Hello!

I learnt about FIRE movement when I was an undergraduate. I binged-read many finance blogs and got my head start in learning how to save, invest and increase my income. It's good to absorb knowledge on how to be savvy with my personal finances and avoid mistakes highlighted by others.

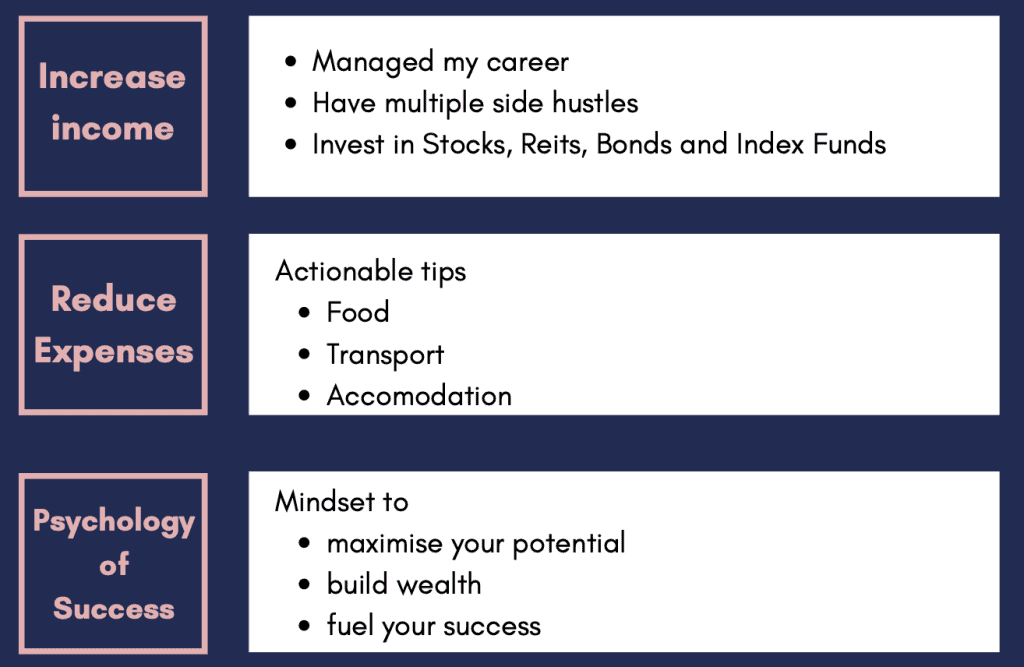

Here’s what I did since graduation to maximise my savings rate.

1. Increase income

I moved to a company with a higher growth potential and secured a role with greater responsibilities.

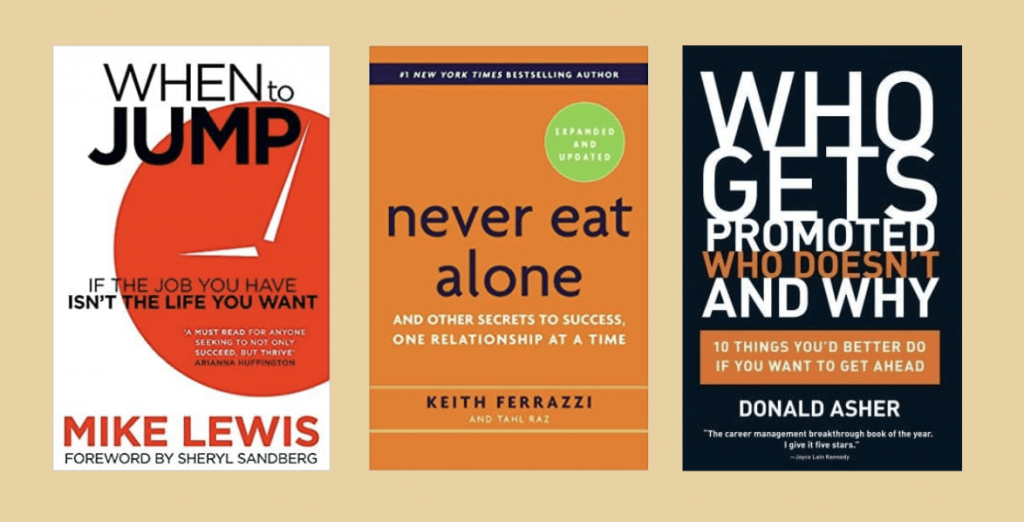

These books helped me in navigating my career in these aspects: transitioning to a new job, negotiating for my salary, asking for a promotion and networking.

When to jump: The four steps to leave your unfulfilling job - listen to the little voice, make a plan, let yourself be lucky and don’t look back

Never eat alone: The specific steps and inner mindset necessary to develop a network of relationships

Who Gets Promoted, Who Doesn't, And Why: The secrets to climbing the career ladder and strategies for career advancement

Having side hustles on top of a 9-5 job increases your net worth and financial safety net. My side hustles cover my monthly expenses and it helps to increase my savings rate.

I chose my side hustles based on my existing skill set and the skills which I want to hone.

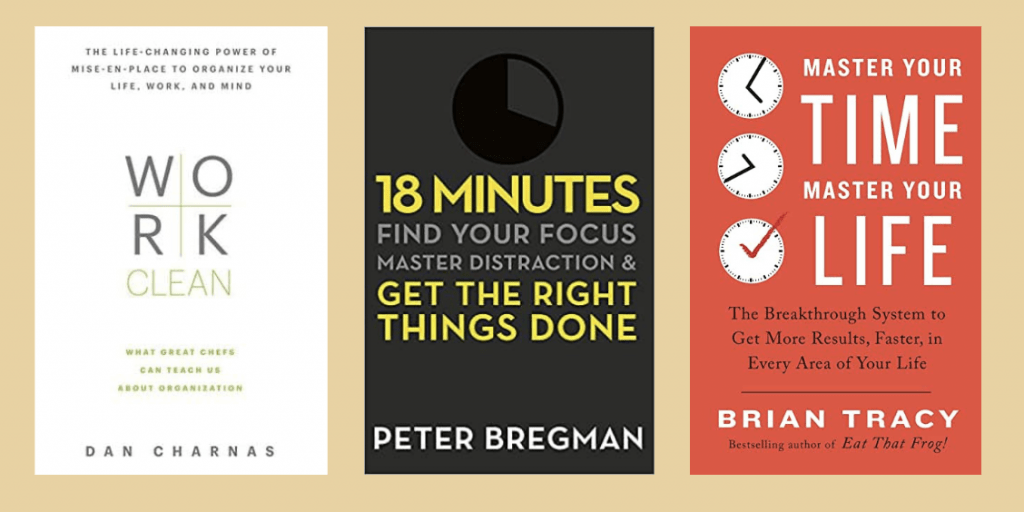

These books are helpful in sharpening my focus and time management skills.

Useful time management techniques

Investments

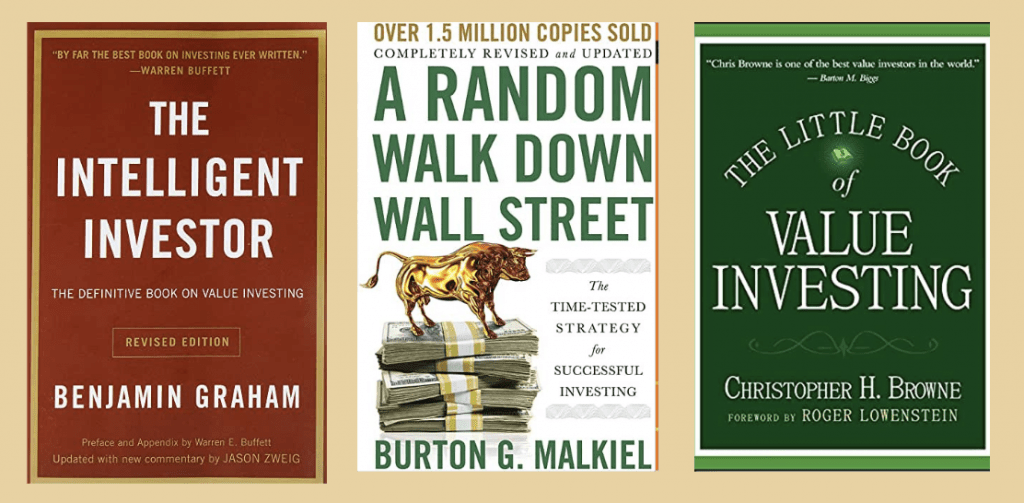

I invested in Index funds, Reits, Bonds, Cryptocurrency and Stocks after I bought my insurance and built up my emergency fund.

I started out with index funds with the intention to stay invested for the long run. It’s the ultimate solution for beginners who want investing to be efficient and simplified.

Index funds are a smart investment because

We probably might not have enough capital to make significant returns in our early 20s. Therefore, the most efficient way to make money is through side-hustling and being good at your job. It is wiser to invest the time to acquire skills, build income streams and accumulate assets instead of researching which stocks to buy.

With the dip in the stock market in May 2020, I invested in stocks. There are so many interesting companies such as Tesla, Lemonade and Revolve to consider.

It’s good to adopt a growth mindset and never stop learning. I started with index funds while taking my time to understand how stock picking works. I made the pivot from ETFs to stocks as I become more comfortable with investing overtime.

I wrote about my Singapore Reits portfolio here

These are the books on investment which I really enjoy.

Decrease expenses

I thought I was pretty good at saving until the circuit breaker showed me how I can further cut my spending on certain areas. It's interesting to observe the differences in my expenditure pre-Covid and post-Covid.

I don’t necessarily need to compromise the quality of my life in order to reach F.I. earlier. All I have to do is to spend on things and experiences that I truly value.

Here’s how I manage the typical expenditures: food, transport, shopping and housing.

- Food: Packing lunch for work and having my dinner at home frequently

-Transport: Setting aside time for public transport and taking cabs only when time is tight.

-Shopping: I plan for big purchases in advance and my purchases annually/bi-annually on non-necessities. I try to purchase quality items that can withstand the test of time and find alternatives (getting a iMac instead of a Macbook).

- Housing: No housing loan as I live with my parents currently

We are conditioned to be consumers, with advertising messages telling us what we need to own in order to feel a certain way. Adopting the habit of consuming mindfully and letting it be ingrained into your lifestyle is the first step to take towards saving up for rainy days.

We can manage our expenses by spending smarter and learning how not to misthink money.

There are ways to overcome biases and think better, in order to make better money decisions. These books taught me how to outwit marketing tactics, manage psychological triggers of influence and make better money decisions.

3) Psychology of Success

There's a big difference between money and wealth. Money is what you earn as you contribute your time. Wealth is the assets that work for you. You want to seek wealth, not money over the long run.

To build wealth, you need to have a success-oriented mindset, in order to move towards the fulfilment of your full potential and build wealth.

Here’s some of my favourites

Thank you for visiting. I hope you enjoy the site! I will share more updates on my Facebook page. Really appreciate if you could drop a like and connect with me.

Here's the list of all the articles on my website. Subscribe to get notified when a new post is up!