Work shapes a third of our lives. If you’re unsure about how to genuinely feel […]

Here's my concise notes after learning about the psychology of successful investors and details about winning trade psychology, from Adam Khoo's Value Momentum Investing Course. These are some useful concepts that I jotted down while going through the online modules.

Part 1 | Part 2 | Part 3 | Part 4 | Part 5 | Part 6

Psychology of successful investors

Discipline

- Buy and sell on pre-determined rules for Fundamental and Technical analysis

- Never buy and sell based on rumours, emotions and opinions of others

- Never buy due to FOMO and never sell in panic

Flexibility

- When the facts change, change your mind

- Be willing to sell at a loss when an investment becomes lousy

- Never stubbornly hold onto a losing investment or fall in love with a stock

Hardwork

- Invest only in what you understand and have thoroughly researched

- Stay within your circle of competence

- Never blindly rely on recommendations and tips from "Experts"

- Research every investment, monitor regularly and keep records

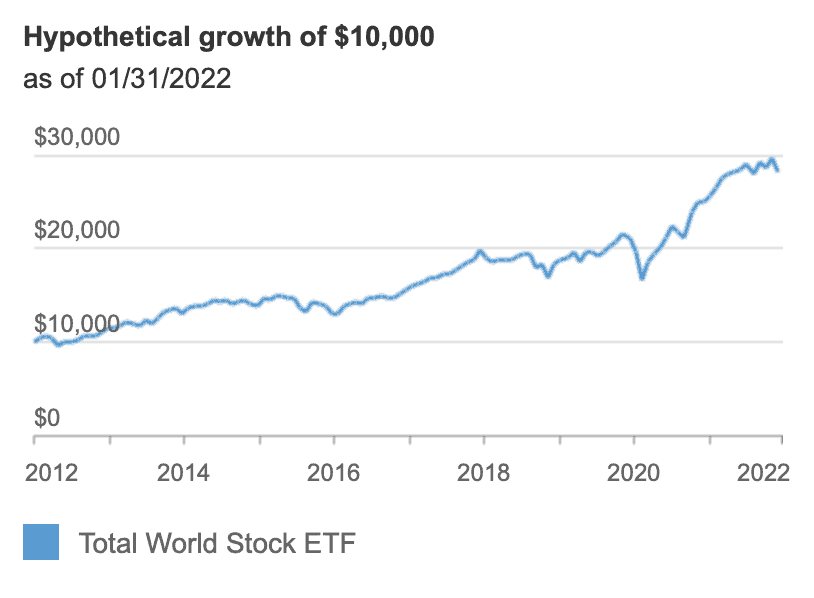

Be patient and think long term

- Rule of 72: a quick, useful formula that is popularly used to estimate the number of years required to double the invested money at a given annual rate of return.

- People love money, and they love to see it grow even more. Getting a rough estimate of how much time it will take to double your money also help you compare different investment options.

- Most investors abandon the investment strategy that don't allow them to get rich overnight

- Successful investing is not a "get rich quick" method but a "get rich slowly" method

- It takes years for small money to grow and compound into huge sums

Think independently

- The majority of investors lose money in the stock markets

- To profit, you must think differently from the masses

- Be fearful when others are greedy and greedy when others are fearful

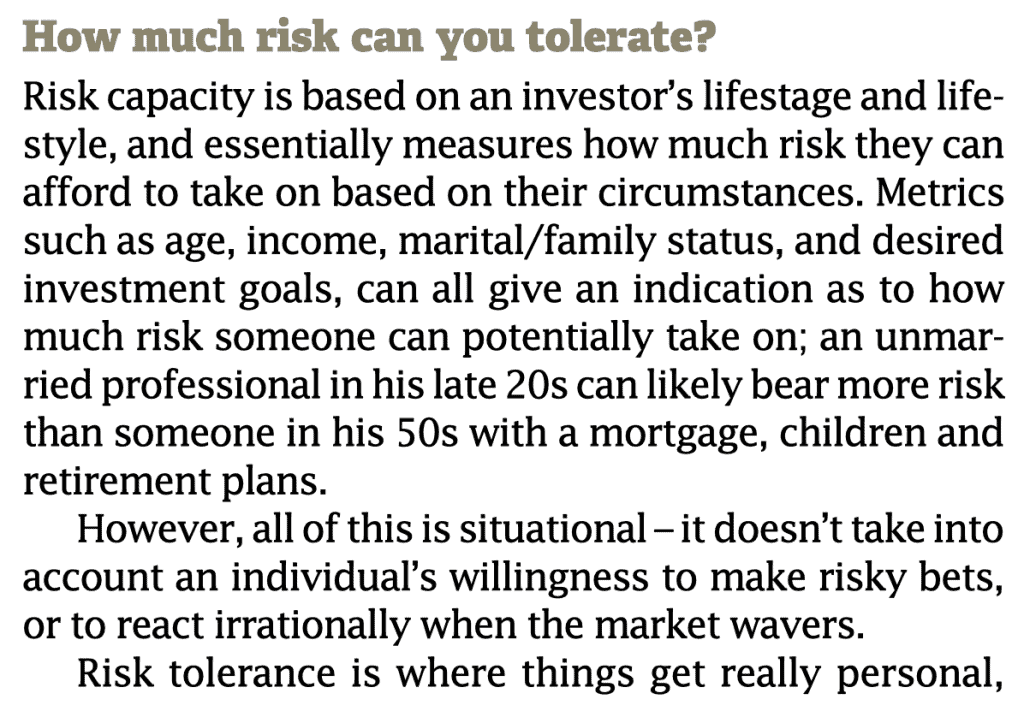

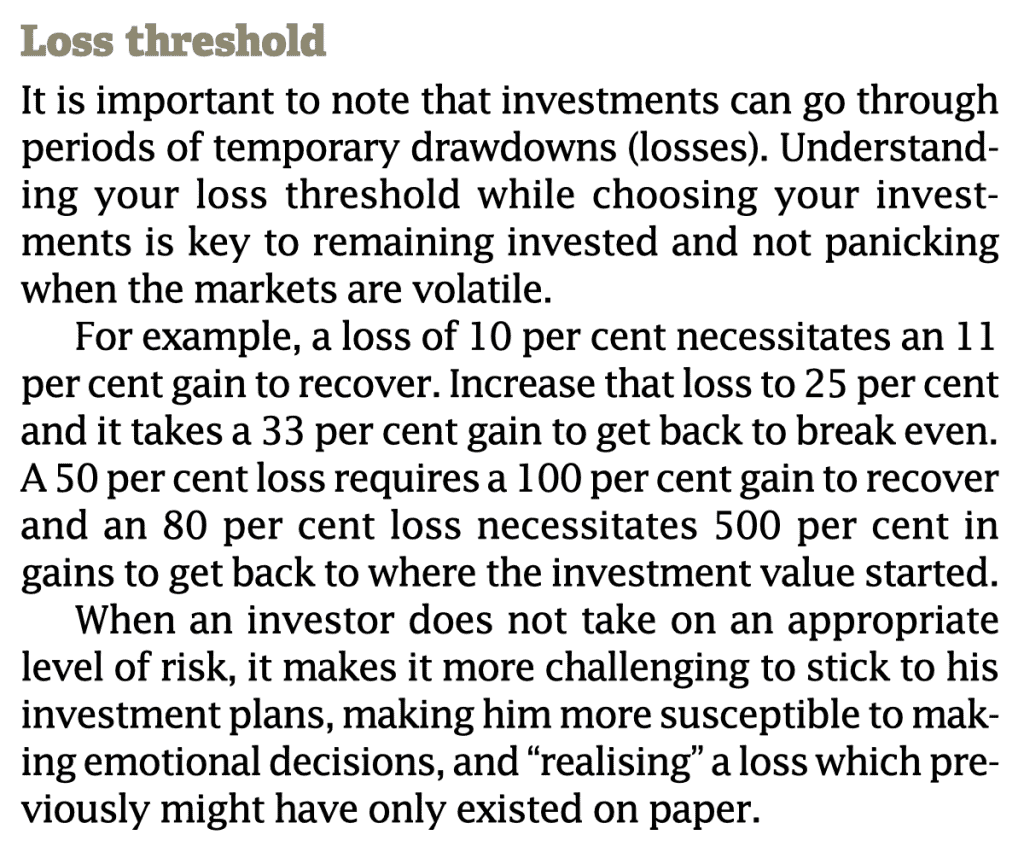

Risk Management and Capital Protection

- Be willing to risk a small percentage of your capital on any single investment

- Always diversify your risks. There is no sure win in the markets

Take responsibility and learn from mistakes

- Don't be a victim and make excuses

- Never blame the market, your luck, your broker or an external source for your results

Taking responsibility puts you in control of your results

Never attempt to predict the market

- The market cannot be predicted and any attempt to do so leads to bad performance

- Decisions should always be made based on Fundamentals/Valuation and Technical Analysis

- Having a predictive mindset causes you to not follow the pre-determined rules

Trade Psychology

- One of the key elements in trading is mastering one's emotions and create a systematic way to manage it

- Adhere to strict risk management in the face of wins and loss

- Bullish bias: more longs than shorts

- Bearish bias: more shorts than long

- Self discipline to stick to risk management rules and money management plan (trading plan)

- Cut mercilessly when a trade is invalidated. Market is open every trading day.

- Avoid over trading. Trigger happy syndrome

- Low price usually can be lower. Vice versa.

Never buy the high. Never sell the low.

Low price doesn't mean good price/ undervalued and vice versa

In trading, we are looking at the percentage gain regardless of price. The price you buy at doesn't matter, is it how much you gain

- Realise your own weakness and use a systematic way to manage it

- Trader advised to focus on price action rather than headline news

- Be patient because you cannot rush time after you got a good entry price

- Trading is about capitalising on a certain price direction with size. No need to be fully right

- Go big at point of maximum reward with minimal risk (almost arbitrate situation)

- Goal is not to outperform all the time, which is not possible. You want to outperform over time

- Successful trading is always an emotional battle for the speculator, not an intelligent battle. your biggest enemy is your own emotions

I really enjoy this article on Risk. It's essential to learn how to manage risk, instead of returns.

The art and science of risk in investment by Dhruv Arora (CEO and Founder of Syfe)

Related article

VTI vs VOO: which index fund is a better investment (updated 2020)

Thank you for reading! Please like my Facebook page to get the latest updates.