Flight (SQ) $400 Food around <$50 per pax Hotel around $100 per night Data: Covered […]

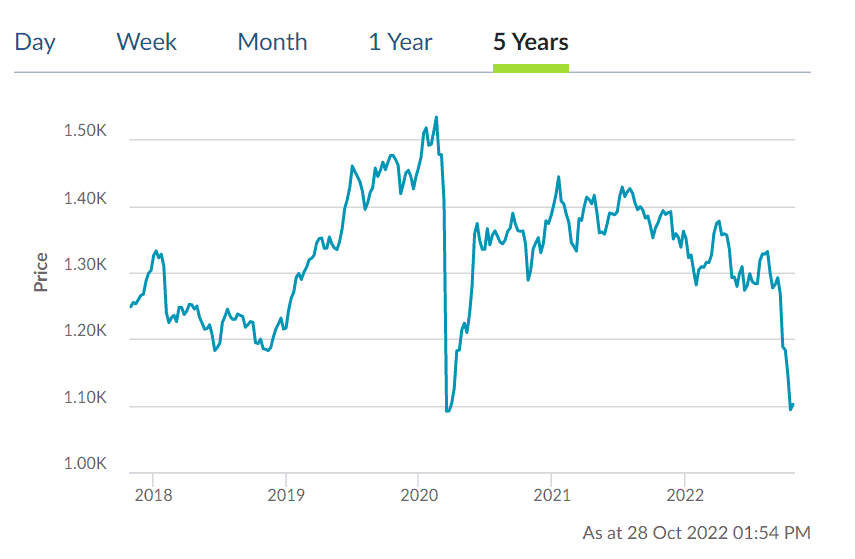

Since graduation, my priority for my finances is on investing my savings aggressively to take advantage of compound interest. I made a couple of mistakes and learnt to be wiser/more careful in my investing approach. I invested in Syfe at an absolutely bad timing (Feb 2020) so I watched my portfolio take a U-shaped turn throughout the years. First post on my Syfe portfolio was uploaded here.

When it comes to increasing my income, there's just this much that could be done until the limit is reached. But I have more leeway to lower my expenses. Blog updates: First 100K, Next 100K

The promotions from credit card signs up helped me to lower my expenses tremendously. I had received Apple Ipad, Ninja Foodi, Vouchers, Dyson Fan, Cash via pay now so far.

You can enjoy the exclusive promotion for Standard Chartered, AMEX, CIMB, and Citibank cards etc here

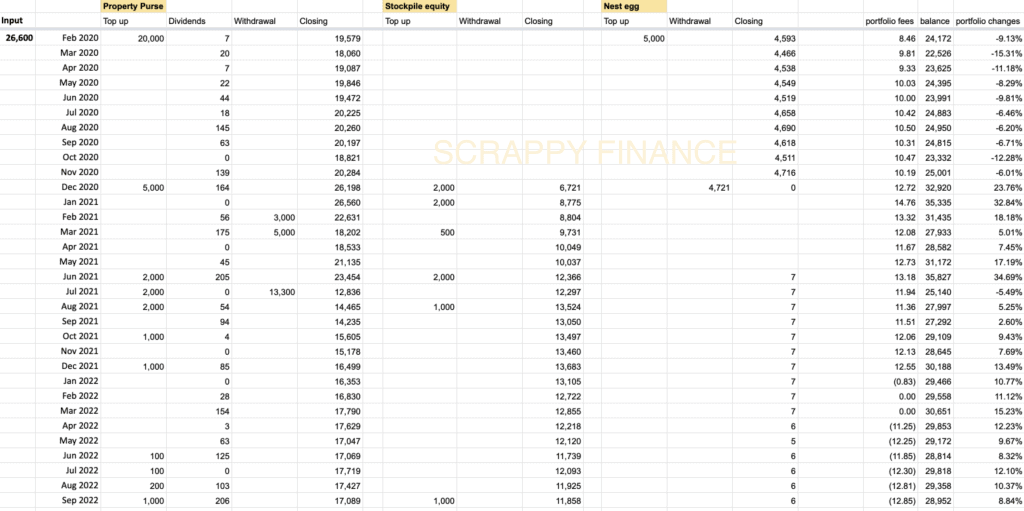

My Syfe portfolio

Currently, I have 2 portfolios with Syfe (blended expense rate is at 0.5%) . For Singapore Reits (Property purse), I set the dividends to be re-invested automatically.

Syfe Reit+ portfolio

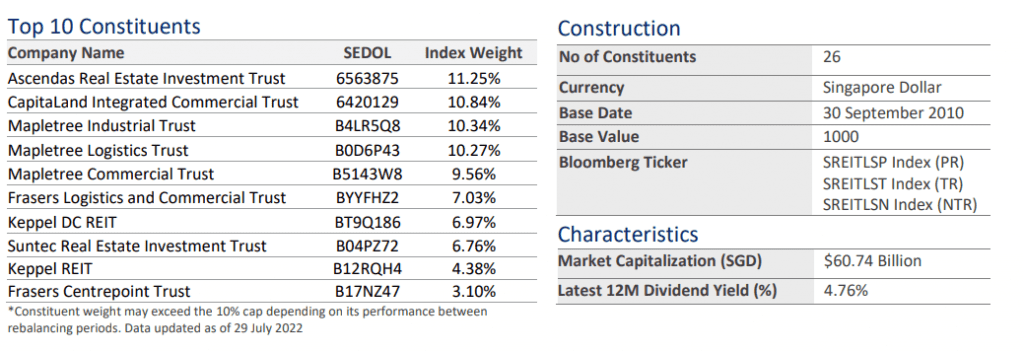

You can invest in Singapore's best REITs in 1 portfolio via Syfe. This tracks the iEdge S-REIT Leaders Index with all its constituents, weights and corporate actions. It is a narrow, tradable, adjusted free-float market capitalisation weighted index that measures the performance of the most liquid real estate investment trusts in Singapore in SGD.

While the iEdge S-REIT Leaders index holds 27 REIT constituents, REIT+ is an optimized portfolio of 20 REITs.

I don't buy individual REITs due to the minimum lot size. It's good that Syfe REIT+ has no minimum investment amount and no brokerage charges as well. You can dollar cost average into Syfe REIT+ to build up your REIT holdings monthly

Index breakdown by REIT type: Industrial and warehouse equity reits (31%), Office equity reits (26%), Retail equity reits (19%)

Syfe referral- Key in code: SRPRCBM3S after downloading the Syfe App on your phone. Or use link here.

Syfe Core portfolios

| Description | Past 5 years annualised returns | Highlights | |

| Core Equity100 | for investors who want maximum exposure to stock market opportunities with an extended investment horizon to capture long-term gains | 6.9% | 3500+ stocks QQQ (20%), RSP (17%), CSPX (13%), MCHI (10.7%) |

| Core Balanced | optimally diversified portfolio designed for investors looking to balance return with risk with a medium term investment horizon. | 2% | 35.5% equity, 52.5% bonds, 12.3% commodities 73% US 5% China |

| Core Defensive | focuses primarily in bonds with some allocation to stock and gold for added diversification. | 1.3% | 52% in United States Treasury Note/Bond |

| Core Growth | capture growth from the stock market and build long-term wealth over a longer investment horizon. | 4.2% | 3500+ stocks 67.6% equities, 26.3% bond 6.1% commodities 73% US 11% China |

Related article

VTI vs VOO: which index fund is a better investment (updated 2020)

Global outlook: Quick bites

Thank you for reading! Please like my Facebook page to get the latest updates.

Please click here for Referral deals.