in the S&P 500 Index, representing 500 of the largest U.S. companies.

- Goal is to closely track the index’s return, which is considered a gauge of overall U.S. stock returns.

- Offers high potential for investment growth; share value rises and falls more sharply than that of funds holding bonds.

- More appropriate for long-term goals where your money’s growth is essential.

VTI

- Seeks to track the performance of the CRSP US Total Market Index.

- Large-, mid-, and small-cap equity diversified across growth and value styles.

- Employs a passively managed, index-sampling strategy.

- The fund remains fully invested.

- Low expenses minimize net tracking error.

Why should you consider an ETF

If you seek a low-cost way to gain broad exposure to the U.S. stock market/ Global market, you may consider these index funds. Because VTI and VT (and similar investments) come with built-in diversification, they involve less risk than individual stocks and bonds.

VTI and VOO: Historical Performance

| VTI | VOO | VT | SPY | VTSAX | |

| YTD return | -24.87 | -23.9 | -25.56 | -24.25 | -24.89 |

| 1 Year Return | -18 | -15.52 | -20.8 | -15.99 | -18.01 |

| 3 Year Return | 7.58 | 8.12 | 3.87 | 7.56 | 7.59 |

| 5 Year Return | 8.55 | 9.2 | 4.45 | 8.62 | 8.55 |

| 10 Year Return | 11.33 | 11.66 | 7.54 | 11.04 | 11.33 |

| Since Inception | 7.26 | 12.52 | 5.53 | 8.81 | 6.89 |

VTI

VTI and VOO: key findings and overlap

| VTI | VOO | |

| Description | Vanguard Total Stock Market ETF | Vanguard S&P 500 ETF |

| Asset Class | Domestic Stock - General/ Large Blend | Domestic Stock - General/ Large Blend |

| Expense Ratio | 0.03% | 0.03% |

| Distributions | Quarterly | Quarterly |

| Minimum investment | N/A | N/A |

| Number of stocks | 4136 | 505 |

| Fund total net assets | $1.1T | $816.6 trillion |

| PE ratio | 17.1x | 18.1x |

| PB ratio | 3.1x | 3.4x |

| Inception Date | 5/24/2001 | 6/24/2008 |

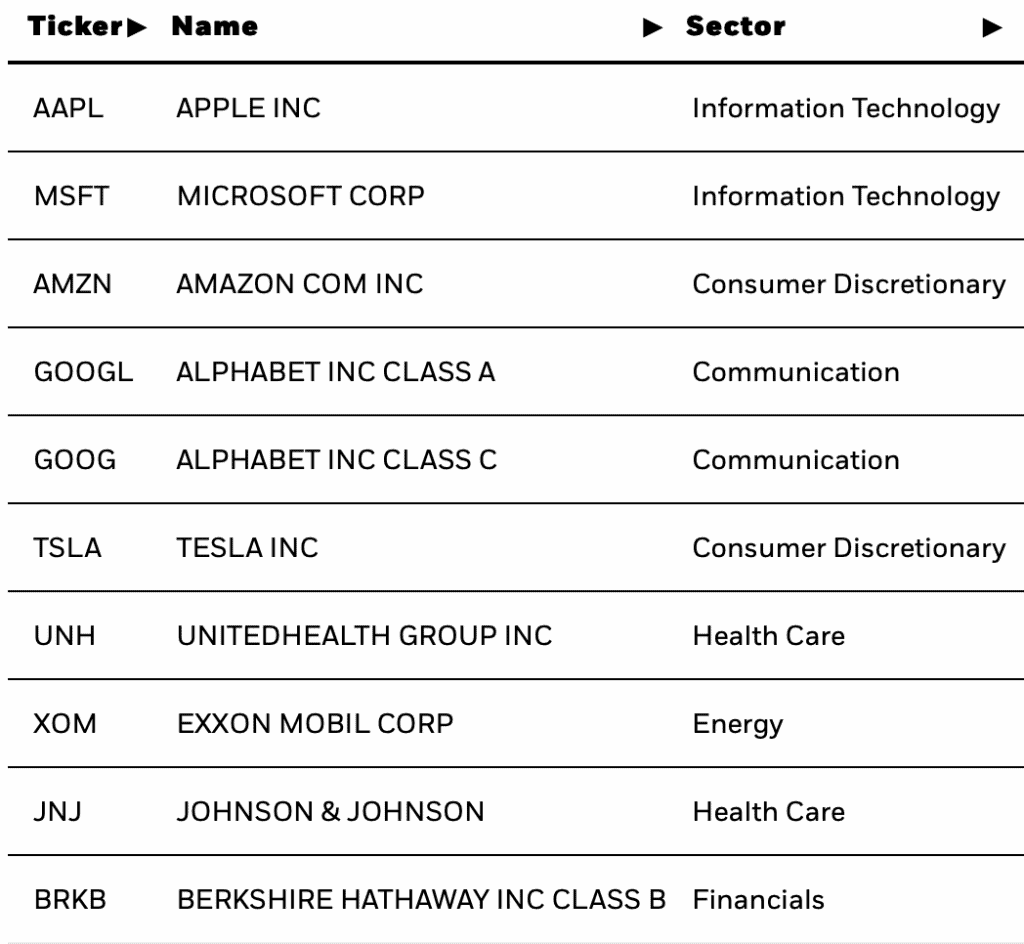

VTI & VOO: Fund top holdings

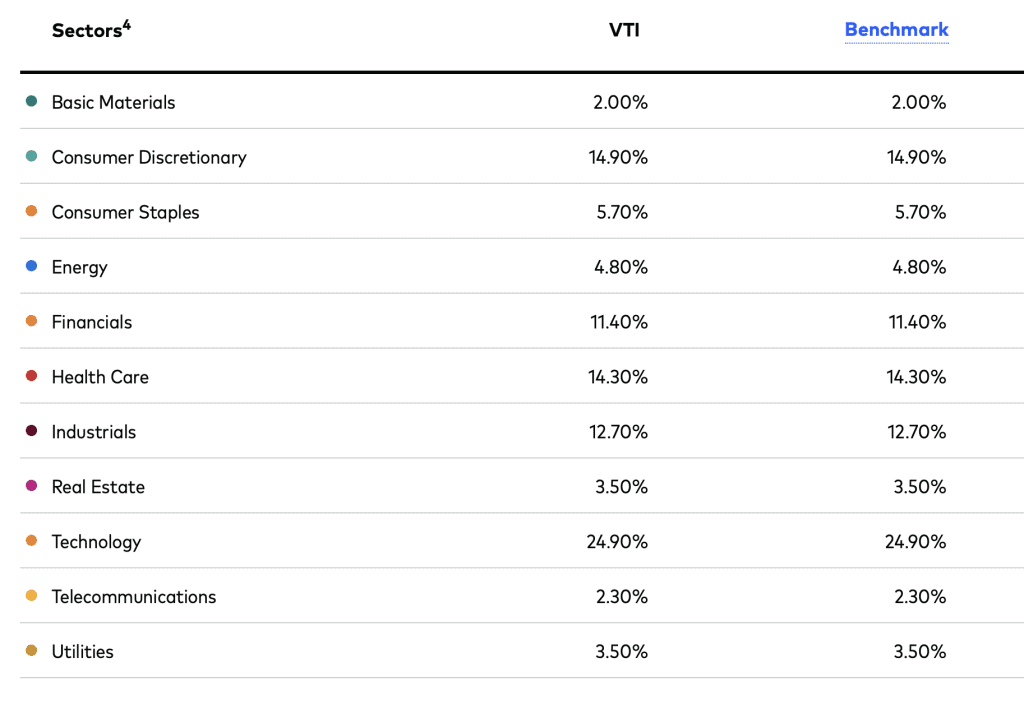

VTI & VOO: Sector Breakdown

Caveat

The key risk for these funds is the volatility that comes with its full exposure to the stock market. Both carry the inherent risk of loss associated with owning assets that follow the stock market.

Differences between VTI vs VOO

Liquidity

Both can be bought or sold throughout the trading day.

They provide real-time pricing since they are an ETF, so you can see their prices change throughout the day during trading hours.

Unlike a mutual fund, it isn’t priced until the trading day is over. You will not know the price until you’ve placed your trade. As Vanguard explains on their investment page:

Regardless of what time of day you place your order, you’ll get the same price as everyone else who bought and sold that day. That price isn’t calculated until after the trading day is over.

Share Price

Both their share price changes according to the stock market's fluctuations.

Expense Ratio

Both have an affordable expense ratio of 0.03%. It's essential that expense ratio is kept low as it can affect the performance of the index funds.

Minimum Fees

- For the price of 1 share

How to buy

You can consider using moomoo/ TD Ameritrade/Tiger Brokers invest in NYSE.

Read the guides here: moomoo, Tiger Brokers

VTI vs VOO summary – which one is better?

Both ETFs focus on different segments of the market. VOO and VTI are the two most popular U.S. stock market ETFs

Are you keen to invest in large-cap stocks (VOO), or with the addition of small- and mid-cap stocks (VTI)? VOO comprises roughly 82% of VTI by weight. As VTI has over 4000 stocks, compared to 507 stocks inside VOO, you can get more diversification with VTI.

Related article

VTI vs VOO: which index fund is a better investment (updated 2020)

Thank you for reading! Please like my Facebook page to get the latest updates. Please click here for Referral deals.