Work shapes a third of our lives. If you’re unsure about how to genuinely feel […]

Here's my concise notes after learning about how we can build a Winning Portfolio, from Adam Khoo's Value Momentum Investing Course. These are some useful concepts that I jotted down while going through the online modules.

Part 1 | Part 2 | Part 3 | Part 4 | Part 5 | Part 6

Part 1: Portfolio Construction

Diversification is needed to achieve low volatility and high returns in a portfolio.

Principles to build a Winning Portfolio

- Divide your capital into 8-30 stocks

- Diversify between countries, sectors and stock categories

- Divide your capital between core long term investments

- For speculative investments, you can allocate 1/2 of a normal position or less

- Balance your portfolio such that each stock will eventually take equal percentage of your total capital

- Do not have more than 25% of your portfolio concentrated in a sector

Add shares of a particular stock if it is

- Undervalued (price below intrinsic value)

- Price has retraced down to a support level

- Not yet at a full position in your portfolio

Part 2: Sector breakdown

Defensive Stocks

- Defensive companies sell product or services that are necessities

- They make consistent sales and profits despite the economic cycle

- Low to moderate growth of 5-10%

- Outperform during economic downturn and underperform during economic cycle

Strategy

- Buy defensive stock during economic boom: J&J, United health, Pepsi, P&G

- You want to do the opposite of others

- During recession: majority usually buy defensive stocks such as Pepsi, Clorox, Unilever, P&G and Coca-Cola. After recession: buy cyclical stocks.

US sector stocks (defensive)

Healthcare (XLV): JNJ, PFE, UNH, WLP, ABT

Consumer staples (XLP): PG, PEP, CL, KO, KMB

Utilities (XLU): DUK, EXC, NEE, D, SO

Cyclical Stocks

- Companies that sell products/services that are dependent on the economic cycle

- Generate high sales & profits during economic boom

- Underperform during a recession, outperform during economic boom

- During economic boom, cyclical stocks lead the way and underperform during recession

Strategy

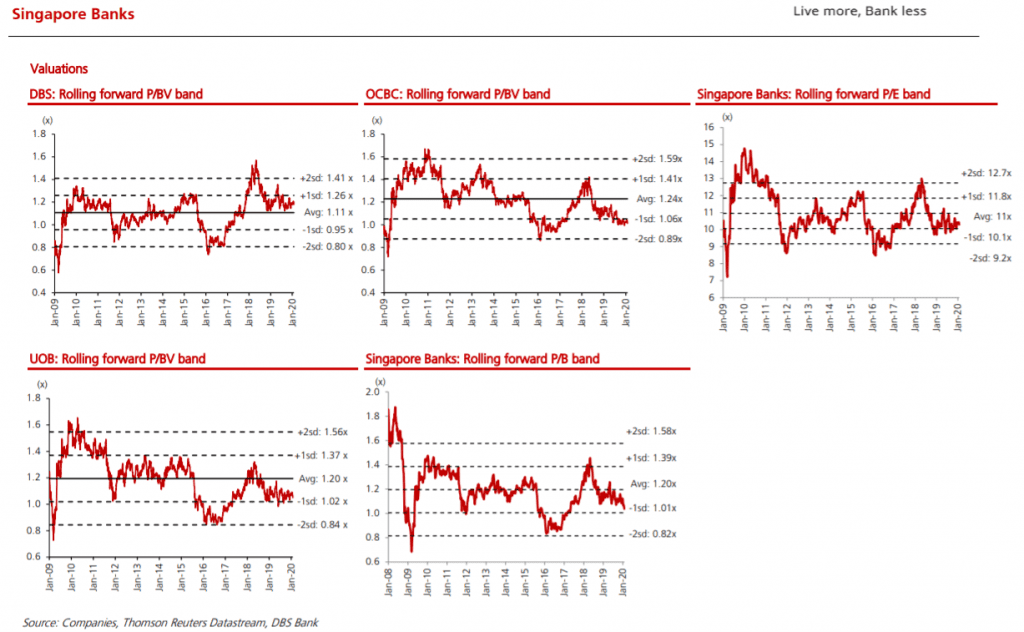

- Buy cyclical stock during economic downturn: JP Morgan, Bank of America, 3M, UOB, DBS & OCBC

- Buy these stocks at the bottom of the cycle

- Sell when they r overvalued (during economic boom)

- Can consider Ping An insurance, Mastercard (>Visa)

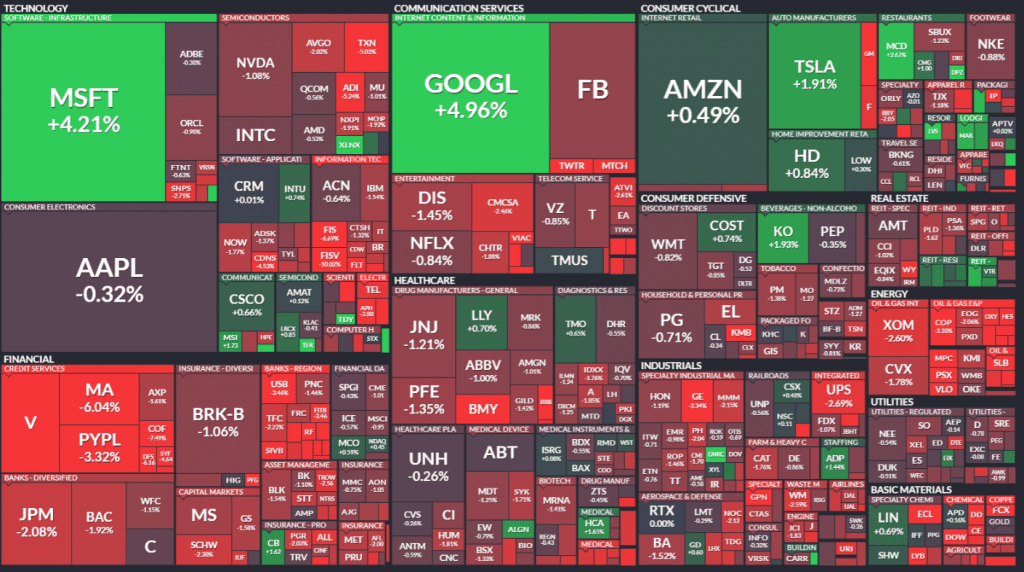

US sector stocks (cyclical)

Basic materials (XLB): DOW, NUE, AA, DD, MON

Finance (XLF): MA, JPM, BAC, GS

Energy (XLE): COP, CVX, BP, XOM

Real estate (XLRE): REG, EXR, IRM, ESS

US sector stocks (moderate cyclical)

Such stocks have consistent profit and sales.

Can look into Home depot, Cosco, Nike, Amazon, Target, 3M, Boeing & Lockheed Martin

Netflix is in a competitive scene as there is Amazon Prime etc

Technology (XLK): Aapl, msft,crm,adbe,pypl

Industrials (XLI): DE,MMM,CAT, BA

Consumer discretionary (XLY): HD, TG,LOW,NKE,AMZN,EBAY

Communication services (XLC): FB,NFLX,GOOGL,DIS,T

Investment categories

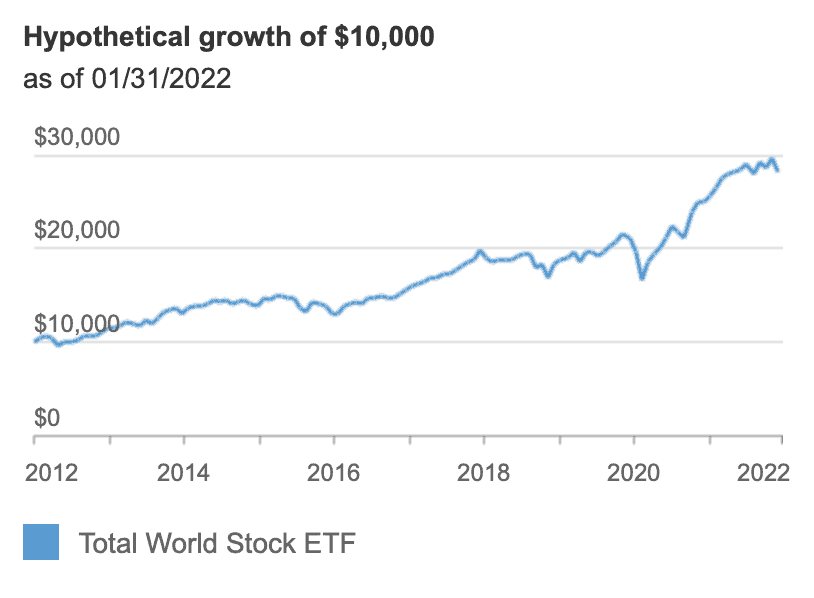

- ETFs

- Large growth

- Predictable

- Cyclical

- Speculative growth

- Turnarounds

- Dividend

- Deep value

Dividend cash cows/Income stocks

- For the objective of earning dividend

- Singapore REITS are in this category

- Do not invest based on high dividend yield

Criteria for dividend stocks

- Dividend yield at least 4-5%

- Consistent increase in dividends per share, net income, CFO for past 5 years

- Stable or increasing share price for past 5 years

- Defensive stocks (avoid cyclical stocks like airlines, commodities, shipping, property etc)

- Conservative debt (debt servicing ratio <30%)

- Dividend payout ratio between 20-100% (If it is more than 100%, means company paying out dividend more than what its profit (not sustainable)

Formulas

- Dividend yield = dividend per share/price per share *100%

- It is possible that dividend yield is high but DPS is falling (because share price is falling more than DPS)

- Payout ratio = dividend per share/earnings per share *100%

Large Cap Predictables

- Products/services that you use regularly, never goes obsolete and tends to be defensive

- Large companies that have wide economic moats, predictable earnings and cash flow from operations

- Low uncertainty in earnings, cash flow and volatility

- Slow but steady capital appreciation

- Growth rates usually 5-10% per year

- High returns can be achieved when bought at big discounts (during crisis/ face temporary problems), combined with selling covered call options

- Examples: YUM, CL, PG, UNH, JNJ, Clorox, Macdonalds

Large Cap Growth

- Large companies that still have high growth potential (>20-25%). Example: Domino

- Majority tend to be technology related companies or in secular growth industries (Cybersecurity, E Commerce, Software)

- Stock price is usually overvalued but investors need to be patient and enter at undervalued levels during temporary bad news or crisis

- Growth companies could either have a wide economic moat (brand monopoly, high switching costs, network effects) that lasts for decades or a narrow economic moat (small competitive advantage, shorter term)

- Wide moat: googl, amzn, fb, baba, tencent, msft and adbe

- Narrow moat companies are more risky - take smaller positions

- Narrow moat: nvda, ulta

Speculative Growth Stocks

- New growth companies that may have the potential to become large wide moat stocks that will dominate their industry

- They may currently have a narrow economic moat now

- Sales revenue growing at >100% but yet to have consistent net income and CFO.

- Company may still be making losses due to high investment costs and lack of EOS

- Example: Zoom, Meituan, Beyond meat and Snowflake

Strategy

- Use PSG as valuation method (PSG should be 0.2 or less)

- High risk investment hence

- Recommend to take smaller position in such stocks (less than 0.5 of a usual position

- May cut losses if stocks turns into a downtrend or 25% down from purchase price

Deep cyclical stocks

- Companies that are in capital intensive industries

- Highly sensitive to the economic cycle and are unable to respond to demand changes quickly

- They make significant profits during Economic booms and smaller profits or even losses during Economic recessions

- Example: banks, real estate developers, industrials, offshore, marine and commodity companies

Strategy

- Buy deep cyclical stocks only when they are near the bottom of their cycles and sell to take profits when they are at the top of their cycles

- Bottom of the cycle

- Generating low profits or temporary losses.

- Very undervalued

- Price is near support levels of long term chart (weekly and monthly candles)

- Can buy for short term opportunity

- Top of the cycle

- Generating high profits

- Overvalued

- Price is near the resistance level of long term chart

Deep value stocks

- Stocks selling for less than the net cash on their balance sheet

- Buying distressed companies (industry recession) that are selling below their net working capital (current assets-current liabilities) less long term debt

- Examples: BSH, CXS, FLXS, GENC, MPAD, OPST, PARF & TNAK

Deep value stocks criteria

- Positive CFO for past 12 months

- Conservative debt

- Current ratio >1

- Debt to equity ratio < 1

- Debt servicing ratio > 30%

- Share price< [(CA-CL)- long term debt]/ shares outstanding Accumulate at support levels of consolidation or the reversal into an uptrend (50MA>150MA, both MA flat or sloping up)

Exit strategy: exit when 50MA crosses below 150MA (both MA flat or sloping down) or when company reports a quarterly loss

Turnaround Stocks

- Great busineses that have been temporary hit by bad news (lawsuit, boycott, scandals, mismanagement, recession etc)

- Company may be making temporary losses but their economic moat remains intact

- Stock price can sell at 40-50% below intrinsic value

- Patience needed in waiting for these stocks to recover and "turnaround"

- Examples: Yum, Booking, Boeing

Strategy

Only go for wide moat industry leaders

Index, Sector and Industry ETFs

- No company specific risks

- Focus only on technical analysis (trends, MA, support/resistance)

Strategy

- Can buy ETFs when there are too many good companies in the sector (not a single company dominate the industry) or when it is too risky to buy one company

- Buy when the undervalued sector is hit by temporary bad news

- When to buy: DCA or buy dips on uptrend

Related article

VTI vs VOO: which index fund is a better investment (updated 2020)

Thank you for reading! Please like my Facebook page to get the latest updates.