Work shapes a third of our lives. If you’re unsure about how to genuinely feel […]

This is a comparison of VFIAX vs VTSAX. Learn how to analyse which mutual fund is a better investment.

- Vanguard 500 Index Fund (VFIAX) seeks to track the performance of a benchmark index that measures the investment return of large-capitalization stocks.

- Vanguard Total Stock Market Index Fund (VTSAX) seeks to track the performance of a benchmark index that measures the investment return of the overall stock market.

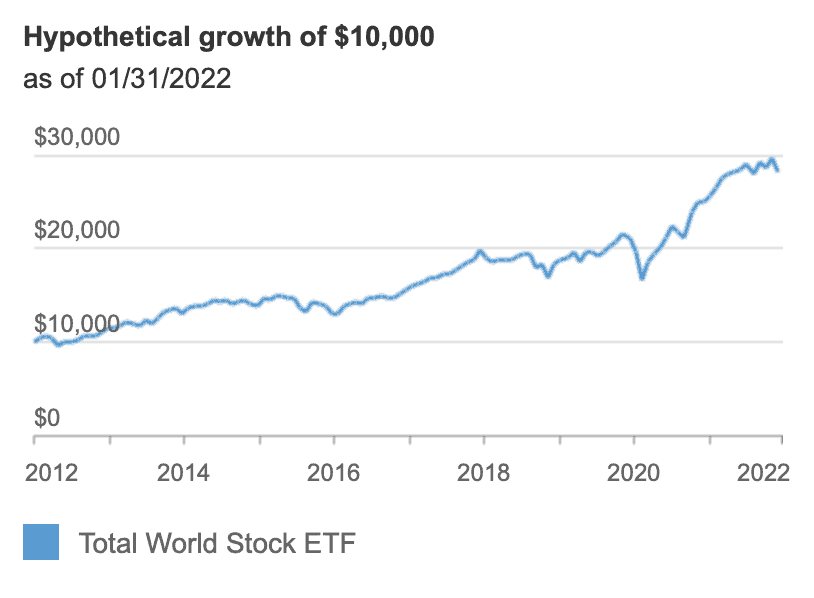

The analysis for the ETF version of these 2 mutual funds can be found here.

- VTSAX’s ETF equivalent is the Vanguard Total Stock Market Index Fund (VTI)

- VFIAX’s ETF equivalent is the Vanguard 500 Index Fund (VOO).

To understand the difference between ETF and mutual funds, please read my article here.

How to choose between VFIAX and VTSAX?

VFIAX is a low-cost way to gain diversified exposure to the U.S. equity market. The fund offers exposure to 500 of the largest U.S. companies, which span many different industries and account for about three-fourths of the U.S. stock market’s value.

VTSAX refers to Vanguard Total Stock Market Index Fund Admiral Shares. It is designed to provide investors with exposure to the entire U.S. equity market, including small-, mid-, and large-cap growth and value stocks. The fund’s key attributes are its low costs, broad diversification, and the potential for tax efficiency.

Let’s find out which mutual fund is a better investment.

Why should you consider VFIAX and VTSAX

VFIAX: As the 500 Index Fund is broadly diversified within the large-capitalization market, it may be considered a core equity holding in your portfolio.

VTSAX: If you seek a low-cost way to gain broad exposure to the U.S. stock market, you may consider this fund as either a core equity holding or US-based stock fund.

VFIAX vs VTSAX: Historical Performance

| VFIAX | VTSAX | |

| 1 Year Return | 29.53% | 31.65% |

| 3 Year Return | 15.47% | 15.55% |

| 5 Year Return | 16.34% | 16.36% |

| 10 Year Return | 16.08% | 16.10% |

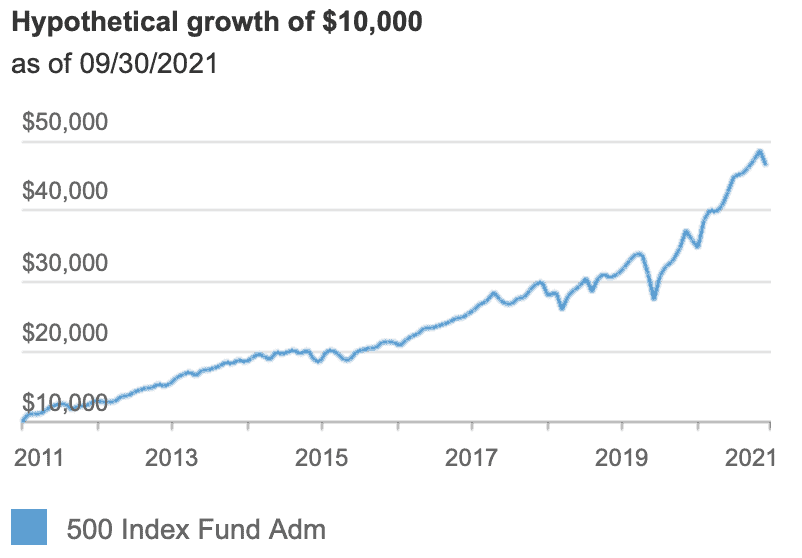

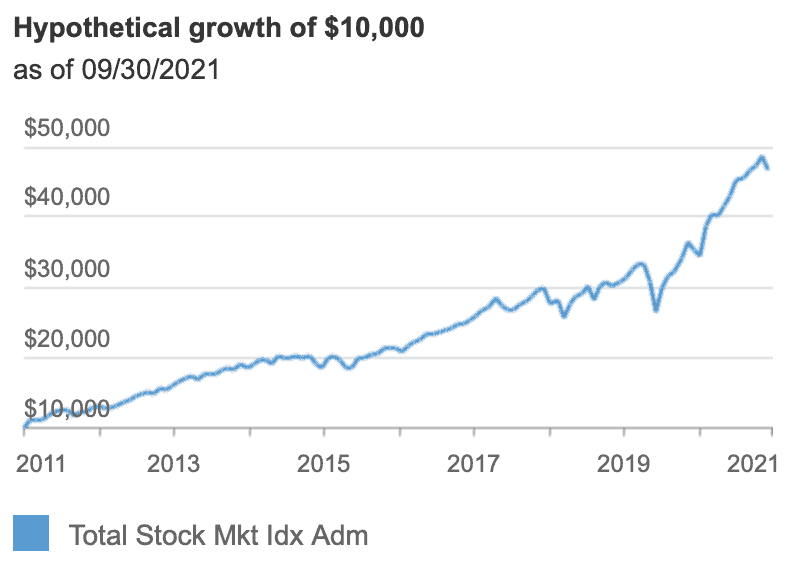

VFIAX

VTSAX

VFIAX vs VTSAX: key findings and overlap

| VFIAX | VTSAX | |

| Description | Vanguard 500 Index Fund Admiral Shares | Vanguard Total Stock Market Index Fund Admiral Shares |

| Asset Class | Domestic Stock - General/ Large Blend | Domestic Stock - General/ Large Blend |

| Expense Ratio | 0.04% | 0.04% |

| Distributions | Quarterly | Quarterly |

| Minimum investment | $3000 | $3000 |

| Number of stocks | 510 | 4025 |

| Fund total net assets | $770.2 billion | $1.3 trillion |

| PE ratio | 24.3x | 23.4x |

| PB ratio | 4.3x | 4.0x |

| ROE | 20.7% | 17.1% |

| Earnings growth rate | 19.4% | 19.0% |

VFIAX vs VTSAX: Fund top holdings

| VFIAX | VTSAX | |

| Apple Inc | 6.08% | 5.02% |

| Microsoft Corp. | 5.80% | 4.78% |

| Alphabet Inc. | 3.92% | 3.45% |

| Amazon | 2.21% | 3.19% |

| 4.26% | 1.83% | |

| Tesla | 1.72% | 1.40% |

| NVIDIA | 1.41% | 1.11% |

| Berkshire Hathaway | 1.38% | 1.06% |

| JP Morgan Chase & Co | 1.34% | 1.10% |

| Johnson & Johnson |

VFIAX vs VTSAX: Sector breakdown

| VFIAX | VTSAX | |

| Communication services/ Telecommunications | 11.3% | 2.9% |

| Consumer Discretionary | 12.4% | 16% |

| Consumer Staples | 5.8% | 4.6% |

| Energy | 2.7% | 2.9% |

| Financials | 11.4% | 11.5% |

| Health Care | 13.3% | 13.1% |

| Industrials | 8% | 13.3% |

| Information Technology | 27.6% | 27.7% |

| Materials | 2.5% | 1.9% |

| Real Estate | 2.6% | 3.5% |

| Utilities | 2.4% | 2.6% |

The performance of VTSAX is better than VFIAX.

Both have an expense ratio of 0.04%. This means that if you invest $10,000 into either fund, you will pay $4 each year in management expenses.

VFIAX was created in 2000 and was designed to provide investors exposure to 500 of the largest U.S. companies by tracking the performance of the S&P 500.

Caveat

The key risk for these funds is the volatility that comes with its full exposure to the stock market.

How to buy

You can consider using moomoo/ TD Ameritrade/Tiger Brokers invest in NYSE.

Read the guides here: moomoo, Tiger Brokers

Differences between VFIAX and VTSAX

When it comes to selecting an index fund to hold for the long term, both mutual funds are great. VTSAX provides exposure to the total stock market, while VFIAX provides exposure to the largest companies in the stock market.

- The dividend yield for VTSAX (1.2%) is slightly lower than that of VFIAX (1.25%).

There used to be a bigger difference for the yields. As such, it could make a small difference for investors who are looking for higher-yielding funds.

- VTSAX is composed of 3,637 individual stocks, compared to just 509 for VFIAX

VFIAX is a subset of VTSAX. All of the 510 stocks under VFIAX are present in VTSAX. Additionally, VTSAX holds a 3,128 (small-cap) stocks as well. As VTSAX functions as a market-cap weighted index, where the proportion of each stock’s holding in the fund reflects its market capitalization size relative to the entire index, the smaller stocks will make up a small portion of the total fund.

Conclusion

Both mutual funds are great to buy and hold. The key difference lies in whether you want to buy the entire US stock market, or a subset of it.

Related article

VTI vs VOO: which index fund is a better investment (updated 2020)

Global outlook: Quick bites

Thank you for reading! Please like my Facebook page to get the latest updates.

Please click here for Referral deals.