Work shapes a third of our lives. If you’re unsure about how to genuinely feel […]

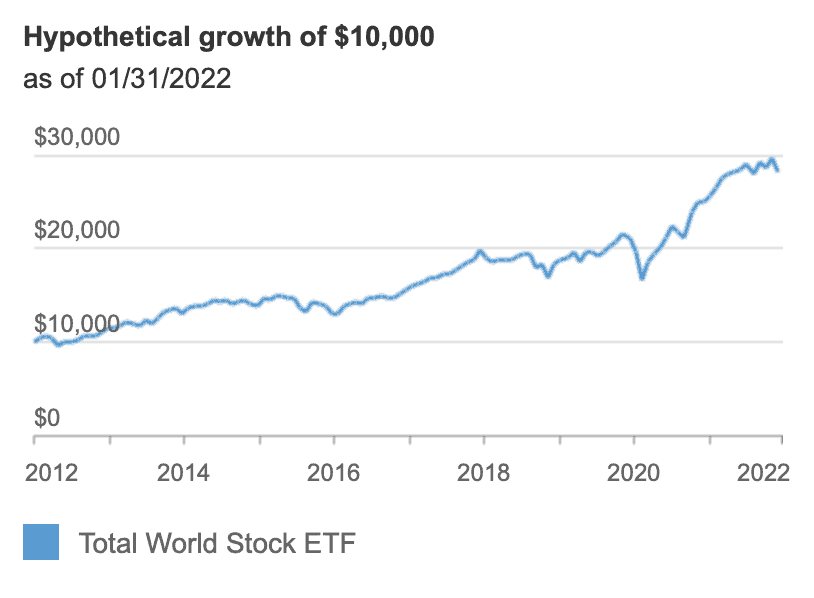

I accumulated my first $100K at age 25. It's quite surprising that my networth could double to $200K within 2 years.

My first $100K was achieved by maximising my savings rate, by increasing my income and reducing my expenses. It's pretty straightforward. Afterwards, it's about a more disciplined and focus approach to have more substantial income streams, cutting down on my spending (without affecting my standard of living) and being a better investor.

One interesting thing to note is how my expenses had changed drastically after my lifestyle has been affected by Covid-19.

Reducing expenses

Saving money by reducing your expenses is the easiest thing to do. In my earlier post on "The Psychology of Money", award-winning author Morgan Housel shares how building wealth has little to do with your income or investment returns, and lots to do with your savings rate.

Less ego, more wealth. Saving money is the gap between your ego and your income. Wealth is what you don’t see. It is created by suppressing what you could buy today in order to have more stuff or more options in the future.

Whether an investing strategy will work, how long it will work for, or whether markets will cooperate, is out of your control. But your savings rate and frugality are within your control.

Managing my expenses well allows me to channel more funds for my investments. Here's how I manage my expenses.

Fitness

Due to Covid-19, I stopped my fitness classes and realised the convenience of doing home workouts. Since then, I had saved so much time and money. Fitness classes can be quite expensive (at least $100 per month). If small purchases can add up to a significant amount overtime, it's even more of the case for pricier expenses. Another reason why I am not buying a package was to reduce the time spent on travelling. A two way trip takes up more than an hour, which could have been put to better use. It's good that I enjoy my YouTube workouts at home a lot! Admittedly, some activities which I did (Muay Thai, Yoga and Spinning) are hard to replicate at home.

Food

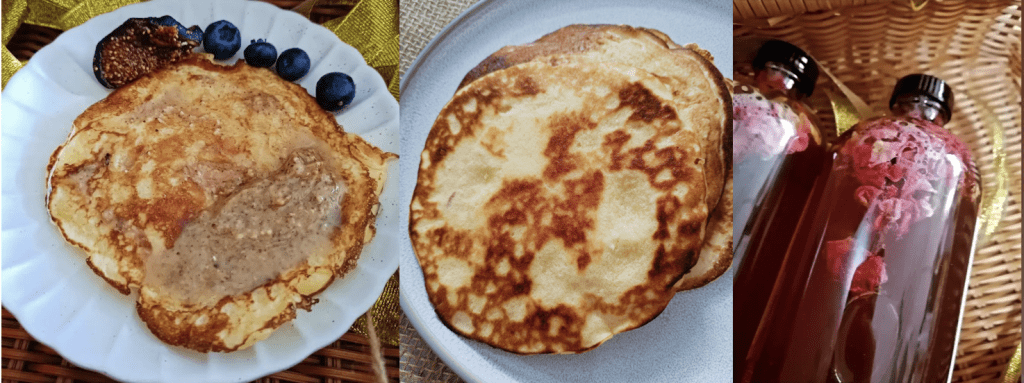

In 2020, I picked up a new habit to prepare my meals more often. I used to dine out quite frequently. Now, I have been going to supermarkets to get perishable food and buying frozen meat/seafood on Shopee. As such, I had since reduced the number of times that I dine out compared to pre-COVID. I have been following through this new habit for more than a year too.

If I dine out, I use these apps whenever possible: Burpple Beyond, Entertainer, Chope, Quandoo, Eatigo, Shopback, Klook and Fave.These discounts by F&B partners make dining out cheaper too. I usually eat out on weekends, and meal prep for weekdays.

I have also been inspired to make my own food such as Kombucha and Sourdough bakes, and these had decreased my spending on bread and drinks drastically.

Since I have been finding much joy in cooking, the big expenses for this year are Ninja Foodi, Soya bean maker and yogurt maker. After much thought, I decided to skip the purchases for a bread maker and food processor for now.

Pampering oneself

As an ultra pragmatic and thrifty individual since graduation (my days of mindless spending had stopped after I had to throw so many unnecessary and unsuitable purchases), I usually spend on the necessities. But recent experiences got me thinking that one should also spend if that semi-rational spending can bring about happiness. During 11.11, I bought an affordable gaming chair ($69), Ninja Foodi ($300) and mountain bike ($219). Honestly, I could live without these 3 gadgets but I noted that I have been thinking about them for sometime, and it would really be nice to upgrade the things that I have been using consistently.

My iMAC and Ipad were my best purchases in 2020. They are probably one of the most expensive items I had purchased so far, but the amount of value I had received out of them is incredible.

Overall expenditure

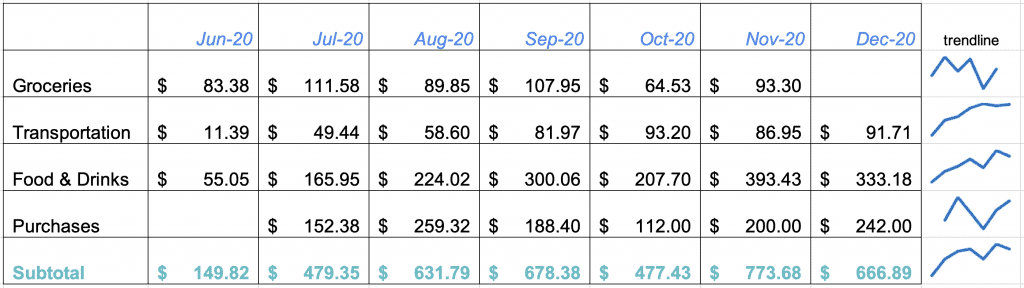

My expenses are quite consistent since last year. Here's my variable expenses from Jun-Dec 20. I had excluded fixed expenses such as insurance (~$500), telco bill ($18) and household contribution ($400).

- Groceries: there might be a minimal reduction as I have been cutting down on fruits. Growing my plants (Thai basil, Italian basil, spinach, rosemary and mints) doesn't help much since the yield is so low

- Transportation: there has been a reduction since I have been cycling whenever possible. I take the public transportation most of the times

- Food & Drinks: this used to be the category which takes up the majority of my spending but it has been reduced significantly

- Purchases: making my bulk purchases from Taobao come with huge significant savings. My recent 11.11 purchases add up to 300SGD although there are over 30 items

How to save money on purchases

I try to make sound purchases with these methods

- Don't give in to instant gratification. Set aside a window of time before you make any purchases

- Head to Carousell to check the offerings before buying anything at retail price

- Shop online, with no pressure from the retail assistants

- Plan for purchases in advance

- Don't bulk buy. Your taste and preferences might change faster than you think. Plus, there can be better alternatives the next time.

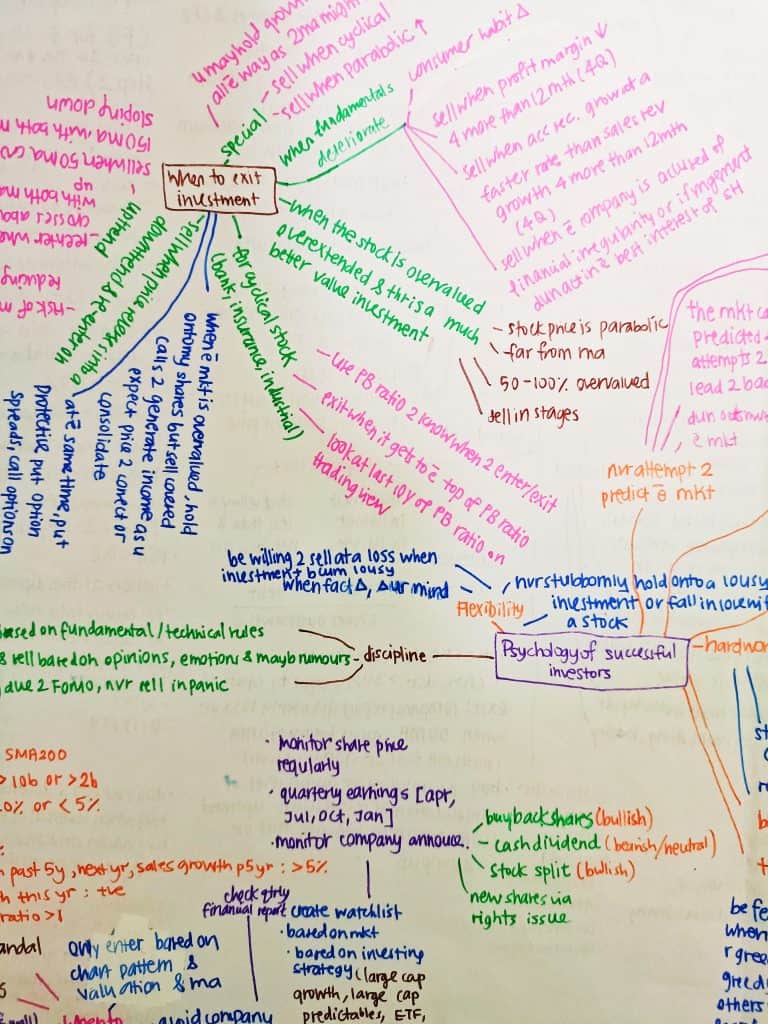

Investments

I made several mistakes in my investment journey, such as listening to opinions of others and made rash purchases. There's minimal clarity, well-thought out methods and foundations behind each move I make. Thankfully, the investment gains are positive overall due to the early buy during COVID and with the guidance of wise friends.

As such, I decided to be more intentional about learning Investing and being more knowledgable in this area. A must read on Investor Psychology can be found here.

These are the articles I wrote which contributed to my learning.

- Adam Khoo Piranha Profits Review And Notes (Stock Analysis) Part 1 | Part 2 | Part 3 | Part 4 | Part 5 | Part 6

- GSG Vs DBC: Which Commodity ETF Is A Better Investment

- 3067 Vs 3033: Which ETF Is A Better Investment

- VTI vs VTSAX: the differences between an ETF and index fund

- VTI vs VOO: which index fund is a better investment

- VFIAX vs VOO: Which index fund is better

- Syfe REITS Portfolio performance | Syfe REIT+ review

- VFIAX vs VTSAX - which mutual fund is better

Individual companies

- Sea Limited (SE) Research and Analysis

- NIO Inc. (NIO) Research and Analysis

- Tesla, Inc. (TSLA) Research and Analysis

- Revolve Group (RVLV) Research and Analysis

- Lemonade Stock (LMND) Research and Analysis

- Splunk Inc. (SPLK) Research and Analysis

Referral bonus for these brokers are here

Brokers

- moomoo Trading App Review (SGD 200 Stock Cash Coupon Bundle)

- Tiger Brokers Review: Best trading platform to invest in the Singapore, US and Hong Kong Stock Market

Increasing income

Increasing your investment knowledge and reducing your expenses can be executed straightaway. You can buy a stock right now; you can cut down your online spending and ignore the sales section. When it comes to increasing your income, it can be tricky as it is dependent on several factors like your company, market outlook, nature of job and your risk appetite to move.

Regardless, it is still essential to do something rather than let things be. I took CFA Level 1 (blog about how to passs on your first try) and it helped me secure a job. Even though the relevance might be limited in my scope of work, it was an opportunity to show my capability and determination in passing the tough exam.

Some might need to move between companies to get a higher pay, some could secure sufficient promotions within the same company. Interestingly, it brings me immense satisfaction to channel my income into my investments. More so than using it to travel and spend on materials goods.

The Rules of Work summary (flourishing in the corporate world) is one of my favourite book in managing my way in the office.

Happiness & Mental health

It amuses me to note that I have never put in much thought about happiness until the age of 26. Happiness is a state, it shouldn't be fleeting where you feel happy after you buy something. Money is tied to happiness because you need money to have a decent standard of living. I would love to thrive, rather than survive and live with a minute amount to get by.

These are my favourite read on happiness, wealth and self-love

- How to accept yourself (Haemin Sunim book review)

- How to look after your mental health (44 tips)

- A guide to wealth and happiness by Naval Ravikant

- Lessons on wealth, greed and happiness (The Psychology of Money)

- Ikigai: The Secret To Live A Long & Happy Life (quick summary)

Investing is a skill. Being better with money is a life skill.

- The difference between money and wealth (biggest economic fallacy)

- How to avoid financial self-sabotage

- The Psychology of Money by Morgan Housel (Book summary)

- How to outsmart biases in personal finance (be better with money)

Your biggest asset is your ability to think and form clear thoughts. There is a saying: Think before you act, but how easy is it to do this when there are so many biases to overcome?

- Book summary: The Art of Thinking Clearly by Rolf Dobelli

- Different Types Of Thinking To Adopt

- How The Art of Thinking Clearly can teach us about Investor Psychology (summary)

- Atomic Habits (James Clear) - Book Summary & Notes

Time has never passed so fast in 2020 and 2021 for me. In a blink of an eye, 2022 will be approaching. I hope my articles have been useful in some way.

Thank you for reading! I will share more updates on my Facebook page. Please click here for Referral deals.